Get the free Investment Funds Application - Garrison Investment Analysis Limited - garrison co

Show details

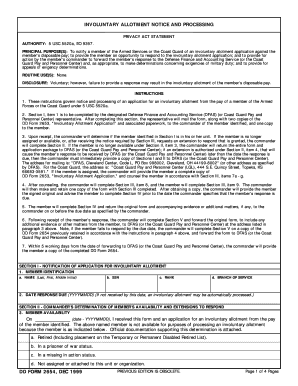

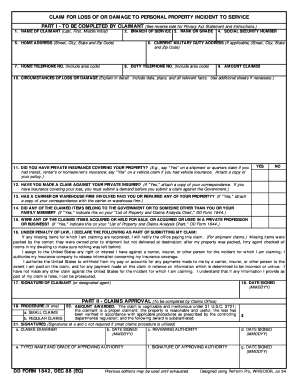

Investment Funds Application Cofounds Authorization 84 (Digital) SELF-DIRECTED, Implicit Pricing Model Please complete using black ink and BLOCK CAPITALS and return to Garrison, 57 Landless lane,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment funds application

Edit your investment funds application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment funds application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investment funds application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit investment funds application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment funds application

How to Fill Out an Investment Funds Application:

01

Start by gathering all the necessary documents and information. This may include your personal identification, proof of address, tax documents, and financial statements.

02

Carefully read and understand the application instructions provided by the investment funds company. This will ensure that you provide all the required information correctly.

03

Begin by filling out your personal information section accurately. This typically includes your full name, date of birth, social security number, and contact details.

04

Next, provide information about your investment goals and risk tolerance. This step helps the investment funds company understand your financial objectives and determine suitable investments for you.

05

It is important to include detailed information about your financial situation, including your income, assets, liabilities, and expenses. This information helps assess your eligibility and investment suitability.

06

If you have any affiliations or connections with the investment funds company, such as being an employee or a family member, disclose this information in the appropriate section of the application.

07

Provide your banking information, including your account numbers and routing numbers. This is necessary for investment funds companies to process transactions and deposits.

08

Review the application thoroughly for any errors or missing information. Making sure all sections are completed accurately reduces the chances of delays or complications in the application process.

09

Sign and date the application as required, acknowledging that the information provided is true and accurate to the best of your knowledge.

10

Finally, submit the completed application along with any required supporting documents to the investment funds company through the specified channels (e.g., mail, online submission).

Who Needs an Investment Funds Application:

01

Individuals who want to invest in mutual funds, index funds, exchange-traded funds (ETFs), or other types of investment funds typically need to fill out an investment funds application.

02

Investors looking to diversify their portfolios and potentially earn higher returns than traditional savings accounts or CDs may opt for investment funds.

03

People who prefer professional management of their investment portfolios rather than choosing individual stocks or bonds may find investment funds suitable.

04

Those who want exposure to various asset classes, such as stocks, bonds, and real estate, but do not have the time or expertise to manage their investments individually, may consider investment funds.

05

Investors looking for flexibility in their investments, such as the ability to make periodic withdrawals or contributions, can benefit from investment funds.

06

Individuals who prioritize convenience, as investment funds typically offer easy access to their investments and provide regular statements and reporting.

07

Investors who are willing to accept some level of risk associated with the investment funds, as the value of funds may fluctuate depending on the performance of the underlying assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify investment funds application without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including investment funds application. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute investment funds application online?

pdfFiller has made filling out and eSigning investment funds application easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit investment funds application straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing investment funds application.

What is investment funds application?

The investment funds application is a form or document used by individuals or entities to apply for investment funds, which are pooled investment vehicles that invest in securities or other assets.

Who is required to file investment funds application?

Any individual or entity looking to invest in a pooled investment vehicle is required to file an investment funds application.

How to fill out investment funds application?

To fill out an investment funds application, you will need to provide personal or entity information, investment preferences, risk tolerance, and other relevant details as required by the fund manager.

What is the purpose of investment funds application?

The purpose of the investment funds application is to gather necessary information from investors to assess their suitability for the investment fund and to ensure compliance with regulatory requirements.

What information must be reported on investment funds application?

The information required on an investment funds application typically includes personal or entity details, investment objectives, financial information, and risk tolerance.

Fill out your investment funds application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Funds Application is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.