Get the free Term Life Insurance Premiums

Show details

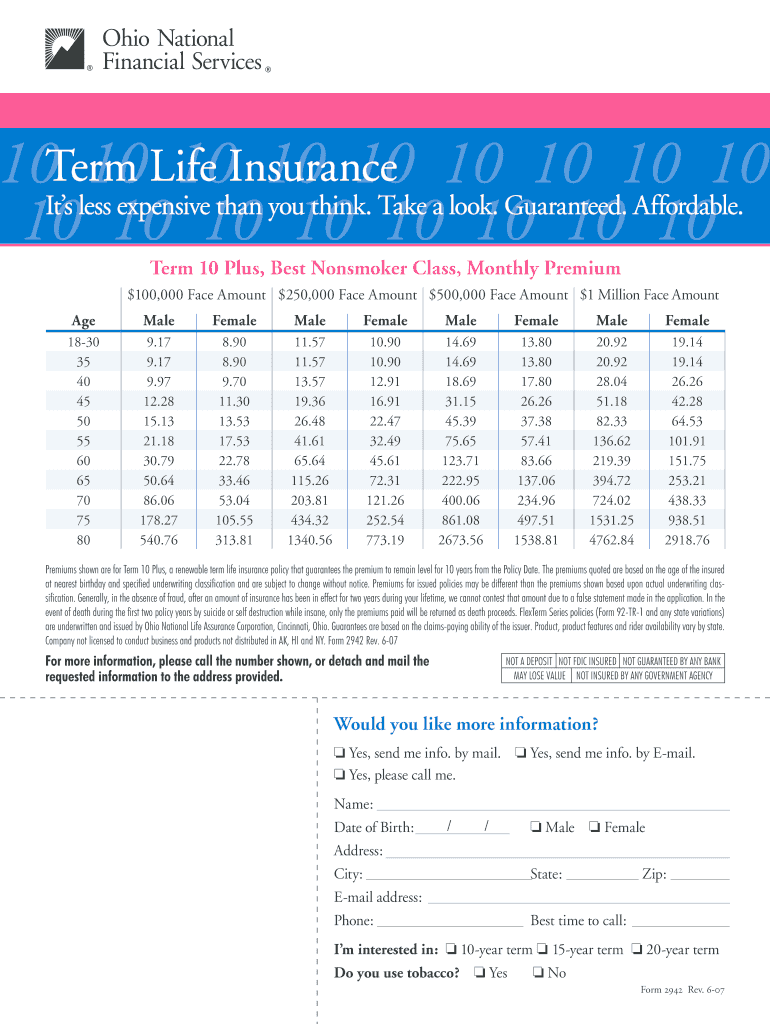

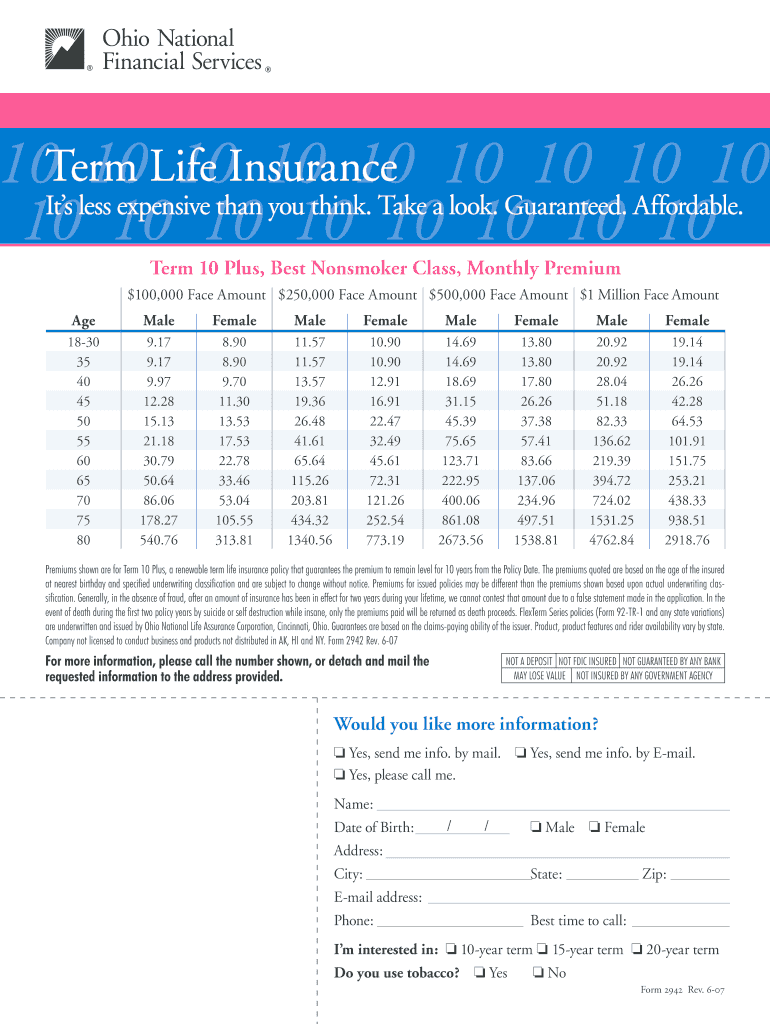

This document provides a detailed breakdown of premium rates for a 10-year term life insurance policy for both male and female applicants of various ages. It includes policy specifics, underwriting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term life insurance premiums

Edit your term life insurance premiums form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term life insurance premiums form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing term life insurance premiums online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit term life insurance premiums. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out term life insurance premiums

How to fill out Term Life Insurance Premiums

01

Determine the coverage amount you need based on your financial obligations and goals.

02

Choose the term length for your policy (e.g., 10, 20, or 30 years).

03

Research various insurance providers to compare premiums and policy features.

04

Provide personal information, including age, health status, and lifestyle habits when applying.

05

Obtain and compare quotes from multiple insurers to find the best rate.

06

Select additional riders or options to customize your policy, if necessary.

07

Complete the application process, which may include a medical exam.

08

Review the policy details carefully before signing to ensure it meets your needs.

Who needs Term Life Insurance Premiums?

01

Individuals with dependents who rely on their income for financial support.

02

Homeowners with a mortgage who want to ensure the mortgage is paid off in the event of their passing.

03

Parents looking to cover future education costs for their children.

04

Individuals who want to ensure that outstanding debts, such as loans or credit cards, are paid off.

05

People looking for an affordable way to provide financial security for their family or loved ones.

Fill

form

: Try Risk Free

People Also Ask about

Should I do 20 or 30 year term life insurance?

If you're not sure you need coverage for 30 years, you could save money every month by going with a 20-year term length for the same coverage amount. However, if you're pretty sure you need coverage for 30 years, consider a 30-year term.

What is the premium for term life insurance?

A term insurance policy provides high life cover@ at lower premiums. For e.g.: Premium for ₹ 1 Crore Term Insurance cover could be as low as ₹ 4402a p.m. These fixed premiums can be paid at once or at regular intervals for the entire policy term or for a limited period.

How much does $100,000 term life insurance cost?

Average Cost of a $100,000 Term Life Insurance Policy TermAverage Monthly RateAverage Annual Rate 10 years $11 $131 15 years $14 $167 20 years $18 $206 25 years $23 $2813 more rows • 5 days ago

What are premiums in life insurance?

A life insurance premium is a payment made to the insurance company that keeps the policy active. Without this payment, the policy will lapse, and the coverage will come to an end. 1. Paying life insurance premiums helps allow your beneficiary to receive the death benefit later.

Do I get my premiums back on term life insurance?

In standard term life insurance, no returns are provided if the policyholder survives the term. However, money-back term insurance plans refund the total premiums paid at the end of the policy term, offering a survival benefit alongside life cover.

Do you pay premiums on term life insurance?

A term life insurance policy is the simplest form of life insurance: You pay a premium for a period of time — typically between 10 and 30 years — and if you pass away during that time, a death benefit is paid to your beneficiary or beneficiaries.

How much is term life insurance for 250 000?

How much does a $250,000 term life insurance policy cost? On average, a $250,000 life insurance policy costs $19 per month for males and $16 per month for females.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Term Life Insurance Premiums?

Term Life Insurance Premiums are the payments made to maintain a term life insurance policy, which provides death benefit coverage for a specified period.

Who is required to file Term Life Insurance Premiums?

Individuals who own a term life insurance policy and wish to claim tax deductions on their premiums may be required to file them.

How to fill out Term Life Insurance Premiums?

To fill out Term Life Insurance Premiums, policyholders typically report the premium amounts paid on their tax return using the appropriate tax forms.

What is the purpose of Term Life Insurance Premiums?

The purpose of Term Life Insurance Premiums is to provide financial protection to the policyholder's beneficiaries in the event of the policyholder's death during the term of the policy.

What information must be reported on Term Life Insurance Premiums?

The information that must be reported includes the amount of premiums paid, the term of the policy, and the name of the insurance provider.

Fill out your term life insurance premiums online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Life Insurance Premiums is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.