Get the free WARRANT AGREEMENT

Show details

This document outlines the creation and issuance of Common Share Purchase Warrants by Kinross Gold Corporation, detailing terms, rights, and responsibilities of the parties involved.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign warrant agreement

Edit your warrant agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your warrant agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit warrant agreement online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit warrant agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

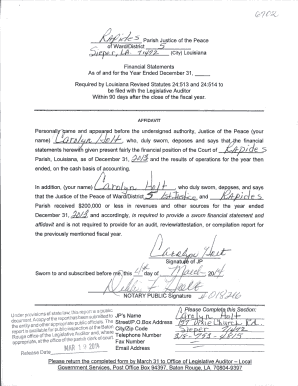

How to fill out warrant agreement

How to fill out WARRANT AGREEMENT

01

Read the Warrant Agreement thoroughly to understand its terms.

02

Fill out the date at the top of the agreement.

03

Insert the names and addresses of the parties involved, typically the issuer and the warrant holder.

04

Specify the number of warrants being issued.

05

Detail the exercise price for the warrants.

06

Include the expiration date of the warrants.

07

Outline any conditions or restrictions regarding the exercise of the warrants.

08

Provide any additional provisions or clauses as required by the agreement.

09

Sign and date the agreement at the designated signature lines.

Who needs WARRANT AGREEMENT?

01

Investors looking to purchase warrants as a form of equity security.

02

Companies or startups issuing warrants to raise capital.

03

Companies engaged in financing arrangements that involve warrants.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a warrant?

For example, if the warrant allows an investor to purchase a stock for $20 per share and it's currently trading at a market price of $25, the investor could purchase it for a $5 per share discount. When someone exercises a warrant to buy shares from a company, the company issues new shares of stock to fulfill it.

What is the purpose of warrants?

In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities.

How do warrant agreements work?

A stock warrant is an agreement between two parties that gives one party the right to buy the other party's stock at a set price, over a specified period of time. Once a warrant holder exercises their warrant, they get shares of stock in the issuing party's company.

What is the definition of a warrant?

warrant verb [T] (MAKE NECESSARY) to make a particular action necessary or correct, or to be a reason to do something: His injury was serious enough to warrant an operation. I can see circumstances in which these types of investigations would be warranted.

What is a warrant subscription agreement?

A warrant subscription agreement is a contract between a company and an investor that promises the investor can buy a certain amount of stock on a set date. The agreement also include details about the price per share, how payment can be made, and what other terms and conditions surround the sale.

What is the difference between a safe agreement and a warrant?

A SAFE (simple agreement for future equity) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment.

What is a warrant agreement?

A warrant is an agreement between two parties – the “issuer” (i.e., a company) and the “holder” of the warrant – that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

Why do companies issue warrants?

Companies issue warrants for two reasons — to raise capital and to entice investors to purchase other securities, such as bonds. But options are issued by third parties, meaning the company doesn't get any of the money. Instead, it's only the investors in the contract that benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WARRANT AGREEMENT?

A warrant agreement is a legal document that outlines the terms and conditions under which a warrant can be exercised. It typically involves the right to purchase a company's stock at a predetermined price within a specified time frame.

Who is required to file WARRANT AGREEMENT?

Generally, companies that issue warrants are required to file warrant agreements with regulatory authorities, such as the SEC, especially if they are publicly traded. Investors may not need to file anything unless they are exercising the warrants.

How to fill out WARRANT AGREEMENT?

To fill out a warrant agreement, include details such as the name of the issuer, the terms of the warrant (exercise price, expiration date), and the number of shares available. Both the issuer and the holder must sign the document.

What is the purpose of WARRANT AGREEMENT?

The purpose of a warrant agreement is to grant investors the right to purchase equity in a company at a set price, thus providing an incentive to invest. It also helps in financing by allowing companies to raise capital.

What information must be reported on WARRANT AGREEMENT?

A warrant agreement must report information such as the warrant's exercise price, expiration date, number of shares, rights of the warrant holder, and any applicable terms and conditions.

Fill out your warrant agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Warrant Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.