Get the free High-technology investment tax credit worksheet for tax year 2011 bb

Show details

BIOTECHNOLOGY INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2011 36 MRSA 5219M TAXPAYER NAME: EIN×SSN: Note: Owners of pass-through entities (partnerships, LCS, S corporations, trusts, etc.) making

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign high-technology investment tax credit

Edit your high-technology investment tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your high-technology investment tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

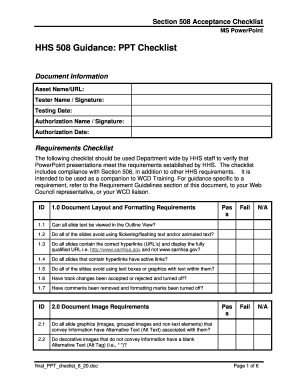

Editing high-technology investment tax credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit high-technology investment tax credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out high-technology investment tax credit

How to fill out high-technology investment tax credit:

01

Gather all relevant information: Start by collecting all the necessary information and documents related to the high-technology investment tax credit. This may include financial statements, expense records, and investment details.

02

Understand the eligibility criteria: Familiarize yourself with the specific eligibility criteria for the high-technology investment tax credit. Different countries or regions may have different requirements, so ensure you meet all the necessary criteria before proceeding.

03

Complete the application form: Fill out the application form for the high-technology investment tax credit. Provide accurate and detailed information, ensuring that all sections are properly filled. Double-check for any errors or omissions.

04

Include supporting documentation: Attach any supporting documentation that may be required along with your application. This may include proof of technology investment, investment certificates, and any other relevant documentation.

05

Review and revise: Once you have completed the application form, carefully review all the information provided. Look for any potential mistakes or areas that may need clarification. Make any necessary revisions or additions.

06

Submit the application: Submit your completed application form and supporting documentation to the designated authority. Follow the prescribed submission process and ensure that you meet any deadlines specified.

07

Track the progress: Keep track of the progress of your application. If there are any additional documents or information requested by the authority, respond promptly and provide the requested information.

08

Seek professional advice if needed: If you are unsure about any aspect of filling out the high-technology investment tax credit, consider seeking guidance from a tax professional or consultant. They can provide expert advice, ensuring that you understand the requirements and that your application is accurate and complete.

Who needs high-technology investment tax credit?

01

Small and medium-sized businesses: High-technology investment tax credits are often beneficial for small and medium-sized businesses operating in the high-tech sector. These credits can provide financial incentives and support for investments in technology infrastructure, research and development, and innovation.

02

Start-ups and entrepreneurs: Start-ups and entrepreneurs involved in technology-driven industries can greatly benefit from high-technology investment tax credits. These credits can help offset the costs of technology investments and encourage the growth and development of innovative businesses.

03

Research and development firms: Companies engaged in research and development activities, especially those focused on developing new technologies or advancing existing technologies, can take advantage of high-technology investment tax credits. These credits can help support their efforts and encourage further technological advancements.

04

Technology-focused industries: Industries such as information technology, biotechnology, clean energy, and advanced manufacturing often rely on cutting-edge technology. High-technology investment tax credits can provide financial incentives for companies operating in these industries, encouraging growth and innovation.

05

Governments and policy-makers: Governments and policy-makers who aim to promote technological advancements and economic growth may implement high-technology investment tax credits. These credits can attract investment, stimulate job creation, and foster a competitive environment in the technology sector.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find high-technology investment tax credit?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the high-technology investment tax credit. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in high-technology investment tax credit?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your high-technology investment tax credit to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I fill out high-technology investment tax credit on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your high-technology investment tax credit. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is high-technology investment tax credit?

High-technology investment tax credit is a tax incentive designed to encourage investments in high-tech industries by providing tax credits for eligible expenditures.

Who is required to file high-technology investment tax credit?

Businesses and individuals who have made qualified investments in high-technology industries are required to file for high-technology investment tax credit.

How to fill out high-technology investment tax credit?

To fill out high-technology investment tax credit, taxpayers need to provide details of their qualified investments, expenditures, and calculations to determine the eligible tax credit amount.

What is the purpose of high-technology investment tax credit?

The purpose of high-technology investment tax credit is to incentivize investments in high-tech industries, spur innovation, and promote economic growth in the technology sector.

What information must be reported on high-technology investment tax credit?

Taxpayers must report details of their qualified investments, including expenditures on research and development, equipment purchases, and other eligible expenses.

Fill out your high-technology investment tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

High-Technology Investment Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.