Get the free CHARITIES AND TRUSTS SAVINGS - bShawbrookb Bank

Show details

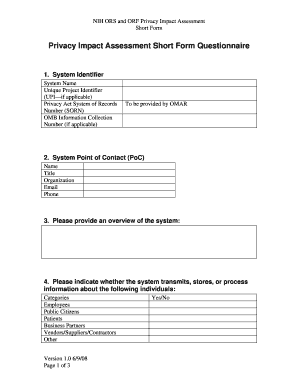

CHARITIES AND TRUSTS SAVINGS ACCOUNT OPENING FORM L A S T U P DAT E D 1 6 × 1 0 × 1 5 S B × S V × C T S AO F × 1 6 1 0 1 5 × 1 0 CHARITIES AND TRUSTS SAVINGS ACCOUNT OPENING FORM PAGE 1 OF 8

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charities and trusts savings

Edit your charities and trusts savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charities and trusts savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charities and trusts savings online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit charities and trusts savings. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charities and trusts savings

How to fill out charities and trusts savings:

01

Begin by researching and identifying the specific charities or trusts that you wish to contribute to or establish savings for. Consider their mission, reputation, and impact on the causes they support.

02

Review the eligibility criteria and guidelines of each organization. Understand the purpose of the savings account and any restrictions or requirements associated with it.

03

Contact the selected charity or trust to gather the necessary paperwork and documentation required to open a savings account. This may include forms, identification documents, proof of address, and financial statements.

04

Determine the type of savings account that best suits your needs. Charities and trusts may offer various options such as donor-advised funds, endowment funds, or individual retirement accounts (IRAs). Consider factors like investment options, tax advantages, and fees associated with each type.

05

Fill out the application form provided by the charity or trust accurately and completely. Include all requested information and attach any supporting documents as outlined in the application process.

06

Consult with a financial advisor or legal professional if you have questions or concerns about the legal and tax implications of establishing or contributing to charities and trusts savings.

07

Review the completed application and supporting materials to ensure everything is in order. Double-check for any mistakes or omissions that could delay the processing of your application.

08

Submit the filled-out application along with any required fees or initial contributions to the charity or trust as per their instructions. Keep copies of all documents for your records.

09

Maintain regular communication with the charity or trust regarding your savings account. Stay updated on any changes in their policies or procedures that may affect your account or contributions.

10

Monitor the performance of your savings account and periodically assess whether your contributions align with your financial goals and philanthropic objectives.

Who needs charities and trusts savings?

01

Individuals who are passionate about supporting charitable causes and want to make a lasting impact.

02

High-net-worth individuals who seek tax advantages and strategic giving opportunities.

03

Families or individuals looking to establish a legacy or preserve their wealth for future generations.

04

Nonprofit organizations or foundations that require a designated savings account for specific projects, scholarships, or endowments.

05

Business owners or professionals seeking to align their corporate social responsibility efforts with savings that can further their social impact objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the charities and trusts savings in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your charities and trusts savings directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit charities and trusts savings on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share charities and trusts savings from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out charities and trusts savings on an Android device?

Complete your charities and trusts savings and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is charities and trusts savings?

Charities and trusts savings are financial accounts set up to save money for charitable organizations or trusts.

Who is required to file charities and trusts savings?

Charities, trusts, non-profit organizations, and any entity that holds funds for charitable purposes are required to file charities and trusts savings.

How to fill out charities and trusts savings?

Charities and trusts savings are typically filled out using specific forms provided by the relevant tax authorities, detailing the financial transactions and balances of the account.

What is the purpose of charities and trusts savings?

The purpose of charities and trusts savings is to ensure transparency and accountability in the management of funds designated for charitable purposes.

What information must be reported on charities and trusts savings?

Information that must be reported on charities and trusts savings include financial transactions, account balances, and details of the charitable purposes for which the funds are allocated.

Fill out your charities and trusts savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charities And Trusts Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.