Get the free POLICY INSURED LIFEVES - bulmutualbbcab

Show details

MORTGAGE (ASSIGNMENT COLLATERAL) POLICY NO.: INSURED LIFE×VES): DECLARATION OF CREDITOR AND IRREVOCABLE BENEFICIARIES (if applicable) As the owner, I hereby transfer the policy indicated above as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign policy insured lifeves

Edit your policy insured lifeves form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your policy insured lifeves form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit policy insured lifeves online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit policy insured lifeves. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out policy insured lifeves

How to fill out policy insured lifeves:

01

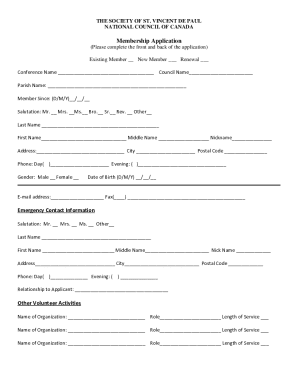

Gather all necessary information: Before filling out the policy for insured lifeves, make sure you have all the required information at hand. This typically includes personal details of the insured individual such as full name, date of birth, address, contact information, and social security number.

02

Evaluate coverage needs: Determine the desired coverage amount for the insured lifeves policy. Consider factors such as the individual's income, outstanding debts, financial dependents, and future obligations to ensure an adequate coverage amount is chosen.

03

Choose the policy type: There are different types of insured lifeves policies available, such as term lifeves or whole lifeves insurance. Research and choose the type that aligns with your needs, budget, and future goals.

04

Contact a reputable insurance provider: Reach out to an insurance provider that offers insured lifeves policies. Discuss your requirements, desired coverage amount, and any specific questions you may have. The insurance provider will guide you through the application process.

05

Complete the application: Fill out the application form provided by the insurance provider accurately and honestly. Provide all the necessary information about the insured individual as requested, including medical history, lifestyle habits, and any other relevant details.

06

Disclose any required documentation: In some cases, the insurance provider may require supporting documents, such as medical records or financial statements, to assess the risk and underwrite the policy. Make sure to submit any required documentation promptly and as requested.

07

Review and sign the policy: Once the application is completed, carefully review all the details of the policy. Understand the terms, conditions, coverage, premiums, and any additional riders or options included. If everything is in order, sign the policy acknowledging your agreement with the terms and conditions.

Who needs policy insured lifeves:

01

Individuals with financial dependents: Policy insured lifeves can provide financial protection for individuals who have dependents relying on their income. It ensures that in case of their untimely demise, their loved ones are financially safeguarded.

02

Breadwinners: The policy can be beneficial for individuals who are the primary earners for their families. It can assist in covering funeral expenses, outstanding debts, mortgage payments, or ensuring ongoing financial stability for their dependents.

03

Individuals with significant financial obligations: Anyone with significant financial obligations, such as outstanding loans or debts, can benefit from policy insured lifeves. The policy can help alleviate the burden on family members or co-signers in case of the insured individual's death.

04

Business owners: Policy insured lifeves can be a vital component of business succession planning. It can provide financial support to the surviving business partners or heirs, ensuring the continuity of the business and covering any outstanding obligations.

05

Individuals looking for tax benefits: Certain types of policy insured lifeves, such as whole lifeves insurance, may offer tax benefits. These benefits can be leveraged for estate planning or creating a tax-efficient legacy for beneficiaries.

Note: It is always recommended to consult with a financial advisor or insurance professional to assess your specific needs and determine the most suitable policy insured lifeves for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit policy insured lifeves from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including policy insured lifeves, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in policy insured lifeves without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your policy insured lifeves, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit policy insured lifeves on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as policy insured lifeves. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is policy insured lives?

Policy insured lives refers to the individuals whose lives are covered by an insurance policy.

Who is required to file policy insured lives?

The policyholder or the insurance company is required to file policy insured lives.

How to fill out policy insured lives?

Policy insured lives can be filled out by providing the necessary information about the individuals covered by the insurance policy.

What is the purpose of policy insured lives?

The purpose of policy insured lives is to ensure that the individuals covered by the insurance policy are accurately documented.

What information must be reported on policy insured lives?

Information such as name, age, gender, and relationship to the policyholder must be reported on policy insured lives.

Fill out your policy insured lifeves online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Policy Insured Lifeves is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.