Get the free 2016 Financing - CHS Sunprairie

Show details

CONTACTS Del Hindenburg Agronomy Manager 3391501 Jeremy Anderson Agronomy Operations Mgr 3390015 LOCATIONS Cowbells : 3772353 Lignite : 9332845 Niobe : 8482759 Norma : 4673300 Branden Homage Seed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2016 financing - chs

Edit your 2016 financing - chs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2016 financing - chs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2016 financing - chs online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2016 financing - chs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

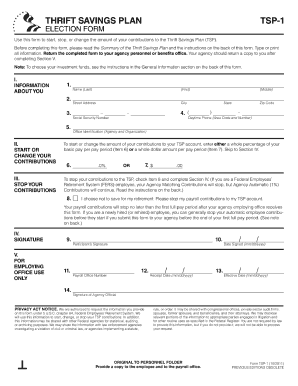

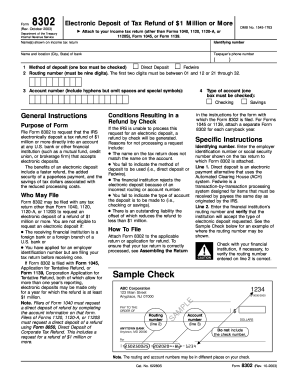

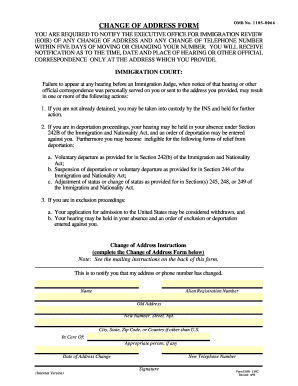

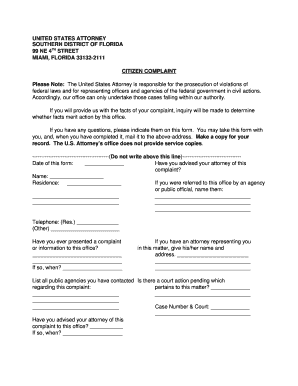

How to fill out 2016 financing - chs

How to fill out 2016 financing - chs:

01

Gather all necessary financial documents for the year 2016, including income statements, expense records, and any other relevant paperwork.

02

Begin by filling out the basic information section, which typically includes your name, address, social security number, and any other personal details required.

03

Move on to the income section and enter all sources of income for the year 2016, such as wages, self-employment earnings, dividends, interests, and any other forms of income received.

04

Next, proceed to the deduction section where you can itemize your eligible deductions such as mortgage interest, property taxes, medical expenses, and charitable contributions. Be sure to have the necessary documentation to support these deductions.

05

Complete the credits section, which allows you to claim any tax credits you may be eligible for, such as the child tax credit or education credits.

06

Double-check all the information entered to ensure accuracy and make any necessary corrections.

07

Once you are satisfied with the accuracy of the information provided, sign and date the form.

08

Keep a copy of the completed form for your records. It is also advisable to keep copies of all supporting documents.

09

Submit the filled-out form and any required attachments to the appropriate tax authority by the specified deadline.

Who needs 2016 financing - chs?

01

Individuals who earned income during the year 2016, regardless of the amount, may need to fill out 2016 financing - chs.

02

Self-employed individuals with business income or contractors with freelance earnings will need to complete this form to report their income and expenses.

03

Salaried individuals who want to claim deductions or tax credits they are eligible for will need to fill out 2016 financing - chs to ensure accurate reporting and potentially reduce their tax liability.

04

Homeowners who paid mortgage interest and property taxes during the year may need to fill out this form to claim these deductions.

05

Individuals who made charitable donations or incurred significant medical expenses may need to complete this form to claim the related deductions.

06

Parents or guardians who qualify for child-related tax credits, such as the child tax credit or the earned income credit, will need to fill out this form to claim those credits.

07

Students or their parents who paid qualifying education expenses may need to complete this form to claim education-related tax credits.

08

Any individual who wants to ensure accurate reporting of their income, deductions, and credits for the year 2016 should fill out 2016 financing - chs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my 2016 financing - chs in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your 2016 financing - chs and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit 2016 financing - chs straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 2016 financing - chs.

How do I fill out the 2016 financing - chs form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 2016 financing - chs on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is financing - chs sunprairie?

Financing - chs sunprairie refers to the process of obtaining funds or capital for the operations and activities of the CHS Sunprairie organization.

Who is required to file financing - chs sunprairie?

CHS Sunprairie employees or representatives who are involved in financial transactions or decision-making may be required to file financing reports.

How to fill out financing - chs sunprairie?

To fill out financing for CHS Sunprairie, one may need to provide details about the source of funds, intended use, timelines, budget estimates, and any other relevant financial information.

What is the purpose of financing - chs sunprairie?

The purpose of financing for CHS Sunprairie is to ensure proper funding for the organization's operations, projects, and initiatives.

What information must be reported on financing - chs sunprairie?

Information such as funding sources, amounts, planned expenditures, budget allocations, financial projections, and any other relevant financial details may need to be reported on CHS Sunprairie financing forms.

Fill out your 2016 financing - chs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2016 Financing - Chs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.