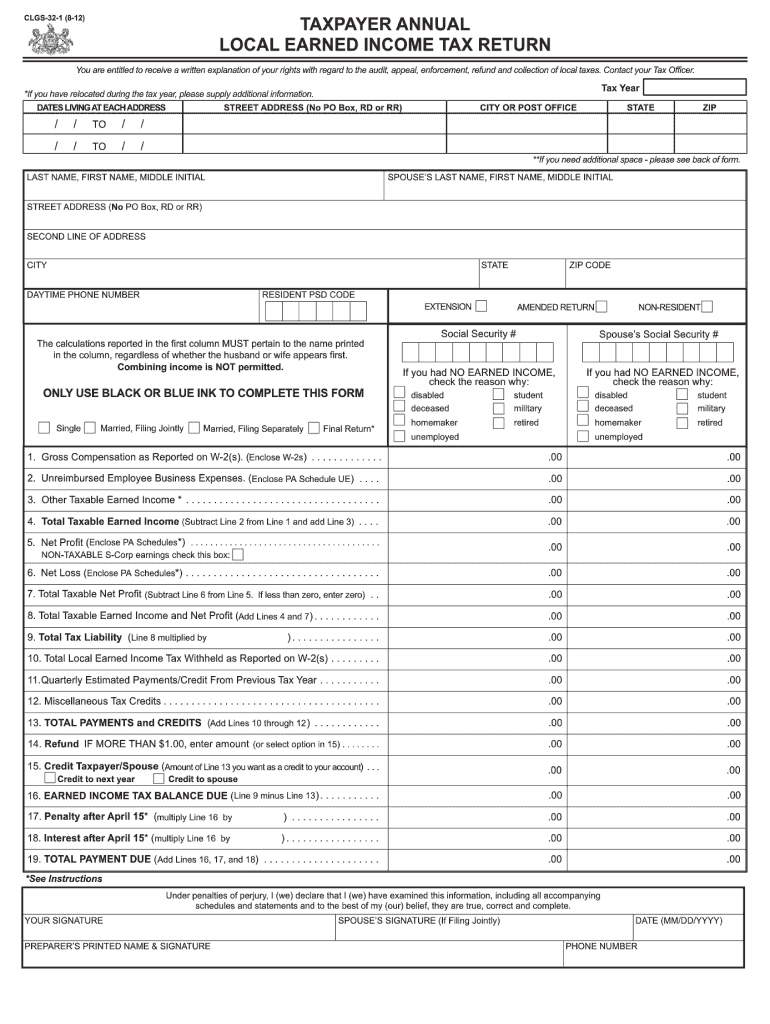

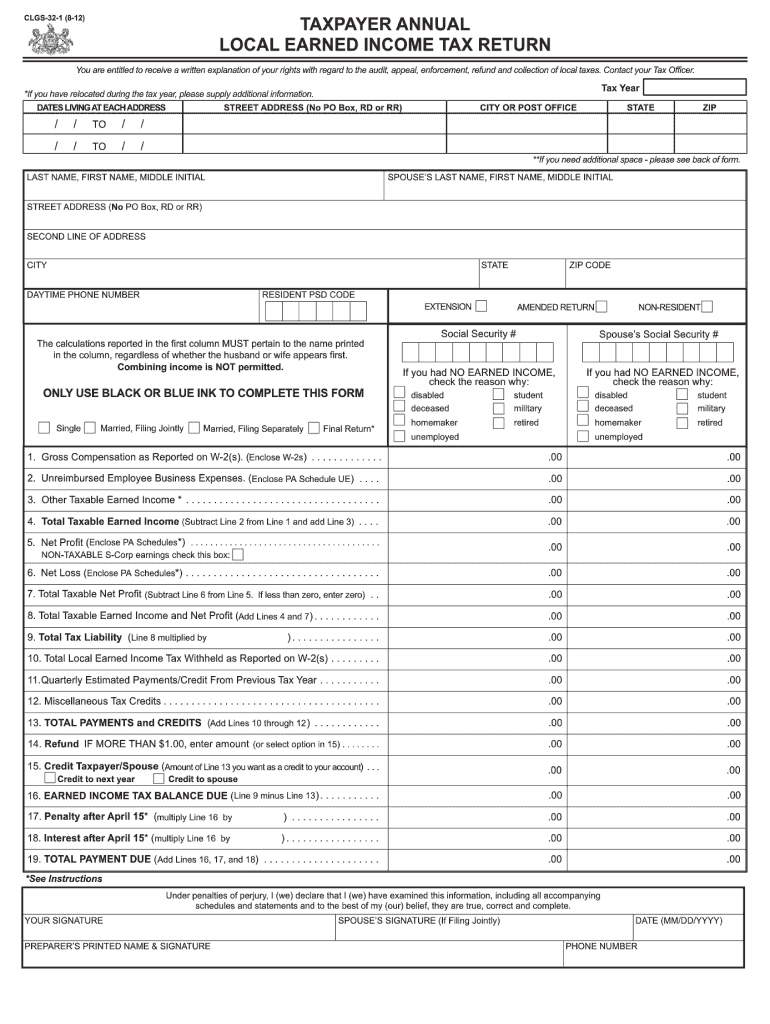

After April 15 you must complete Form W-2, Employee's Withholding Allowance Statement. Use Form W-2-EZ, Employee's Withholding Request, and the instructions to complete this form and send it to the IRS. You cannot change this payment as long as you are filing this return. 2. EXEMPTIONS: A taxpayer is relieved from the tax due on the value of any exempt property if the taxpayer: (1) holds the exempt property continuously through December 31 of the year; (2) has held the exempt property continuously for the preceding tax year; and (3) has reasonable cause for reasonable delay in filing the return. B. Forms and Instructions 1. Form 1099-MISC, Miscellaneous Income Tax Return. The form is available electronically through the IRS Website at. To submit your claim for a refund by mail, you may wish to use Form 4029. The return must be submitted by June 30 of the year following the year it was claimed. All forms must be accompanied by a bill or receipt. 2. Internal Revenue Code, Section 6516, Foreign Currency Reporting on a Cash or Credit Return. This section of the Internal Revenue Code requires taxpayers to report the fair market value of property held by the taxpayer in foreign countries based on a reasonable basis. The provisions of this section are intended to prevent overpayment of tax. 3. Internal Revenue Code, Section 6517, Interest Deduction on Tax-Exempt Bond Interest. If you are married and file joint returns, you may be eligible for an income tax credit if you file an applicable section 72(t) tax return. The interest deduction should be claimed on Form 8283. You must claim the interest deduction for the period when the interest is actually paid, the tax year in question. You may be entitled to a refund at any time if it has been more than five years since the last return was filed for the tax year of the interest. If you do not use Form 8283, you should report the interest deduction on Form 1040, line 14. 4. Internal Revenue Code, Section 6501, Payment of Tax Due Under a Deferred Compensation Plan or Annuity Agreement. In general, you can't get a tax credit for amounts paid on a deferred compensation plan or annuity agreement. However, the rules have been interpreted to permit credit for certain amounts paid that have been deferred under a deferred compensation plan but not for those payments that were based on performance.

PA DCED CLGS-32-1 2012 free printable template

Show details

CLGS-32-1 (8-12) TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN INSTRUCTIONS A. General Instructions 1. WHEN TO FILE: This return must be completed and filed by all persons subject to the tax on or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit . Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

PA DCED CLGS-32-1 Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

People Also Ask about -

What is a form defined as?

What is form and meaning examples?

What do you mean by a form?

What is the definition of form for kids?

What is an example of a form in English?

What is a form in grammar?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your in seconds.

How do I edit straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing .

How do I complete on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your . You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.