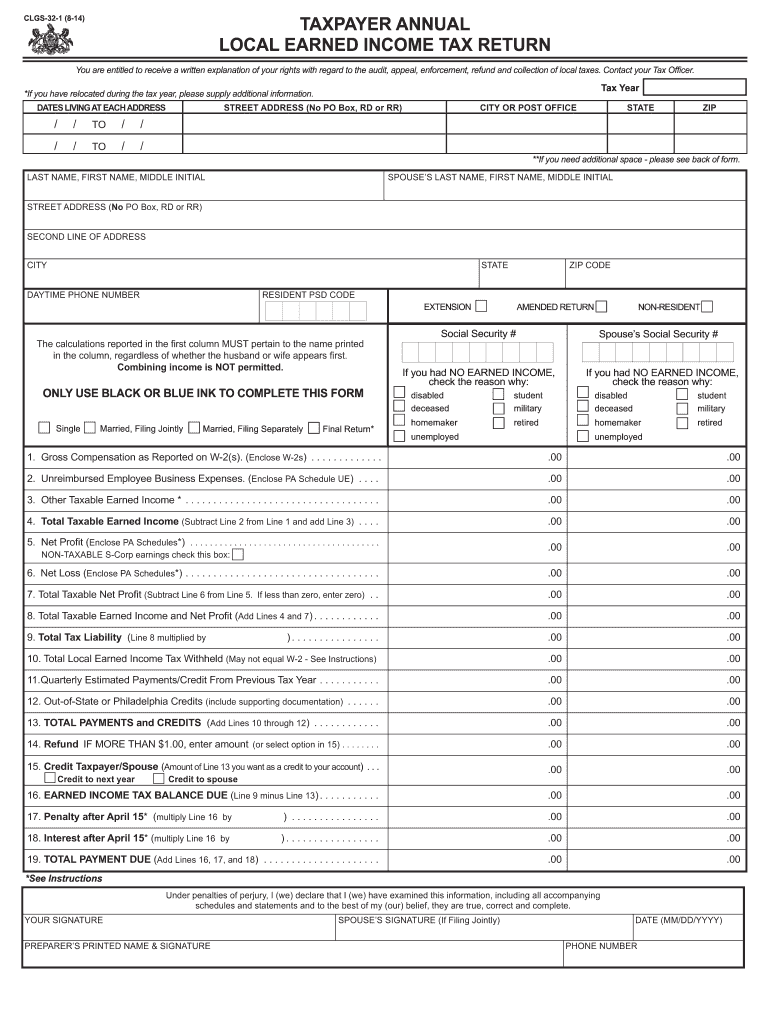

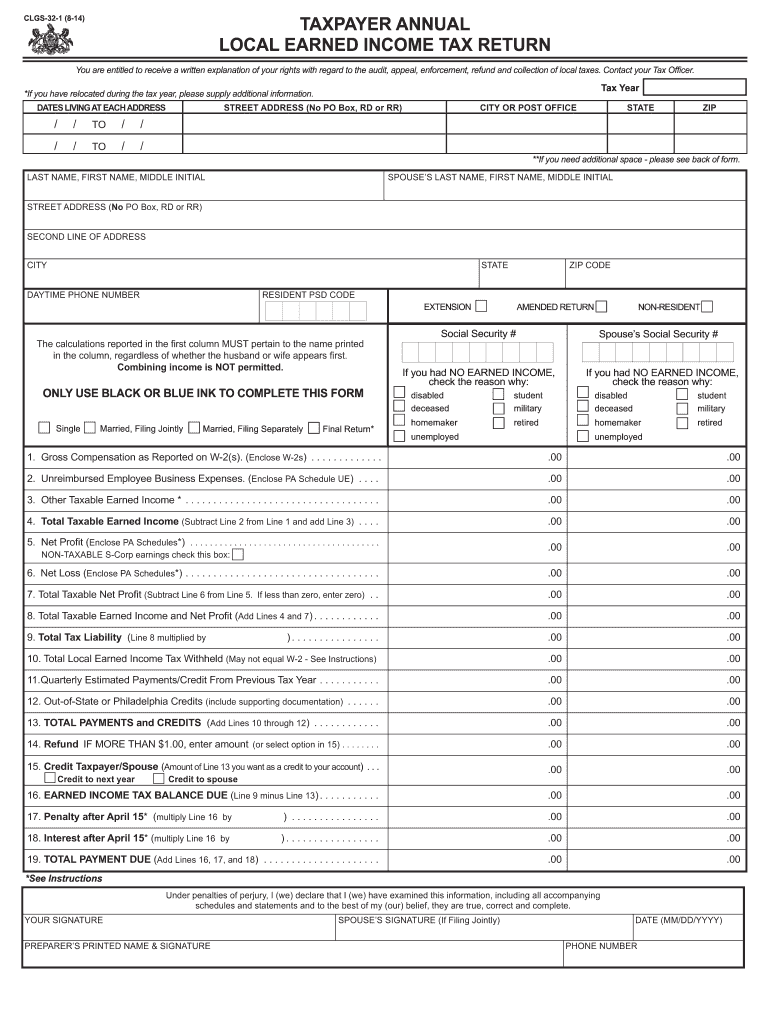

PA DCED CLGS-32-1 2014 free printable template

Show details

Local tax 1 or as specified on the front of this form. Tax Liability Paid to other state s. PA Income Tax line 1 x PA Income Tax rate for year being reported. CLGS-32-1 8-14 TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN INSTRUCTIONS A. General Instructions WHEN TO FILE This return must be completed and filed by all persons subject to the tax on or before April 15 unless the 15th is a Saturday or Sunday then file the next business day regardless of whether or not tax is due. If you file a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form clgs 32 1

Edit your form clgs 32 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form clgs 32 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form clgs 32 1 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form clgs 32 1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DCED CLGS-32-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form clgs 32 1

How to fill out PA DCED CLGS-32-1

01

Download the PA DCED CLGS-32-1 form from the official website.

02

Fill in your business name at the top of the form.

03

Provide the legal address of the business.

04

Enter the contact information including phone number and email.

05

Specify the type of business organization (e.g., LLC, corporation).

06

Complete the financial information section detailing revenue and expenses.

07

Include any additional required documentation as indicated in the form instructions.

08

Review all information for accuracy.

09

Sign and date the form.

10

Submit the completed form to the appropriate department.

Who needs PA DCED CLGS-32-1?

01

Businesses looking to apply for a grant or funding through the PA Department of Community and Economic Development (DCED).

02

Organizations that qualify for programs aimed at economic development in Pennsylvania.

03

Entrepreneurs seeking assistance for business expansion or start-up initiatives.

Instructions and Help about form clgs 32 1

Fill

form

: Try Risk Free

People Also Ask about

What is the PA local tax form called?

If you are trying to locate, download, or print state of Pennsylvania tax forms, you can do so on the Pennsylvania Department of Revenue. The most common Pennsylvania income tax form is the PA-40.

Who is exempt from filing local taxes in PA?

Mandatory Low-Income Exemption. Political subdivisions that levy an LST at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the political subdivision is less than $12,000.

Do PA non residents pay local taxes?

Pennsylvania law requires withholding at a rate of 3.07 percent on non-wage Pennsylvania source income payments made to nonresidents. Withholding of payments that are less than $5,000 during the calendar year are optional and at the discretion of the payor.

Where can I get local tax forms?

Local IRS Taxpayer Assistance Center (TAC) – The most common tax forms and instructions are available at local TACs in IRS offices throughout the country.

Do I have to file a local income tax return in PA?

Yes. State law requires Pennsylvania residents with earned income, wages and/or net profits, to file an annual local earned income tax return and supply income and withholding documentation, such as a W-2. Even if you have employer withholding or are not expecting a refund, you must file an annual tax return.

How do I file local income tax in PA?

File Your Local Earned Income Tax Return Online Access e-file. Provide the required information (e.g., your wages, local tax withholding and where you lived during the year). Schedule your payment to arrive on or before the due date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form clgs 32 1 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form clgs 32 1. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute form clgs 32 1 online?

pdfFiller has made filling out and eSigning form clgs 32 1 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I fill out form clgs 32 1 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your form clgs 32 1, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is PA DCED CLGS-32-1?

PA DCED CLGS-32-1 is a specific form used by the Pennsylvania Department of Community and Economic Development for reporting financial information related to community and economic development projects.

Who is required to file PA DCED CLGS-32-1?

Entities or organizations that receive funding from the Pennsylvania Department of Community and Economic Development for community development projects are required to file PA DCED CLGS-32-1.

How to fill out PA DCED CLGS-32-1?

To fill out PA DCED CLGS-32-1, you need to provide accurate financial information as specified in the form, including project details, funding sources, and expenses. Make sure to follow the guidelines provided by the Pennsylvania DCED.

What is the purpose of PA DCED CLGS-32-1?

The purpose of PA DCED CLGS-32-1 is to collect essential information regarding the financial status of community development projects funded by state grants, ensuring transparency and accountability.

What information must be reported on PA DCED CLGS-32-1?

PA DCED CLGS-32-1 requires reporting information such as project name, funding amounts, expenditure details, project objectives, and outcomes. Additionally, it may require supporting documents to validate the reported data.

Fill out your form clgs 32 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Clgs 32 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.