Get the free CLGS-32-3 (8-11)

Show details

Este formulario se utiliza para calcular y reportar el impuesto local sobre la renta ganada estimado trimestralmente. Incluye secciones para corregir la información de contacto y calcular el impuesto

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign clgs-32-3 8-11

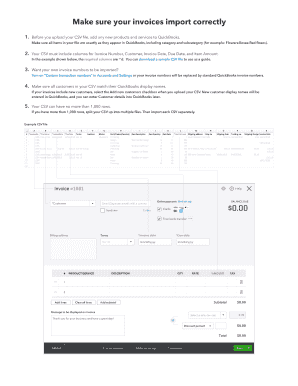

Edit your clgs-32-3 8-11 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your clgs-32-3 8-11 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing clgs-32-3 8-11 online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit clgs-32-3 8-11. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out clgs-32-3 8-11

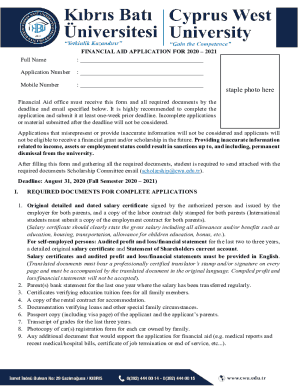

How to fill out CLGS-32-3 (8-11)

01

Begin with your personal information in the designated fields.

02

Clearly print your name, address, and contact details.

03

Provide any required identification numbers, such as Social Security or tax ID numbers.

04

Fill in the specific information requested about the purpose of the form.

05

Review the instructions carefully to ensure completeness.

06

Sign and date the form at the bottom.

Who needs CLGS-32-3 (8-11)?

01

Individuals or organizations that want to apply for a particular service or benefit related to CLGS-32-3 (8-11).

02

Those required to report certain information to a regulatory authority.

03

Anyone seeking compliance or regulatory approvals for specific activities.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from local service tax?

Section 2 of the Local Tax Enabling Act requires each taxing authority to, by ordinance or resolution, exempt from the LST any person whose yearly earned income and net profits is less than $12,000, if the rate of the LST imposed is more than $10 ($15,600 if tax is greater than $52.00).

What is a PA residency certification form?

This form is to be used by employers and taxpayers to report essential information for the collection and distribution of Local Earned Income Taxes to the local EIT collector. This form must be used by employers when a new employee is hired or when a current employee notifies employer of a name or address change.

Do I have to pay local earned income tax?

Yes. If you live in a jurisdiction with an Earned Income tax in place and had wages for the year in question, a local earned income return must be filed annually by April 15, (unless the 15th falls on a Saturday or Sunday then the due date becomes the next business day) for the preceding calendar year.

What income is taxable for PA local earned income tax?

TAXABLE INCOME INCLUDES: Salaries, Wages, Commissions, Bonuses, Tips, Stipends, Fees, Incentive Payments, Employee Contributions to Retirement Accounts, Compensation Drawing Accounts (If amounts received as a drawing account exceed the salaries or commission earned, the tax is payable on the amounts received.

Do you have to pay local earned income tax?

Yes. If you live in a jurisdiction with an Earned Income tax in place and had wages for the year in question, a local earned income return must be filed annually by April 15, (unless the 15th falls on a Saturday or Sunday then the due date becomes the next business day) for the preceding calendar year.

What is exempt from the local earned income tax?

Certain income, such as Social Security benefits, Unemployment Compensation, military pay, interest and dividends are not taxable. For greater detail, access Instructions, or contact your professional tax preparer.

What happens if you don't file local income tax?

There may be a $25.00 fee for failure to file a Local Earned Income Tax Return by April 15th of the following tax year. The fee is per individual. Persons filing a combined return with a spouse could owe a late filing fee of $50.00.

Do you pay local taxes on social security in PA?

Retirement benefits are subject to federal income taxes; however, retirement benefits are not subject to Pennsylvania state and local taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CLGS-32-3 (8-11)?

CLGS-32-3 (8-11) is a specific form used for reporting certain information related to specific regulatory requirements in the context of state regulations.

Who is required to file CLGS-32-3 (8-11)?

Individuals or organizations that meet the legal criteria set forth by the relevant authorities and are involved in activities that necessitate this filing are required to submit CLGS-32-3 (8-11).

How to fill out CLGS-32-3 (8-11)?

To fill out CLGS-32-3 (8-11), you should provide all necessary personal or organizational details, be sure to include relevant signatures, and follow the instructions provided on the form regarding specific sections.

What is the purpose of CLGS-32-3 (8-11)?

The purpose of CLGS-32-3 (8-11) is to ensure compliance with state regulations by collecting necessary information from filers to monitor and enforce the applicable laws effectively.

What information must be reported on CLGS-32-3 (8-11)?

The information that must be reported on CLGS-32-3 (8-11) includes details such as contact information, the nature of the activities undertaken, relevant dates, and any additional documentation required by the state.

Fill out your clgs-32-3 8-11 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Clgs-32-3 8-11 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.