Get the free Exchange Between Funds Form

Show details

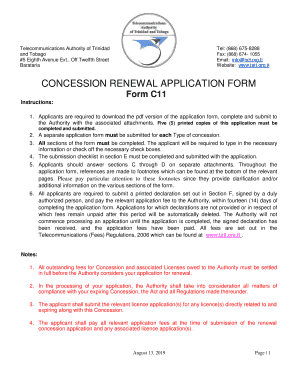

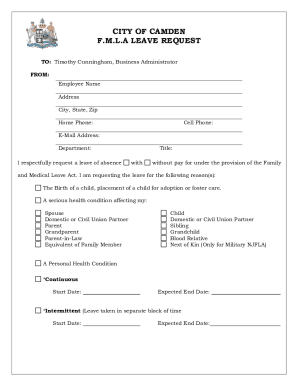

This form is used to request an exchange between funds for a shareholder account, allowing for either dollar or share amounts, and includes information related to account and representative.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign exchange between funds form

Edit your exchange between funds form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your exchange between funds form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit exchange between funds form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit exchange between funds form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out exchange between funds form

How to fill out Exchange Between Funds Form

01

Obtain the Exchange Between Funds Form from your financial institution or website.

02

Fill in your personal details, including your name, account number, and contact information.

03

Indicate the funds you wish to exchange from and to, including fund names and account numbers.

04

Specify the amount you want to exchange between the funds.

05

Review the form for accuracy and completeness.

06

Sign and date the form to authorize the transaction.

07

Submit the completed form to your financial institution via the method they provide (mail, email, in-person, etc.).

Who needs Exchange Between Funds Form?

01

Investors who wish to change their investment allocation between different funds.

02

Clients of financial institutions who have multiple investment accounts.

03

Individuals looking to rebalance their investment portfolio.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for exchange funds?

To take full advantage of the tax benefits of an exchange fund, investors must hold shares in the exchange fund for at least seven years. If investors withdraw from the fund early, they may receive back the l original public stock rather than diversified shares.

What is a fund transfer in English?

A Funds Transfer is a sequence of events that results in the movement of funds from the remitter to the beneficiary. It is also defined as the remittance of funds from one party to itself or to another party through the banking system.

What is an exchange-traded fund in English?

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product; i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars.

What are exchange transfer funds?

ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF, you get a bundle of assets you can buy and sell during market hours — potentially lowering your risk and exposure, while helping to diversify your portfolio.

What is exchange of funds?

An exchange fund, also known as a swap fund, is an investment vehicle that allows investors with large stock positions to pool their stocks into a single fund, diversifying their holdings without triggering a taxable event.

What is the meaning of exchange fund?

Exchange funds (not to be confused with exchange-traded funds) are private investment vehicles that allow investors with concentrated stock positions to pool their holdings together.

How to use exchange funds?

Process for Using an Exchange Fund Find a brokerage that facilitates the building of an exchange fund. Tell the brokerage about your appreciated asset and express interest. Wait for the firm to find others interested in an exchange fund. Accept the offer once they call. Move your stock position into the exchange fund.

Do exchange funds still exist?

Morgan Stanley Exchange Funds In 2021, Eaton Vance was acquired by Morgan Stanley. Together, they continue to offer exchange funds that allow investors to enjoy tax-deferred growth, reduce the risk of a concentrated position, and approximate the diversification and performance of broad index funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Exchange Between Funds Form?

The Exchange Between Funds Form is a document used to request the transfer of assets from one investment fund to another within the same investment platform.

Who is required to file Exchange Between Funds Form?

Investors or account holders who wish to exchange their investments from one fund to another within the same financial institution are required to file this form.

How to fill out Exchange Between Funds Form?

To fill out the form, investors need to provide details such as their account information, the funds they wish to exchange, amounts being transferred, and their signature to authorize the transaction.

What is the purpose of Exchange Between Funds Form?

The purpose of the form is to provide a formal request and documentation for the transfer of funds between different investment options, ensuring proper record keeping and compliance.

What information must be reported on Exchange Between Funds Form?

The form typically requires the investor's account details, the names and codes of the funds involved in the exchange, the amount to be exchanged, and the investor's signature.

Fill out your exchange between funds form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exchange Between Funds Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.