Get the free Simplified Profit Sharing Plan - JD Seibert and Company

Show details

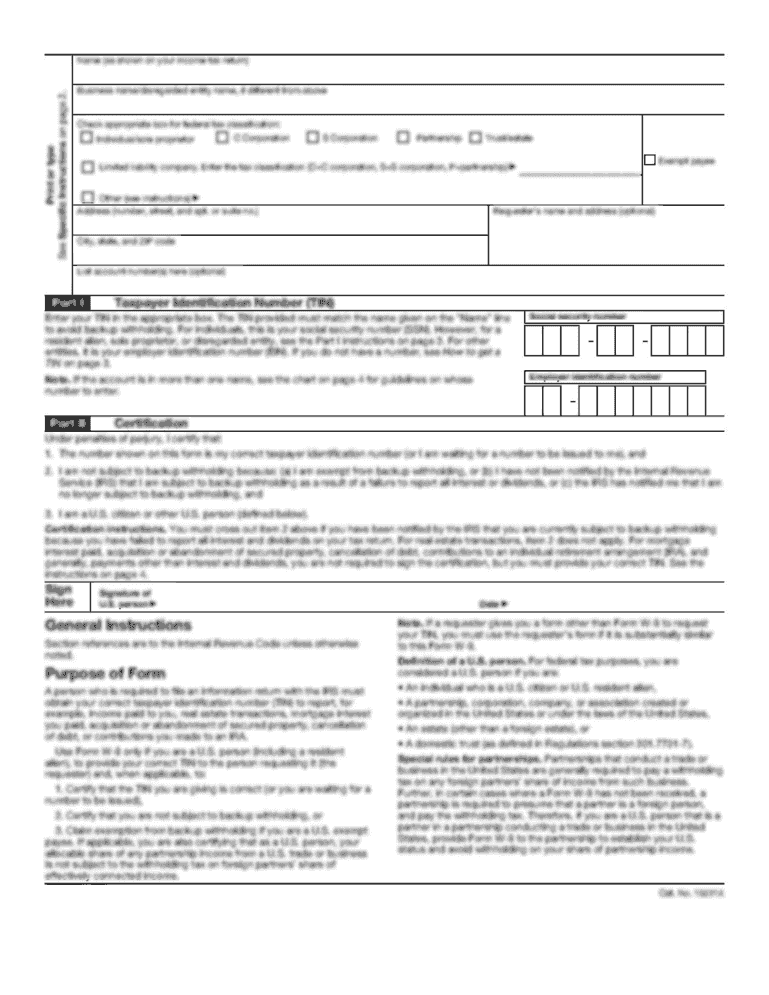

SIMPLIFIED STANDARDIZED PROFIT SHARING PLAN PF10072 06×05/2012 Qualified Retirement Plan Simplified Profit Sharing Plan STANDARDIZED ADOPTION AGREEMENT EMPLOYER INFORMATION Name of Adopting Employer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simplified profit sharing plan

Edit your simplified profit sharing plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simplified profit sharing plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit simplified profit sharing plan online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit simplified profit sharing plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simplified profit sharing plan

How to fill out a simplified profit sharing plan:

01

Start by gathering the necessary information: This includes the names and contact information of all participating employees, the percentage of each employee's eligible compensation to be contributed to the plan, and any applicable vesting schedules.

02

Determine the contribution method: There are various methods for contributing to a profit sharing plan, such as a flat dollar amount, a percentage of eligible compensation, or a combination of both. Choose the method that aligns with your company's goals and budget.

03

Establish the plan document: Create a written document that outlines the details of the profit sharing plan, including eligibility requirements, contribution rules, and provisions for plan termination or amendment. Consult with a legal professional or benefits consultant if needed.

04

Communicate the plan to employees: Provide clear and concise information to all eligible employees about the profit sharing plan. Explain how their contributions will be calculated, how the plan will be administered, and any other relevant details. It's important to ensure that employees understand the benefits and any potential risks associated with the plan.

05

Set up a trust or custodial account: To ensure the funds are properly managed and protected, establish a trust or custodial account specifically for the profit sharing plan assets. This account should be separate from the company's general funds and managed according to legal requirements.

06

Monitor and report plan activity: Keep track of contributions, earnings, and distributions made through the profit sharing plan. Regularly review and reconcile the plan's financial records to ensure compliance with applicable laws and regulations. Provide periodic statements to participating employees, detailing their individual account activity and balance.

Who needs a simplified profit sharing plan:

01

Small businesses: A simplified profit sharing plan can be an attractive option for small businesses looking to offer retirement benefits without the complexity and cost associated with larger retirement plans.

02

Employers looking to incentivize employees: By providing a profit sharing plan, employers can motivate employees to contribute to the company's success and align their interests with the overall financial performance.

03

Employers seeking tax advantages: Contributions made to a profit sharing plan are generally tax-deductible for the employer, helping to reduce taxable income. Additionally, the earnings on contributions grow tax-deferred until distributed to participants.

In conclusion, filling out a simplified profit sharing plan involves gathering information, determining contribution methods, establishing a plan document, communicating with employees, setting up a trust or custodial account, and monitoring plan activity. Small businesses, employers looking to incentivize employees, and those seeking tax advantages can benefit from implementing a simplified profit sharing plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the simplified profit sharing plan electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your simplified profit sharing plan in seconds.

Can I create an electronic signature for signing my simplified profit sharing plan in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your simplified profit sharing plan and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit simplified profit sharing plan straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing simplified profit sharing plan, you can start right away.

What is simplified profit sharing plan?

A simplified profit sharing plan is a retirement plan that allows employers to make discretionary contributions on behalf of their employees.

Who is required to file simplified profit sharing plan?

Employers who offer a simplified profit sharing plan to their employees are required to file the plan.

How to fill out simplified profit sharing plan?

To fill out a simplified profit sharing plan, the employer must provide information about the contributions made to the plan and the participants who are eligible to receive the contributions.

What is the purpose of simplified profit sharing plan?

The purpose of a simplified profit sharing plan is to provide a retirement benefit to employees and help them save for the future.

What information must be reported on simplified profit sharing plan?

The simplified profit sharing plan must report information about the contributions made to the plan, the participants who are eligible to receive the contributions, and any distributions made from the plan.

Fill out your simplified profit sharing plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simplified Profit Sharing Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.