Get the free Residential Loan Scenario Sheet(pdf) - Better Mortgage Management

Show details

Better Mortgage Management Pty. Ltd. ABN: 65 089 835 192 Australian Credit License Number 389612 PO Box 274 SPRING HILL QLD 4004 Phone: 1300 662 661 Fax: 1300 305 753 Email: info bettermm.com.AU LOAN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign residential loan scenario sheetpdf

Edit your residential loan scenario sheetpdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your residential loan scenario sheetpdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit residential loan scenario sheetpdf online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit residential loan scenario sheetpdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out residential loan scenario sheetpdf

How to fill out a residential loan scenario sheetpdf:

01

Begin by downloading the residential loan scenario sheetpdf from a reputable source or your lender's website.

02

Open the downloaded file using a PDF reader such as Adobe Acrobat Reader or any other compatible software.

03

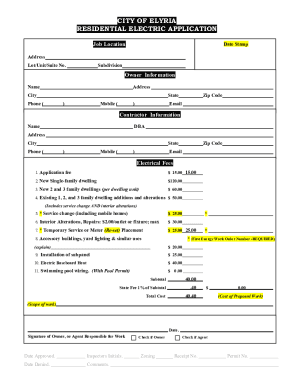

The sheetpdf typically consists of several sections and fields that need to be filled out accurately. Start with the borrower's information section which will require details such as name, address, contact information, social security number, and employment details.

04

Next, you will need to provide information about the desired loan scenario. This includes the type of loan (fixed rate, adjustable rate, FHA, VA, etc.), the loan amount, the desired term, and any other specific loan requirements or preferences.

05

Moving on, you may need to provide details about the property being financed, such as the address, property type (single-family, condo, etc.), estimated value, and the purpose of the loan (purchase, refinance, etc.).

06

The residential loan scenario sheetpdf may also require information about the borrower's income and assets. This can include employment history, current income, sources of income, and any other assets such as savings, investments, or real estate.

07

Additionally, the sheetpdf may have sections to input details about liabilities, expenses, and credit history. This can include information about existing debts, monthly expenses, and credit score.

08

Finally, review the filled-out form carefully to ensure accuracy and completeness. If required, make any necessary corrections or additions.

09

Save a copy of the completed residential loan scenario sheetpdf for your records and submit it to your lender as instructed.

Who needs a residential loan scenario sheetpdf?

01

Individuals or families who are planning to apply for a residential loan, such as a mortgage or home loan, may need a residential loan scenario sheetpdf.

02

Mortgage brokers and loan officers may also use this document to gather relevant information from borrowers in order to assess their loan eligibility and provide suitable loan options.

03

Lenders and financial institutions often require loan applicants to fill out a residential loan scenario sheetpdf as part of the loan application process to obtain detailed information about the borrower and their loan requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my residential loan scenario sheetpdf directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your residential loan scenario sheetpdf as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find residential loan scenario sheetpdf?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific residential loan scenario sheetpdf and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute residential loan scenario sheetpdf online?

Filling out and eSigning residential loan scenario sheetpdf is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is residential loan scenario sheetpdf?

Residential loan scenario sheetpdf is a document used to provide detailed information about a residential loan scenario.

Who is required to file residential loan scenario sheetpdf?

Lenders and financial institutions are required to file residential loan scenario sheetpdf.

How to fill out residential loan scenario sheetpdf?

To fill out residential loan scenario sheetpdf, one must provide accurate and detailed information about the residential loan scenario.

What is the purpose of residential loan scenario sheetpdf?

The purpose of residential loan scenario sheetpdf is to report and document information about a residential loan scenario for regulatory and compliance purposes.

What information must be reported on residential loan scenario sheetpdf?

Information such as borrower details, loan amount, interest rate, loan term, and any other relevant details about the residential loan scenario must be reported on residential loan scenario sheetpdf.

Fill out your residential loan scenario sheetpdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Residential Loan Scenario Sheetpdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.