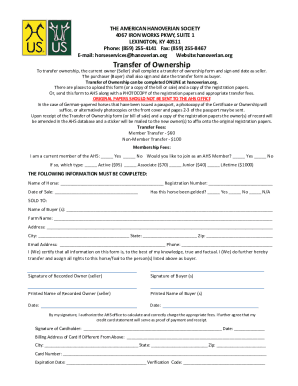

Get the free Investment Plans

Show details

This document outlines the FTSE 100 Growth Plan 17, detailing investment opportunities, potential returns, risks, and terms associated with this structured investment plan.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment plans

Edit your investment plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investment plans online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit investment plans. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment plans

How to fill out Investment Plans

01

Determine your investment goals and risk tolerance.

02

Gather your financial statements, including income, expenses, and existing investments.

03

Research different investment options, such as stocks, bonds, and mutual funds.

04

Create a diversified portfolio that aligns with your investment goals.

05

Decide on an investment timeframe (short-term, medium-term, or long-term).

06

Fill out the investment plan document with your chosen strategies and allocations.

07

Review and adjust your plan regularly based on performance and changes in your financial situation.

Who needs Investment Plans?

01

Individuals looking to grow their wealth over time.

02

Young professionals planning for retirement.

03

Families saving for education or major purchases.

04

Businesses seeking to allocate capital effectively.

05

Retirees aiming to manage their income from investments.

Fill

form

: Try Risk Free

People Also Ask about

What is the 7 5 3 1 rule?

The 7-5-3-1 rule in mutual fund investing is essentially a behavioural framework designed for SIP investors in equity mutual funds. It encompasses four major aspects: time horizon, diversification, emotional discipline, and contribution escalation.

What is an investment plan in English?

An investment plan is a financial product that helps you grow your money over time to achieve future financial goals. In India, you can choose from various types of investment plans, such as mutual funds, life insurance, Public Provident Fund (PPF), and bonds, with each serving a specific financial need.

How to write an investment plan?

How to Make an Investment Plan? Step 1: Examine Your Current Financial Circumstances. Step 2: Define Your Financial Objectives. Step 3: Determine Your Risk Tolerance. Step 4: Decide on Where You Want to Invest. Step 5: Keep an Eye on Your Investments and Rebalance Them if Necessary.

What is an investment plan?

An investment plan is a tool in the process of financial planning designed to develop an investing strategy to achieve your financial goals. An investment plan helps you structure how much cash, stock, bonds, and real estate to invest in to maximize returns.

How much will I have if I invest $1000 a month for 30 years?

How Much Investing $1,000 Per Month Pays Long-Term. The precise amount you'll have after investing $1,000 monthly at 6%, a conservative number depending on what you choose to invest in, for 30 years is $1,010,538, as figured by SmartAsset's free online Investment Calculator.

What is the 10/5/3 rule of investment?

The 10,5,3 rule will assist you in determining your investment's average rate of return. Though mutual funds offer no guarantees, according to this law, long-term equity investments should yield 10% returns, whereas debt instruments should yield 5%. And the average rate of return on savings bank accounts is around 3%.

What are the 4 types of investments?

Bonds, stocks, mutual funds and exchange-traded funds, or ETFs, are four basic types of investment options. They have the potential to earn a higher return, but they also carry a greater potential for loss if sold when the market is lower.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Investment Plans?

Investment Plans are strategic documents that outline an individual's or organization's strategy for allocating resources into various financial instruments, assets, or projects with the aim of generating returns over time.

Who is required to file Investment Plans?

Individuals or entities involved in investment activities, such as investors, companies, or funds, may be required to file Investment Plans, especially if mandated by regulatory bodies or required for reporting purposes.

How to fill out Investment Plans?

To fill out Investment Plans, one should gather relevant financial information, outline investment goals, specify the types of investments, and detail the expected timelines and returns. Additionally, one must often adhere to specific regulatory guidelines and forms provided by authorities.

What is the purpose of Investment Plans?

The purpose of Investment Plans is to provide a clear framework for managing investments, to set objectives for financial growth, to enable tracking of performance, and to comply with legal or regulatory requirements.

What information must be reported on Investment Plans?

Investment Plans typically require reporting on details such as investment objectives, asset allocation strategies, performance metrics, risk assessment, and any compliance or regulatory information relevant to the investments.

Fill out your investment plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.