Get the free Business Income & Expense Worksheet.xlsx - Hetletved CPA

Show details

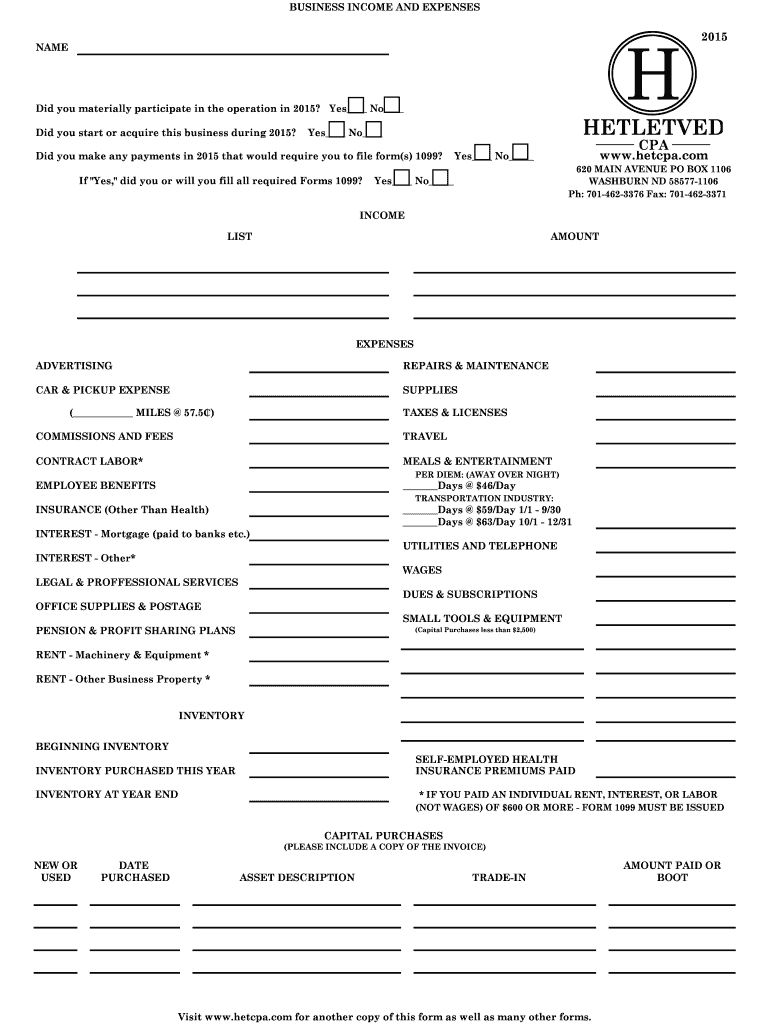

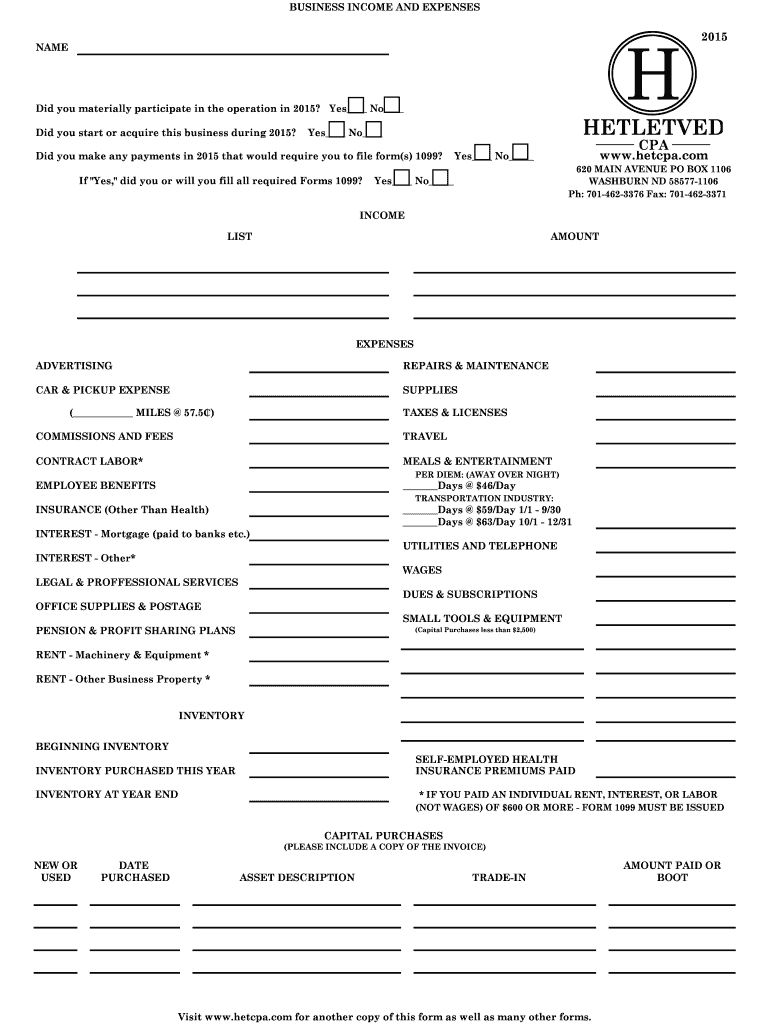

BUSINESS INCOME AND EXPENSES H NAME Did you materially participate in the operation in 2015? Yes No Did you start or acquire this business during 2015? DELETED Yes No Did you make any payments in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business income amp expense

Edit your business income amp expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business income amp expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business income amp expense online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business income amp expense. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business income amp expense

To fill out a business income and expense form, follow these steps:

01

Gather all relevant financial records: Collect receipts, invoices, bank statements, and any other documents that pertain to your business income and expenses. Organize them in a systematic manner for easy reference.

02

Review your income sources: Identify all the different streams of income your business generated during the given period. This could include sales revenue, rental income, interest earned, or any other sources. Make sure to record each income source separately.

03

Document your expenses: Carefully track and record all the expenses incurred by your business. This can encompass a wide range of items, such as office supplies, rent, utilities, employee wages, marketing costs, and any other relevant expenditures. Separating the expenses into categories can aid in later analysis.

04

Calculate your net profit or loss: Subtract your total expenses from your total income to determine the net profit or loss for the given period. If your total expenses exceed your total income, it results in a loss. Conversely, a positive net profit signifies that your business earned more revenue than it spent on expenses.

05

Complete the income and expense statement form: Using the appropriate form provided by your accounting software or the tax authorities, enter the required information. This usually includes your business name, tax ID, and the breakdown of income and expenses. Double-check the accuracy of the data before submitting.

06

Retain supporting documents: Keep copies of all the documents used to fill out the form, such as receipts and invoices. These serve as evidence and can be crucial in case of any future audits or inquiries.

Who needs business income and expense information?

Business income and expense information is necessary for various individuals and entities, including:

01

Small business owners: Properly tracking income and expenses allows owners to assess the financial health of their business, determine profitability, and make informed decisions about budgeting or identifying areas for potential cost reduction.

02

Self-employed individuals: Freelancers, contractors, and solopreneurs should maintain accurate records of their business income and expenses for tax purposes. This information helps in accurately reporting earnings and benefiting from relevant deductions.

03

Financial institutions: When applying for loans or credit, lenders often require business income and expense details to evaluate the creditworthiness of a company. It provides insights into the business's ability to generate consistent income and manage expenses effectively.

04

Tax authorities: Business income and expenses are crucial for tax reporting. The data is used to calculate taxable income, determine tax liability, and verify the accuracy of the tax returns submitted by individuals and businesses.

In conclusion, systematically filling out a business income and expense form is crucial for maintaining financial records, assessing business performance, complying with tax regulations, and meeting the requirements of various stakeholders.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the business income amp expense in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your business income amp expense in seconds.

How do I fill out the business income amp expense form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign business income amp expense and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit business income amp expense on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as business income amp expense. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is business income amp expense?

Business income and expenses refer to the financial transactions, revenues, and costs associated with operating a business.

Who is required to file business income amp expense?

Any individual or entity that operates a business is required to file business income and expenses.

How to fill out business income amp expense?

Business income and expenses are typically reported on a business tax return, such as a Schedule C for sole proprietors.

What is the purpose of business income amp expense?

The purpose of reporting business income and expenses is to calculate the taxable income of a business and determine the amount of taxes owed.

What information must be reported on business income amp expense?

Business income and expenses typically include revenue, costs of goods sold, operating expenses, and other financial transactions related to the business.

Fill out your business income amp expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Income Amp Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.