Get the free Schedule K-1 (Form 1065) 2003

Show details

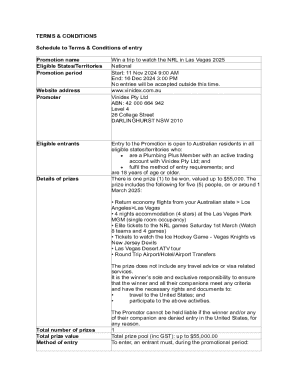

This form is used by partnerships to report a partner's share of income, deductions, and credits for tax purposes. It is part of the instructions for completing IRS Form 1065, applicable for the tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule k-1 form 1065

Edit your schedule k-1 form 1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule k-1 form 1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule k-1 form 1065 online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule k-1 form 1065. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule k-1 form 1065

How to fill out Schedule K-1 (Form 1065) 2003

01

Obtain a copy of Schedule K-1 (Form 1065) 2003.

02

Enter the partnership's name, address, and Employer Identification Number (EIN) at the top of the form.

03

Fill in the partner's name, address, and identifying number (such as Social Security Number).

04

Enter the partner's share of income, deductions, credits, and other tax-related items as specified in the partnership's documentation.

05

Complete the 'Partner's Share of Income, Deductions, Credits, etc.' section by providing the amounts applicable to each category.

06

Review the completed form for accuracy and ensure all necessary information is provided.

07

Provide copies of the completed Schedule K-1 to each partner and submit the original to the IRS with Form 1065.

Who needs Schedule K-1 (Form 1065) 2003?

01

Partners in a partnership who receive income or losses from the partnership must fill out Schedule K-1 (Form 1065) 2003.

02

Tax professionals preparing tax returns for partnerships also need this form to report individual partner's shares.

Fill

form

: Try Risk Free

People Also Ask about

Where to report foreign tax paid on form 1065?

Form 1065, Page 4, Schedule K, Line 16a requires the name of the country or U.S. possession if there is foreign transactions in the return. To enter the name of the country or U.S. possession, do the following: Go to Foreign > Foreign Taxes. Select Section 1 - Foreign Tax Information.

What is schedule K-1 form 1065?

Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc. The partnership files a copy of Schedule K-1 (Form 1065) with the IRS to report your share of the partnership's income, deductions, credits, etc.

Do you have to file a schedule K-1 in Canada?

In general, Canadian resident unitholders may disregard the Schedule K-1 (unless for example, they are a U.S. citizen). Schedule K-1 forms are anticipated to be mailed each year in early March for the prior tax year.

Who should file a 1065?

Who Must File Form MO-1065 Form MO-1065 must be filed, if Federal Form 1065 is required to be filed and the partnership has (1) a partner that is a Missouri resident or (2) any income derived from Missouri sources, Section 143.581, RSMo.

What is K-1 1065?

partnerships (form 1065): partnerships file an informational return with the irs and issue schedule k-1s to each partner, detailing their share of the partnership's income, deductions, and credits.

Where do I enter distributions on 1065?

Partner Distributions are entered under Business Info >> Partner/Member Information. For each partner, enter the cash distribution received on the Member Capital page. TurboTax will carry that information to the related Schedule K-1.

What does K1 mean in business?

Written by a TurboTax Expert • Reviewed by a TurboTax CPA Updated for Tax Year 2024 • July 31, 2025 8:20 AM. OVERVIEW. Schedule K-1 is used to report the amount of income each party is responsible for in a pass-through entity, like an S corporation or partnership. Each shareholder or partner will receive a Schedule K-1

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule K-1 (Form 1065) 2003?

Schedule K-1 (Form 1065) 2003 is a tax document used to report income, deductions, and credits from partnerships to the partners. It provides a detailed breakdown of each partner's share of the partnership's income, losses, and other relevant information for tax reporting purposes.

Who is required to file Schedule K-1 (Form 1065) 2003?

Partnerships that are classified as pass-through entities are required to file Schedule K-1 (Form 1065) 2003 for each partner. Each partner receives a K-1 form that reflects their share of the partnership's income, deductions, and credits.

How to fill out Schedule K-1 (Form 1065) 2003?

To fill out Schedule K-1 (Form 1065) 2003, the partnership must include information such as the partnership's name, address, and Employer Identification Number (EIN), as well as the specific amounts of income, deductions, and credits allocated to each partner. It's essential to follow the instructions accompanying the form to ensure accurate reporting.

What is the purpose of Schedule K-1 (Form 1065) 2003?

The purpose of Schedule K-1 (Form 1065) 2003 is to report the individual partner's share of the partnership's financial results, which is required for the partner's income tax return. It allows partners to properly report their income and claim any allowable deductions or credits.

What information must be reported on Schedule K-1 (Form 1065) 2003?

Schedule K-1 (Form 1065) 2003 must report information such as the partner's name, address, and tax identification number, the partnership's name, EIN, and total income or loss allocated to the partner, including specific figures for various types of income and deductions.

Fill out your schedule k-1 form 1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule K-1 Form 1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.