Get the free Commercial Yields: Agency Vs Valuer

Show details

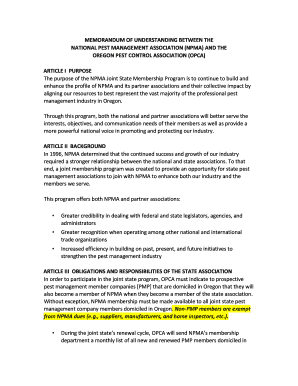

This document is a registration form for a seminar discussing the outlook on the commercial market from the perspectives of an owner, valuer, and agent, including details on registration fees and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial yields agency vs

Edit your commercial yields agency vs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial yields agency vs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial yields agency vs online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit commercial yields agency vs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial yields agency vs

How to fill out Commercial Yields: Agency Vs Valuer

01

Gather all necessary financial data related to the commercial property.

02

Identify the agency and the valuer for the property.

03

Determine the methods used by the agency for calculating yields, such as market comparisons or rental assessments.

04

Collect yield figures from the agency based on their calculations.

05

Consult the valuer for their independent assessment of the property's value and yield.

06

Compare the yields provided by the agency and the valuer.

07

Analyze discrepancies and document the reasons for any differences.

08

Use the finalized yield figures for investment decisions or financial reporting.

Who needs Commercial Yields: Agency Vs Valuer?

01

Real estate investors looking to evaluate potential returns on commercial properties.

02

Property developers seeking accurate valuations for financing.

03

Real estate agencies that need to provide insights to clients.

04

Financial institutions assessing risk and value for lending purposes.

05

Appraisers and valuers requiring market insights to inform their assessments.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate commercial yield?

Calculating yield To calculate, take the 'Annual rental income (Weekly rent x 52 weeks)' and divide by the 'Property value'. Then multiply this number by 100.

What are the five types of valuation?

This course examines in detail the five key property valuation methods: comparison, investment, residual, profits, and cost-based.

What is commercial yield?

Commercial property yield is the annual return on investment from a commercial property, expressed as a percentage of its purchase price or current market value.

What is the best valuation method for real estate?

One of the most important tools for valuing income-producing properties is the capitalization rate, or "cap rate." This measures a property's value based on potential income, similar to how bonds can be assessed based on their expected yield, not merely on how much you can sell them for.

What is a commercial yield?

A commercial property yield is the total annual return on a commercial property investment, expressed as a percentage. This is how you can calculate yield:: Commercial Property Yield = Rental Income + Capital Growth / Purchase Price x 100.

What does a 5% yield mean?

It's stated as a percentage of the price of the bond. For example, if you have a $1,000 bond that pays $50 per year, the yield is 5%. A bond's yield is influenced by the current market climate, meaning how much investors can demand for lending money to an issuer for a specified period of time.

What is a good commercial yield?

The definition of a "good" yield depends on various factors, including location, market conditions, and the investor's goals. Generally speaking: Prime commercial properties (e.g., in central business districts) tend to offer yields between 4% and 6%, due to lower risk and higher demand.

What is a commercial valuation?

To refresh on the basics: a commercial property valuation is an appraisal of a building that is used for business purposes. This covers many different types of properties and industries. Common examples include offices or retail stores. Then there are the more niche options, such as laboratories or medical centres.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Commercial Yields: Agency Vs Valuer?

Commercial Yields refer to the income generated from commercial properties, measured by the rent received relative to the property value. The term 'Agency' typically involves real estate agents who represent sellers or landlords in leasing properties, while 'Valuer' refers to professionals who assess the value of commercial properties, providing appraisals based on various factors.

Who is required to file Commercial Yields: Agency Vs Valuer?

Individuals or entities involved in the commercial property market, including real estate agents and valuers, may be required to file Commercial Yields. This may include property owners reporting income, property managers, and other stakeholders involved in the commercial property sector.

How to fill out Commercial Yields: Agency Vs Valuer?

To fill out Commercial Yields, one should collect necessary financial data regarding the property, including total rental income, operating expenses, and property valuation. This information should be documented according to the provided guidelines, ensuring accuracy in reporting metrics like gross yield, net yield, and other pertinent financial indicators.

What is the purpose of Commercial Yields: Agency Vs Valuer?

The purpose of Commercial Yields is to provide a standardized measure of the financial performance of a commercial property, helping stakeholders evaluate investment potential, make informed decisions, and comply with regulatory requirements regarding financial reporting.

What information must be reported on Commercial Yields: Agency Vs Valuer?

Required information typically includes the property's rental income, occupancy rates, maintenance costs, the property's assessed value, comparable market data, and any other financial metrics pertinent to the yield calculation. This ensures a comprehensive overview of the property's financial performance.

Fill out your commercial yields agency vs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Yields Agency Vs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.