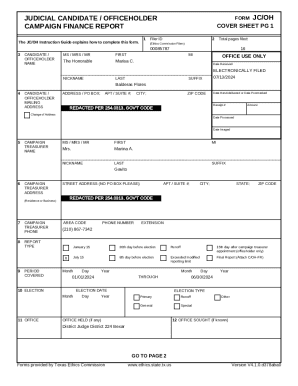

Get the free FORM 104CR—INDIVIDUAL CREDIT SCHEDULE

Show details

This form is used by individuals to claim various tax credits in Colorado for the year 2010, including child care credits and other refundable credits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 104crindividual credit schedule

Edit your form 104crindividual credit schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 104crindividual credit schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 104crindividual credit schedule online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 104crindividual credit schedule. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 104crindividual credit schedule

How to fill out FORM 104CR—INDIVIDUAL CREDIT SCHEDULE

01

Obtain FORM 104CR—INDIVIDUAL CREDIT SCHEDULE from the tax authority's website or local office.

02

Read the instructions carefully to understand eligibility for credits.

03

Gather necessary documentation, such as proof of income and any relevant expense receipts.

04

Start filling out the form by providing personal information, including your name, address, and Social Security number.

05

List all applicable tax credits that you qualify for in the appropriate sections of the form.

06

Calculate the total amount of credits by adding them up in the designated space.

07

Double-check all information for accuracy before submission.

08

Sign and date the form before submitting it to the tax authority.

Who needs FORM 104CR—INDIVIDUAL CREDIT SCHEDULE?

01

Individuals residing in the relevant jurisdiction who are eligible for tax credits.

02

Taxpayers who have expenses that qualify for deductions under state tax laws.

03

Residents seeking to claim credits for specific individual circumstances such as education, health care, or other qualifying expenses.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies for the Colorado pension and annuity exclusion?

Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year. Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension.

What is form 104cr Colorado?

DR 0104CR - Individual Credit Schedule. Use this schedule to calculate your income tax credits. For best results, view the DR 0104 Booklet for line-by-line information about claiming these credits.

Should I fill out a Colorado employee withholding certificate?

This Certificate is Optional for Employees. If you do not complete this certificate, then your employer will calculate your Colorado withholding based on your IRS Form W-4.

What is line 4 on Colorado tax return?

Line 4 — Report the amount indicated as Colorado payments from Colorado Form 106 line 17. Line 5 — Report the amount reported as the amount you owe from Colorado Form 106 line 24. Line 6 — Report the amount reported as a refund on Colorado Form 106 line 27.

Who is eligible for the family affordability tax credit in Colorado?

Who is eligible for Colorado's Family Affordability Tax Credit? Colorado residents with adjusted gross incomes of less than $85,000 for single filers and less than $95,000 for joint filers are eligible if they have children age 16 or younger who qualify for the federal child tax credit.

Does Colorado give credit for taxes paid to another state?

The credit for tax paid to another State can be claimed by a part-year Colorado resident to the extent that the income derived in, and taxed by, the other State was earned while the taxpayer was a Colorado resident. The credit is limited as set forth in paragraph (3), above.

What is Colorado form 104cr?

DR 0104CR - Individual Credit Schedule. Use this schedule to calculate your income tax credits. For best results, view the DR 0104 Booklet for line-by-line information about claiming these credits.

Who qualifies for Colorado child tax credit?

For the regular Colorado child tax credit, the child must be under age 6 at the end of 2024 (born in 2019 or later), and your Adjusted Gross Income (AGI) must be $75,000 or less ($85,000 if filing jointly).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 104CR—INDIVIDUAL CREDIT SCHEDULE?

FORM 104CR—INDIVIDUAL CREDIT SCHEDULE is a tax form used by individuals in certain jurisdictions to claim nonrefundable and refundable credits against their state income tax.

Who is required to file FORM 104CR—INDIVIDUAL CREDIT SCHEDULE?

Individuals who are eligible for tax credits in their state and who are filing a state income tax return are required to file FORM 104CR—INDIVIDUAL CREDIT SCHEDULE.

How to fill out FORM 104CR—INDIVIDUAL CREDIT SCHEDULE?

To fill out FORM 104CR, individuals should gather all relevant financial information, including income details, the specific credits they wish to claim, and any supporting documentation. They should then complete the form by accurately entering this information and calculating the credits.

What is the purpose of FORM 104CR—INDIVIDUAL CREDIT SCHEDULE?

The purpose of FORM 104CR is to provide a detailed account of the tax credits that an individual is claiming, allowing for the reduction of their taxable income or tax due, thus potentially lowering their overall tax liability.

What information must be reported on FORM 104CR—INDIVIDUAL CREDIT SCHEDULE?

FORM 104CR requires individuals to report personal identification details, the types of tax credits they are claiming, the amounts associated with each credit, and any other pertinent information that supports their eligibility for those credits.

Fill out your form 104crindividual credit schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 104crindividual Credit Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.