Get the free PA SCHEDULE E

Show details

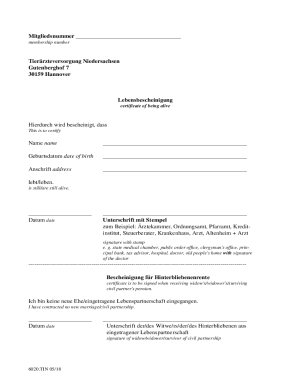

Este formulario se utiliza para informar ingresos y gastos relacionados con propiedades en renta y regalías en el estado de Pensilvania.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pa schedule e

Edit your pa schedule e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa schedule e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pa schedule e online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pa schedule e. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pa schedule e

How to fill out PA SCHEDULE E

01

Gather all necessary information regarding your income and expenses from rental properties.

02

Obtain the current PA SCHEDULE E form from the Pennsylvania Department of Revenue website or relevant tax resources.

03

Fill out your identifying information such as name, address, and Social Security number at the top of the form.

04

Report income from each rental property in the appropriate sections, ensuring to include gross rents received.

05

Document any deductible expenses incurred, such as repairs, property management fees, and mortgage interest, in the sections designated for expenses.

06

Calculate net rental income by subtracting total expenses from total income.

07

Transfer the net rental income figure to the appropriate lines on your PA Personal Income Tax Return.

08

Make a copy of the completed PA SCHEDULE E for your records before submitting it with your tax return.

Who needs PA SCHEDULE E?

01

Individuals who own rental properties and earn income from them in Pennsylvania.

02

Taxpayers who are required to report rental income and expenses on their Pennsylvania state tax returns.

03

Investors who are involved in generating rental income and wish to claim allowable deductions associated with their rental activities.

Fill

form

: Try Risk Free

People Also Ask about

What is PA schedule B?

PURPOSE OF SCHEDULE Use PA-20S/PA-65 Schedule B to report dividend income and capital gain distributions of PA S corporations, partnerships and limited liability companies filing as partnerships or PA S corporations for federal income tax purposes.

What is PA EE UI?

Unemployment compensation in Pennsylvania and across the country is designed to provide unemployed workers time to find a new job equivalent to the one lost without financial distress. UI, referred to as unemployment compensation in some states, is based on a dual program of federal and state statutes.

What is the PA GL schedule?

Use PA Schedule G-L to calculate and report the amount of resident credit claimed for income tax, wage tax or other tax (measured by gross or net earned or unearned income) paid to another state when the other state imposes its tax on income also subject to PA personal income tax in the same taxable year.

What is PA schedule C?

Use PA Schedule C to report income or loss from a business you operate or a profession you practice as a sole proprietor.

What is Pennsylvania schedule UE?

PURPOSE OF SCHEDULE Use PA-40 Schedule UE to report unreimbursed employee business expenses incurred in the performance of the duties of the taxpayer's job or profession. Refer to the PA Personal Income Tax Guide – Gross Com- pensation section for additional information.

What is PA schedule E?

PURPOSE OF SCHEDULE Use PA-20S/PA-65 Schedule E to report income (loss) from rent and royalty income of PA S corporations, partnerships and LLC's filing as S corporations and partnerships for fed- eral income tax purposes.

What is a PA schedule UE?

You can claim a deduction for an unreimbursed employee business expense by filing a PA Schedule UE, Allowable Employee Business Expenses form along with your PA-40 Personal Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PA SCHEDULE E?

PA Schedule E is a form used by residents of Pennsylvania to report income from various sources such as rental properties, partnerships, S corporations, and estates or trusts.

Who is required to file PA SCHEDULE E?

Individuals who receive income from rental properties, partnerships, or S corporations, or report income from estates and trusts are required to file PA Schedule E.

How to fill out PA SCHEDULE E?

To fill out PA Schedule E, taxpayers need to gather information about their income sources, complete the form by entering relevant income amounts, expenses, and any applicable credits, and then submit it along with their Pennsylvania tax return.

What is the purpose of PA SCHEDULE E?

The purpose of PA Schedule E is to provide a detailed account of income from various sources and determine the correct state tax liability for individuals who earn such income.

What information must be reported on PA SCHEDULE E?

PA Schedule E requires taxpayers to report income from rental properties, partnerships, S corporations, estates, trusts, and any associated expenses related to these income sources.

Fill out your pa schedule e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Schedule E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.