Get the free Personal Financial Statement - Casey State Bank

Show details

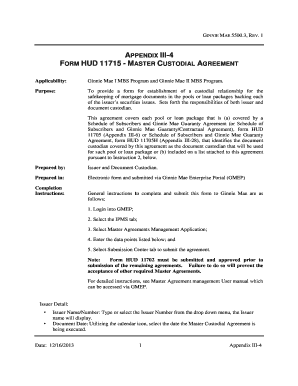

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 I Debt Schedule Summary Creditor Loan Balance Interest Rate Payment Purpose

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal financial statement online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal financial statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

How to fill out a personal financial statement:

01

Start by gathering all necessary documents such as bank statements, investment statements, tax returns, and any other relevant financial records.

02

Begin with personal information: include your name, address, contact details, and social security number or identification number.

03

Provide an overview of your assets: list all your bank accounts, investment accounts, real estate properties, vehicles, and any other valuable possessions you own.

04

Specify your liabilities: include all outstanding debts such as mortgages, loans, credit card debt, and any other financial obligations.

05

Calculate your net worth: subtract your total liabilities from your total assets to determine your net worth. This will give you an overall view of your financial health.

06

Include your income: list all sources of income, including salaries, wages, rental income, dividends, and any other regular income you receive.

07

Detail your expenses: categorize and list all regular expenses, such as mortgage or rent payments, utilities, insurance premiums, groceries, transportation costs, and any other recurring expenses.

08

Provide information on your financial goals: explain your short-term and long-term financial objectives, such as saving for retirement, paying off debts, or investing in education.

09

Sign and date the personal financial statement: verify the accuracy of the information provided and acknowledge its authenticity.

Who needs a personal financial statement?

01

Individuals applying for a loan: Lenders often require a personal financial statement to assess the borrower's financial situation and determine their creditworthiness.

02

Business owners and entrepreneurs: Personal financial statements may be requested by financial institutions or investors when evaluating the financial health and stability of a business owner or entrepreneur.

03

Individuals seeking financial planning or advisory services: Financial planners and advisors often require personal financial statements to develop tailored strategies and provide appropriate recommendations based on the individual's financial circumstances.

04

Professionals applying for certain licenses or certifications: Some professions, such as financial advisors, require individuals to submit personal financial statements as part of the certification or licensing process.

05

Individuals seeking to evaluate their financial health: Creating a personal financial statement can be beneficial for individuals who want to assess their financial situation, set goals, and plan for the future.

Fill

form

: Try Risk Free

People Also Ask about

How do you fill out a personal financial statement for a bank?

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program. Step 2: Fill In Your Personal Information. Step 3: Write Down Your Assets. Step 4: Write Down Your Liabilities. Step 5: Fill Out the Notes Payable to Banks and Others Section. Step 6: Fill Out the Stocks and Bonds Section.

How do I make my own personal financial statements?

To create a personal financial statement, follow these simple steps: Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.

What is my personal financial statement?

A personal financial statement is a snapshot of your personal financial position at a specific point in time. It lists your assets (what you own), your liabilities (what you owe), and your net worth. To get your net worth, subtract liabilities from assets.

What is a personal financial statement for a bank?

A personal financial statement is a spreadsheet that details the assets and liabilities of an individual, couple, or business at a specific point in time. Typically, the spreadsheet consists of two columns, with assets listed on the left and liabilities on the right.

What is a personal financial statement for business owners?

A personal financial statement details your finances in a simple form. This is an important document for those seeking a business loan proposal. It allows lenders to quickly glean your assets and liabilities. If you are married, the personal financial statement may include your spouse's assets and liabilities, as well.

What is an example of personal financial?

Examples include paying bills, rent, mortgage, paying for a round of drinks with friends, shopping, filling our cars, buying presents, and making donations to charity. Our credit card and tax payments also come under the term spending. We either spend with money we have or money we borrow, i.e., credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get personal financial statement?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the personal financial statement. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my personal financial statement in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your personal financial statement right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out personal financial statement using my mobile device?

Use the pdfFiller mobile app to fill out and sign personal financial statement on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is personal financial statement?

A personal financial statement is a document that outlines an individual's financial situation at a specific point in time.

Who is required to file personal financial statement?

Individuals in certain positions, such as government officials or candidates for public office, are often required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, individuals typically list their assets, liabilities, income, and expenses.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide an overview of an individual's financial health and to disclose any potential conflicts of interest.

What information must be reported on personal financial statement?

Information such as bank accounts, investments, real estate holdings, debts, sources of income, and major expenses must be reported on a personal financial statement.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.