Get the free Guinness Ireland Group Pension Scheme

Show details

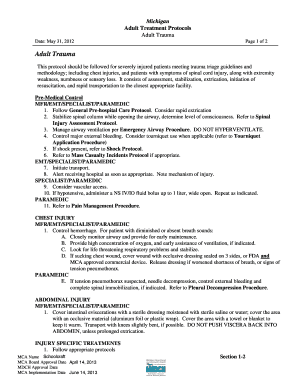

This document is a form for employees to provide instructions for making a lump sum Additional Voluntary Contribution (AVC) to their pension scheme, detailing personal information, contribution amounts,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guinness ireland group pension

Edit your guinness ireland group pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guinness ireland group pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guinness ireland group pension online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit guinness ireland group pension. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guinness ireland group pension

How to fill out Guinness Ireland Group Pension Scheme

01

Gather necessary personal information such as your name, address, and National Insurance number.

02

Obtain and read the Guinness Ireland Group Pension Scheme documentation to understand terms and conditions.

03

Fill out the application form with your personal information, ensuring all details are accurate.

04

Indicate your chosen contribution rate and any additional options, such as investment choices if applicable.

05

Review your application for completeness and accuracy before submission.

06

Submit your completed application form to the designated pension scheme administrator.

07

Keep a copy of your application and confirmation for your records.

Who needs Guinness Ireland Group Pension Scheme?

01

Employees of Guinness Ireland Group looking to secure their retirement.

02

Individuals seeking a structured savings plan with potential employer contributions.

03

Workers wanting to make long-term investments for their future financial stability.

04

Those who are nearing retirement and require a supplemental income source.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for pension in Ireland?

To get a State Pension (Contributory) at 66, you must have started paying PRSI before the age of 56. If you are deferring your pension, you must have started paying PRSI at least 10 years before you draw down your pension. You will meet this condition, if you qualify for Long-Term Carer's Contributions.

How does a pension scheme work in Ireland?

How do pensions work? Each payday, each year or as often as you like, you save some money into a retirement fund. Your fund is put away and invested. Its aim is to grow over time, so that when you finally decide to retire, you'll have savings to live out your life with a good income - happily.

Is a pension worth it in Ireland?

Private pensions benefit from tax relief at the marginal rate of income tax, with the percentage of your salary you can save increasing with age. There is a maximum salary cap of €115,000 for income tax relief. Making contributions to a private pension are a tax efficient way to save for retirement.

What happens to my pension when I leave Ireland?

You can withdraw it with all of your employers contributions if you leave the country ( and employment with current employer) and move to another EU country and find a job within 2 years of starting the pension fund. This is thanks to the EU's Outgoing Workers Directive.

How many years do you have to work in Ireland to get a full pension?

If you reach pension age on or after 6 April 2012, you need to have 520 full-rate PRSI contributions (10 years' contributions).

How much is the average private pension in Ireland?

The average pension in Ireland is €111,000 in 2024. This has increased in recent years but still falls short of being adequate to provide the 50% of your final salary advised by financial advisers as an optimal retirement income.

What is the new pension scheme in Ireland?

Auto-enrolment is a new pension savings scheme for certain employees who are not paying into a pension. They will be automatically included in the scheme but can opt out after 6 months. The introduction of the Auto-Enrolment Retirement Savings Scheme, called My Future Fund, will start from 1 January 2026.

How much do you get on a local government pension scheme?

For membership built up between 1 April 2008 and 31 March 2014 you receive a pension of 1/60th of your final pay as a pension. For membership before 1 April 2008, you receive a pension of 1/80th of your final pay plus an automatic lump sum of three times your pension.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Guinness Ireland Group Pension Scheme?

The Guinness Ireland Group Pension Scheme is a retirement savings plan established by the Guinness Ireland Group to provide financial security and benefits to its employees upon retirement.

Who is required to file Guinness Ireland Group Pension Scheme?

Employees of Guinness Ireland Group who are members of the pension scheme are required to file any necessary documentation related to their participation in the scheme.

How to fill out Guinness Ireland Group Pension Scheme?

To fill out the Guinness Ireland Group Pension Scheme, employees must complete the required application forms provided by the company, ensuring that all personal information, beneficiary details, and contribution levels are accurately recorded.

What is the purpose of Guinness Ireland Group Pension Scheme?

The purpose of the Guinness Ireland Group Pension Scheme is to provide employees with a reliable and effective way to save for retirement, offering benefits such as regular pension payments based on contributions made during their employment.

What information must be reported on Guinness Ireland Group Pension Scheme?

The information that must be reported includes personal details of the employee, contribution amounts, beneficiary designations, and any changes in circumstances that may affect pension eligibility or benefits.

Fill out your guinness ireland group pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guinness Ireland Group Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.