Get the free REinsurance

Show details

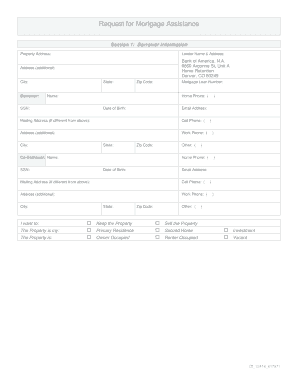

This document is an application for a comprehensive professional liability policy for real estate professionals, covering various activities such as residential and commercial sales, property management,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reinsurance

Edit your reinsurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reinsurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reinsurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit reinsurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reinsurance

How to fill out REinsurance

01

Gather necessary information about your insurance policies.

02

Determine the types of risks you want to transfer to reinsurers.

03

Select a reinsurance structure (e.g., treaty or facultative).

04

Prepare detailed documentation to present to potential reinsurers.

05

Analyze and negotiate terms with shortlisted reinsurers.

06

Finalize the reinsurance agreement and ensure compliance with regulations.

07

Continuously monitor and evaluate the reinsurance program effectiveness.

Who needs REinsurance?

01

Insurance companies looking to manage risk.

02

Large corporations with significant assets to protect.

03

New insurance startups needing to stabilize their portfolio.

04

Government programs providing disaster coverage.

05

Specialized insurers covering unique or high-risk areas.

Fill

form

: Try Risk Free

People Also Ask about

What is reinsurance with an example?

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company.

What is a reinsurer in English?

Definition of 'reinsurer' A reinsurer is an insurance company that insures the risks of other insurance companies. A cedant is an insurer who transfers all or part of a risk to a reinsurer. The reinsurer covers all the insurance policies coming within the scope of the reinsurance contract.

What is an example of reinsurance in real life?

With the formation of a reinsurance agreement, the premiums paid by insured individuals are usually divided among insurance companies. For instance, an insurer sells an insurance plan to 5000 individuals, and the amount of coverage for each policy is equivalent to ₹ 1 Crore.

What are the two main types of reinsurance?

Key Takeaways There are two main types of reinsurance: facultative, which covers specific individual risks, and treaty, which covers broad categories of policies.

What is reinsurance in simple words?

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company.

What is insurance vs reinsurance?

Insurance is a legal agreement between an insurer and an insured in which the former guarantees to defend the latter in the event of damage or death. Reinsurance is the insurance a firm purchase to lessen severe losses when it decides not to absorb the entire loss risk and instead shares it with another insurer.

What's the difference between insurance and reinsurance?

Insurance is a legal agreement between an insurer and an insured in which the former guarantees to defend the latter in the event of damage or death. Reinsurance is the insurance a firm purchase to lessen severe losses when it decides not to absorb the entire loss risk and instead shares it with another insurer.

What is reinsurance for dummies?

Reinsurance occurs when multiple insurance companies share risk by purchasing insurance policies from other insurers to limit their own total loss in case of disaster.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REinsurance?

Reinsurance is a financial arrangement where an insurance company transfers a portion of its risk to another insurance company. This helps to protect against significant losses and stabilize the insurer's financial performance.

Who is required to file REinsurance?

Insurance companies that engage in reinsurance transactions are typically required to file reinsurance agreements and relevant financial information with regulatory authorities to ensure compliance and transparency.

How to fill out REinsurance?

Filling out reinsurance documentation involves providing detailed information about the reinsurance agreements, including the types of risks covered, terms of the agreement, reinsurance premiums, and any other required data as specified by regulatory agencies.

What is the purpose of REinsurance?

The purpose of reinsurance is to reduce the risk exposure of insurance companies, enhance their financial stability, manage volatility, and provide additional capacity to underwrite new policies.

What information must be reported on REinsurance?

The information that must be reported on reinsurance includes the terms of the agreements, amounts of risk transferred, premium amounts, information on ceded losses, and any other financial metrics as required by regulators.

Fill out your reinsurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reinsurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.