Get the free ESCROW AGREEMENT

Show details

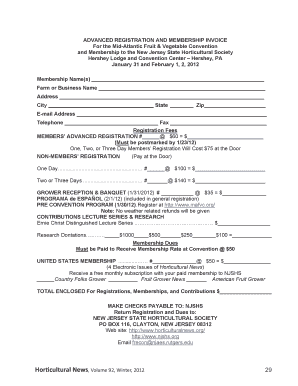

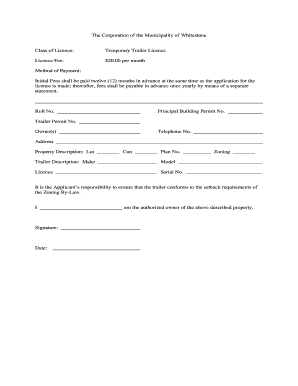

This document establishes an escrow agreement between a Developer and a Property Owner for the reimbursement of professional fees associated with land use applications under the jurisdiction of Kingwood

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign escrow agreement

Edit your escrow agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your escrow agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit escrow agreement online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit escrow agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out escrow agreement

How to fill out ESCROW AGREEMENT

01

Title the document as 'Escrow Agreement'.

02

Identify the parties involved: Escrow Agent, Buyer, and Seller.

03

Define the purpose of the escrow arrangement.

04

Specify the funds or assets to be held in escrow.

05

Describe the conditions for release of funds or assets.

06

Detail the responsibilities of the Escrow Agent.

07

Include any fees associated with the escrow service.

08

Provide signatures for all parties involved.

Who needs ESCROW AGREEMENT?

01

Individuals or businesses involved in a real estate transaction.

02

Buyers and sellers of high-value assets.

03

Parties wishing to ensure security in financial transactions.

04

Anyone requiring a neutral third party to hold funds or documents until specific conditions are met.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of an escrow agreement?

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

What does escrow translate to in English?

Escrow Examples In a real estate transaction, the buyer and seller will sign a contract that outlines the terms of the sale. The buyer will then make a deposit into an escrow account. The escrow agent will hold onto the deposit until the seller transfers ownership of the property to the buyer.

What does escrow mean in simple terms?

Escrow is used when the property is bought, sold, or refinanced. An escrow ensures that the seller receives payment for the home and that the buyer gets title to the property. The escrow company is a neutral third party. They hold money and title to the property until both the buyer and seller agree to release them.

What is an escrow agreement?

Meaning of escrow in English. an agreement between two people or organizations in which money or property is kept by a third person or organization until a particular condition is met : The agreement with the investment bankers did not call for escrow of fees.

What happens when a property is in escrow?

Is Escrow Good or Bad? Escrow is generally considered good because it protects the buyer and seller in a transaction. In addition, escrow as part of mortgage payments is generally good for the lender and helps the buyer by ensuring property taxes and homeowners insurance are paid on time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ESCROW AGREEMENT?

An escrow agreement is a legal contract between two parties where a third party holds funds or assets until specific conditions are met.

Who is required to file ESCROW AGREEMENT?

Typically, parties involved in a transaction that requires a neutral third party to manage funds or assets are required to file an escrow agreement.

How to fill out ESCROW AGREEMENT?

To fill out an escrow agreement, include the names of the parties involved, details of the funds or assets, the conditions for release, and the role of the escrow agent.

What is the purpose of ESCROW AGREEMENT?

The purpose of an escrow agreement is to ensure that all parties fulfill their obligations before the funds or assets are released.

What information must be reported on ESCROW AGREEMENT?

The information that must be reported includes the identities of the parties, details of the transaction, the escrow agent's information, and specific conditions for the release of the escrowed items.

Fill out your escrow agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Escrow Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.