Get the free RETAIL INVESTMENT OPPORTUNITY

Show details

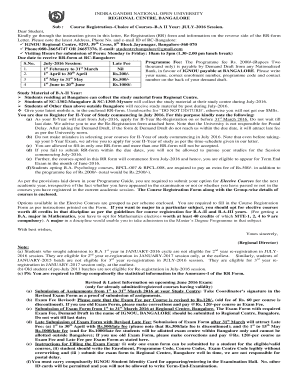

This document outlines the investment opportunity for the Battlefield Place Shopping Center located in Chickamauga, GA, providing key details such as property size, occupancy, anchor tenant, and confidentiality

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retail investment opportunity

Edit your retail investment opportunity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retail investment opportunity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retail investment opportunity online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit retail investment opportunity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retail investment opportunity

How to fill out RETAIL INVESTMENT OPPORTUNITY

01

Gather your business information, including a detailed description of your retail opportunity.

02

Outline your target market, detailing demographics and purchasing behaviors.

03

Prepare your financial projections, including initial investment, expected revenues, and profit margins.

04

Include a marketing strategy to attract customers and promote the retail opportunity.

05

Detail any competitive advantages or unique selling points of your retail venture.

06

Compile your team's qualifications, highlighting experience relevant to retail operations.

07

Review and proofread your document for clarity and completeness before submission.

Who needs RETAIL INVESTMENT OPPORTUNITY?

01

Investors looking for profitable retail opportunities.

02

Entrepreneurs wanting to start a retail business.

03

Financial institutions assessing potential business loans.

04

Market researchers analyzing emerging retail trends.

05

Business advisors or consultants helping clients assess investment options.

Fill

form

: Try Risk Free

People Also Ask about

What are the 4 types of investments?

Bonds, stocks, mutual funds and exchange-traded funds, or ETFs, are four basic types of investment options. They have the potential to earn a higher return, but they also carry a greater potential for loss if sold when the market is lower.

How much will I have in 30 years if I invest $1000 a month?

The precise amount you'll have after investing $1,000 monthly at 6%, a conservative number depending on what you choose to invest in, for 30 years is $1,010,538, as figured by SmartAsset's free online Investment Calculator.

What are retail investment services?

Typically, retail investors buy and sell debt, equity, and other investments through a broker, bank, or mutual fund. They execute their trades through traditional, full-service brokerages, discount brokers, and online brokers. Retail investors invest for their own benefit and not on behalf of others.

Who is considered as a retail investor?

Retail investors are average Indian, salaried workers, independent small business owners, students and all stakeholders, who invest a small amount of their relatively small savings in the stock market or other investments.

What is retail investment?

Retail investors are non-professional individuals who invest money in their own accounts through brokerage firms. • Retail investors may manage their own accounts, or hire a professional to guide their investment decisions. • Retail investors typically make smaller transactions compared to institutional investors.

What are examples of retail investments?

Some common ways retail investors invest include stocks, bonds, mutual funds, ETFs, and alternative investments.

What are investment opportunities?

Investment opportunities refer to the various avenues available for individuals and businesses to allocate their funds with the aim of generating returns or achieving financial growth.

How to start retail investing?

Bottom line Decide what type of investment account you want, which is often based on the goal you are investing for. Open an investment account at an online broker. Choose your investments. Low-cost index funds are a good choice for many investors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RETAIL INVESTMENT OPPORTUNITY?

Retail Investment Opportunity refers to investment options available for individual investors, typically involving publicly traded companies or alternative investments that are accessible to the general public.

Who is required to file RETAIL INVESTMENT OPPORTUNITY?

Typically, businesses offering retail investment opportunities must file necessary documentation with regulatory bodies to ensure compliance with securities laws, particularly if they are soliciting investments from the public.

How to fill out RETAIL INVESTMENT OPPORTUNITY?

To fill out a retail investment opportunity, individuals or companies must provide accurate and complete information regarding the investment terms, risk factors, and other material details, often using specific forms mandated by regulatory authorities.

What is the purpose of RETAIL INVESTMENT OPPORTUNITY?

The purpose of retail investment opportunities is to provide individual investors access to various investment options, allowing them to diversify their portfolios and participate in the financial markets.

What information must be reported on RETAIL INVESTMENT OPPORTUNITY?

Information that must be reported includes details about the investment, such as expected returns, risks involved, the business model, financial statements, and any other disclosures required by law.

Fill out your retail investment opportunity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retail Investment Opportunity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.