Get the free Good Faith Estimate GFE - California Properties and Mortgage

Show details

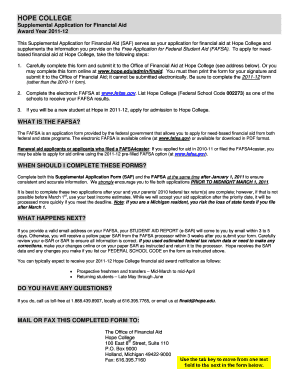

California Properties and Mortgage 00706023, NLS# 920352 Originator: Aswan Haiti, NLS# 297729 OMB Approval No. 25020265 Good Faith Estimate (GFE) Name of Originator California Properties and Mortgage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign good faith estimate gfe

Edit your good faith estimate gfe form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your good faith estimate gfe form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing good faith estimate gfe online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit good faith estimate gfe. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out good faith estimate gfe

How to fill out a Good Faith Estimate (GFE):

Start by obtaining the necessary forms:

You can typically obtain a Good Faith Estimate (GFE) form from your lender or mortgage broker. Some loan officers may also provide an electronic version that you can fill out online.

Fill in your personal information:

Begin by providing your name, address, and contact information as required on the form. This will help identify the loan application and ensure accurate documentation.

Identify the loan terms:

Fill in the loan amount you are seeking and specify the loan term, such as 30 years or 15 years. The GFE will also ask for the interest rate and whether it is fixed or adjustable.

Enter the projected monthly payment:

Calculate and insert the estimated monthly payment, including principal and interest, property taxes, homeowner's insurance, and any mortgage insurance required.

Include the loan's settlement charges:

The GFE requires you to list any settlement charges or costs associated with the loan. This typically includes fees for origination, appraisal, credit reports, title insurance, and other applicable charges.

Disclose the estimated total closing costs:

Calculate the estimated total closing costs by including both the lender's charges and other settlement costs. This will give you an idea of the expenses involved in finalizing the loan.

Review the loan summary:

The GFE will typically include a summary section, where you can find key details about your loan, such as the interest rate, loan term, and estimated monthly payment. Verify this information for accuracy.

Who needs a Good Faith Estimate (GFE):

01

Borrowers seeking a mortgage loan: A GFE is usually required for those who are applying for a home loan. It helps borrowers understand the estimated costs associated with the loan and allows for comparison between different lenders.

02

Real estate professionals: Real estate agents, brokers, and other professionals involved in the home buying process often need a GFE to provide accurate information to their clients. It helps them understand the loan terms and potential costs.

03

Lenders and mortgage brokers: These professionals use the GFE to explain loan terms and provide borrowers with a breakdown of their estimated charges. It helps build transparency and trust between the lender and borrower.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my good faith estimate gfe in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your good faith estimate gfe and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make edits in good faith estimate gfe without leaving Chrome?

good faith estimate gfe can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit good faith estimate gfe on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing good faith estimate gfe, you need to install and log in to the app.

What is good faith estimate gfe?

Good Faith Estimate (GFE) is an estimate of the costs associated with a mortgage loan that must be provided to the borrower by a lender or mortgage broker.

Who is required to file good faith estimate gfe?

Lenders or mortgage brokers are required to provide the Good Faith Estimate (GFE) to the borrower.

How to fill out good faith estimate gfe?

The Good Faith Estimate (GFE) should be filled out by the lender or mortgage broker with accurate information about the estimated costs of the mortgage loan.

What is the purpose of good faith estimate gfe?

The purpose of the Good Faith Estimate (GFE) is to help borrowers understand and compare the costs associated with different mortgage loan offers.

What information must be reported on good faith estimate gfe?

The Good Faith Estimate (GFE) must include information about the loan terms, estimated closing costs, and other fees associated with the mortgage loan.

Fill out your good faith estimate gfe online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Good Faith Estimate Gfe is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.