Get the free Property and Debt Listing - North Dakota Supreme Court - ndcourts

Show details

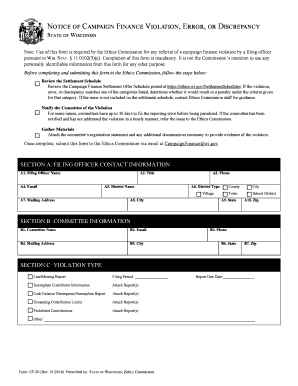

This document is used for listing and agreeing on the values of assets and debts in a civil court case in North Dakota.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property and debt listing

Edit your property and debt listing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property and debt listing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property and debt listing online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit property and debt listing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property and debt listing

How to fill out property and debt listing:

01

Gather all relevant financial documents, such as bank statements, mortgage statements, credit card statements, and loan agreements.

02

Begin by listing all your properties, including real estate, vehicles, and valuable possessions. Include their estimated values and any outstanding loans or mortgages associated with them.

03

Move on to listing your debts, such as credit card balances, personal loans, student loans, and any other outstanding obligations. Include the remaining balance, monthly payment amount, and the interest rate for each debt.

04

Make sure to include any additional information related to your debts, such as the name of the creditor, account numbers, and contact information.

05

Double-check your listing to ensure accuracy and completeness.

06

Update your property and debt listing regularly to reflect any changes or new acquisitions.

Who needs property and debt listing:

01

Individuals who are applying for a loan or mortgage may be required to provide a detailed property and debt listing to the financial institution.

02

People who are in debt and looking to manage their finances more effectively can benefit from creating a property and debt listing as a way to understand their overall financial situation.

03

Individuals who are planning for retirement or other major financial goals can use a property and debt listing as a tool to assess their net worth and make informed decisions.

Note: It is always advisable to consult with a financial advisor or professional when filling out a property and debt listing to ensure accuracy and understanding of your financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my property and debt listing in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your property and debt listing and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send property and debt listing to be eSigned by others?

Once you are ready to share your property and debt listing, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit property and debt listing in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your property and debt listing, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is property and debt listing?

Property and debt listing refers to the process of disclosing and documenting all assets (property) and liabilities (debts) owned by an individual or organization. It provides a comprehensive overview of one's financial standing.

Who is required to file property and debt listing?

The requirement to file property and debt listing varies by jurisdiction and legal framework. Generally, individuals, businesses, and organizations may be required to file these listings, depending on local laws and regulations.

How to fill out property and debt listing?

To fill out the property and debt listing, you typically need to gather information about your assets and liabilities, such as property ownership documents, bank statements, loan agreements, and credit card statements. Then, you can use the designated form or online platform provided by the relevant authority to record and report these financial details.

What is the purpose of property and debt listing?

The purpose of property and debt listing is to create transparency and accountability in financial matters. It allows individuals, organizations, and authorities to assess one's financial situation, monitor assets and liabilities, and ensure compliance with laws and regulations regarding disclosure.

What information must be reported on property and debt listing?

The information that must be reported on property and debt listing typically includes details of owned properties (e.g., real estate, vehicles), financial assets (e.g., bank accounts, investments), debts and loans (e.g., mortgages, credit card debts), and other significant financial obligations (e.g., alimony, child support). The specific requirements may vary depending on the jurisdiction.

Fill out your property and debt listing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property And Debt Listing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.