Get the free Audit File / Reports - hamilton

Show details

This document outlines the various personal information collected, used, and retained by different departments within the City Manager's Office, including details on audit files, personnel records,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit file reports

Edit your audit file reports form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit file reports form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing audit file reports online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit audit file reports. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

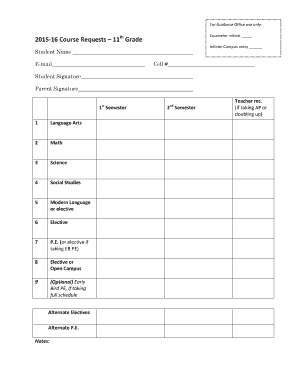

How to fill out audit file reports

How to fill out Audit File / Reports

01

Gather all necessary financial documents and records.

02

Organize the documents into appropriate categories (income, expenses, assets, liabilities).

03

Ensure all entries are accurate and reflect the true financial status of the entity.

04

Fill out the Audit File / Reports template with the gathered information, following the specified format.

05

Include notes or explanations for any significant items or discrepancies.

06

Review the completed report for any errors or omissions.

07

Submit the Audit File / Reports to the designated auditor or regulatory body.

Who needs Audit File / Reports?

01

Businesses undergoing a financial audit.

02

Accountants and auditors preparing for an audit.

03

Regulatory agencies requiring compliance documentation.

04

Stakeholders interested in the financial health of the organization.

05

Investors assessing the company’s financial statements.

Fill

form

: Try Risk Free

People Also Ask about

What is an audit report in English?

This type of report is issued by an auditor when the financial statements are free of material misstatements and are presented fairly in accordance with the Generally Accepted Accounting Principles (GAAP), which in other words means that the company's financial condition, position, and operations are fairly presented

What is an audit report in simple words?

An audit report is a formal document that communicates an auditor's opinion (or probably your opinion, if you're reading this) on an organization's financial performance and concludes whether it complies with financial reporting regulations.

How do you write an audit report?

10 Best Practices for Writing a Digestible Audit Report Reference everything. Include a reference section. Use figures, visuals, and text stylization. Contextualize the audit. Include positive and negative findings. Ensure every issue incorporates the five C's of observations. Include detailed observations.

What are audit reports?

An audit report summarizes an organization's financial statements, internal controls, and accounting practices to determine if the financials are accurate, complete, and in accordance with generally accepted accounting principles (GAAP) or other relevant accounting standards.

What is an example of audit in English?

Examples of audit in a Sentence Noun The Internal Revenue Service selected us for an audit. You will need all your records if you are selected for audit by the IRS. Verb They audit the company books every year. The Internal Revenue Service audited him twice in 10 years.

What are the 7 elements of an audit report?

The audit report template includes 7 parts elements these are: report title, introductory Paragraph, scope paragraph, executive summary, opinion paragraph, auditor's name, and auditor's signature.

How do I write an audit report?

10 Best Practices for Writing a Digestible Audit Report Reference everything. Include a reference section. Use figures, visuals, and text stylization. Contextualize the audit. Include positive and negative findings. Ensure every issue incorporates the five C's of observations. Include detailed observations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Audit File / Reports?

An Audit File / Reports refers to a structured compilation of financial data and documentation that is prepared for the purpose of auditing. It typically includes records relevant to a company's transactions, accounting practices, and adherence to regulatory compliance.

Who is required to file Audit File / Reports?

Typically, companies that are subject to audit requirements based on legal, regulatory, or financial obligations are required to file Audit Files / Reports. This often includes publicly traded companies, larger private enterprises, and other organizations mandated by local laws.

How to fill out Audit File / Reports?

Filling out Audit File / Reports generally involves gathering all necessary financial data, organizing it according to specified formats, ensuring accurate reporting, and including any required documentation that supports the financial records.

What is the purpose of Audit File / Reports?

The purpose of Audit File / Reports is to provide a transparent and organized overview of a company's financial health, to facilitate the auditing process, ensure compliance with financial regulations, and help stakeholders make informed decisions based on the financial data presented.

What information must be reported on Audit File / Reports?

Audit File / Reports must typically include financial statements, supporting documents such as invoices and receipts, transaction logs, tax-related information, and any other data relevant to the company's financial activities and compliance with auditing standards.

Fill out your audit file reports online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit File Reports is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.