Get the free Home bMortgage Applicationb - Iron Harbor

Show details

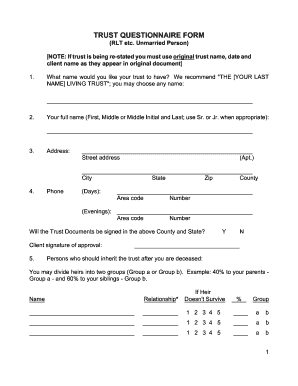

Home Mortgage Application Page 1 Applicant Information Please Fax to 8663557904 (no cover sheet is needed) Applicant General Information Full Legal Name (first, middle initial, last) Phone including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home bmortgage applicationb

Edit your home bmortgage applicationb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home bmortgage applicationb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home bmortgage applicationb online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit home bmortgage applicationb. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home bmortgage applicationb

How to fill out a home mortgage application:

01

Gather all necessary documents: To start filling out a home mortgage application, you'll need to gather important documents such as your identification, income statements, bank statements, tax returns, and any other relevant financial information.

02

Research and choose a lender: Before filling out the application, it's important to research and select a reputable lender that offers favorable mortgage terms and interest rates. This step is crucial in ensuring that you get the best deal possible.

03

Begin the application process: Once you have chosen a lender, you can begin the application process. This typically involves filling out an online or paper application form provided by the lender. Make sure to provide accurate and complete information to avoid any delays or complications.

04

Input personal information: The application will require you to input personal information such as your full name, contact details, social security number, and date of birth. Be careful when entering this information to avoid any errors.

05

Provide employment and income details: The application will also ask for information regarding your employment history, current job position, and income. Be prepared to provide details about your employer's name, address, and contact information.

06

List your assets and liabilities: It's important to provide a comprehensive list of your assets (savings, investments, properties, etc.) and liabilities (debts, loans, credit card balances, etc.) as this information helps assess your financial standing and eligibility for a mortgage.

07

Disclose your financial history: The application will require you to disclose any bankruptcies, foreclosures, or legal judgments you may have had in the past. Honesty is crucial during this step as false information may result in a denial of the application.

08

Choose the type of mortgage: The application may ask you to choose the type of mortgage you are interested in, such as fixed-rate mortgage or adjustable-rate mortgage. Consider your financial goals and consult with your lender to make an informed decision.

09

Provide property details: If you have already identified a property to purchase, the application may require you to provide details about the property, such as its address, estimated value, and type of property (single-family home, condo, etc.).

10

Review and submit the application: Once you have filled out all the required information, carefully review the application to ensure accuracy. Double-check all the details before submitting it to the lender.

Who needs a home mortgage application?

Anyone who wishes to secure a mortgage loan to purchase a home needs to complete a home mortgage application. Whether you are a first-time homebuyer or looking to refinance an existing mortgage, the application process is a vital step in obtaining the necessary financing for homeownership.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute home bmortgage applicationb online?

Filling out and eSigning home bmortgage applicationb is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the home bmortgage applicationb form on my smartphone?

Use the pdfFiller mobile app to fill out and sign home bmortgage applicationb on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete home bmortgage applicationb on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your home bmortgage applicationb. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is home mortgage application?

A home mortgage application is a form that individuals fill out when applying for a loan to purchase a home.

Who is required to file home mortgage application?

Any individual looking to secure a loan to purchase a home is required to file a home mortgage application.

How to fill out home mortgage application?

To fill out a home mortgage application, individuals must provide personal, financial, and property information requested on the form.

What is the purpose of home mortgage application?

The purpose of a home mortgage application is to allow lenders to evaluate the financial stability and creditworthiness of individuals applying for a home loan.

What information must be reported on home mortgage application?

Information such as personal identification, income, employment history, debt obligations, and details about the property being purchased must be reported on a home mortgage application.

Fill out your home bmortgage applicationb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Bmortgage Applicationb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.