Get the free Section 125 cafeteria plan - Corporate Planning Network

Show details

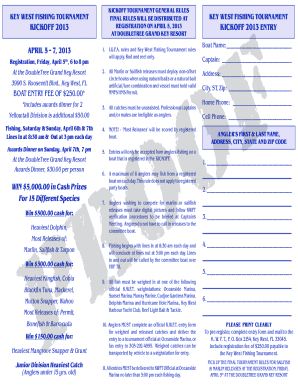

DL / KR / SL SECTION 125 CAFETERIA PLAN DESIGN AND ADOPTION AGREEMENT I. EMPLOYER DATA Legal Name: Fed Tax ID: Street Address: Mailing Address: City: State: Zip: Phone: () Contact Person: Fax: ()

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 125 cafeteria plan

Edit your section 125 cafeteria plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 125 cafeteria plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 125 cafeteria plan online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit section 125 cafeteria plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 125 cafeteria plan

How to fill out section 125 cafeteria plan:

01

Review the specific requirements: Before filling out the section 125 cafeteria plan, it is important to understand the specific requirements and guidelines set forth by the Internal Revenue Service (IRS). Familiarize yourself with the rules and regulations to ensure compliance.

02

Determine eligible benefits: Section 125 cafeteria plans allow employees to choose from a variety of pre-tax benefits, such as health insurance, dependent care assistance, and flexible spending accounts. Identify the eligible benefits that you would like to offer to your employees.

03

Consult with a benefits provider: It is recommended to seek guidance from a benefits provider or a qualified accountant who can assist you with the implementation and administration of the section 125 cafeteria plan. They can help you navigate the complex regulations and ensure proper documentation.

04

Communicate with employees: Inform your employees about the availability of the section 125 cafeteria plan and the eligible benefits they can choose from. Provide clear instructions on how to enroll and any deadlines they need to be aware of.

05

Offer enrollment period: Set a designated enrollment period during which employees can sign up for the section 125 cafeteria plan. This window of time should allow employees sufficient opportunity to review the benefits offered and make informed decisions.

06

Provide necessary paperwork: Distribute the required forms and documents needed to enroll in the section 125 cafeteria plan. This may include enrollment forms, beneficiary designations, and any other required paperwork. Ensure that employees understand how to complete these forms accurately.

07

Collect and process employee elections: Once the enrollment period ends, collect the completed forms from employees and process their benefit elections accordingly. Keep accurate records of each employee's choices and enrollment status.

08

Communicate with payroll: Coordinate with your payroll department or provider to ensure that the necessary adjustments are made to employees' pre-tax deductions for their chosen benefits. This ensures proper payroll deductions are made in compliance with the section 125 cafeteria plan.

Who needs section 125 cafeteria plan:

01

Employers looking to offer tax advantages: Section 125 cafeteria plans can provide tax advantages for both employers and employees. Employers can benefit from reduced payroll tax expenses, while employees can enjoy the ability to pay for eligible benefits with pre-tax dollars, saving on their overall tax liability.

02

Employees seeking flexibility and choice: Section 125 cafeteria plans grant employees the opportunity to select from a range of benefits that best suit their individual needs. This flexibility allows them to customize their benefits package and potentially save money by utilizing pre-tax dollars.

03

Businesses aiming to attract and retain talent: Offering a section 125 cafeteria plan can be an attractive benefit for potential employees and can improve employee retention. It demonstrates an employer's commitment to providing a comprehensive benefits package and can give them a competitive edge in the job market.

04

Employers wanting to reduce administrative burden: Implementing a section 125 cafeteria plan may simplify the administration of employee benefits. By allowing employees to make pre-tax deductions for eligible benefits, employers can reduce administrative tasks associated with managing different benefit programs separately.

05

Companies striving for cost-effectiveness: Section 125 cafeteria plans can provide cost-effectiveness for both employers and employees. Employers can control benefit costs by setting specific contribution limits, while employees can save on taxes by utilizing pre-tax dollars for eligible expenses. Ultimately, this can contribute to the overall financial well-being of the company and its workforce.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find section 125 cafeteria plan?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific section 125 cafeteria plan and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the section 125 cafeteria plan in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your section 125 cafeteria plan right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit section 125 cafeteria plan straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing section 125 cafeteria plan.

What is section 125 cafeteria plan?

A section 125 cafeteria plan is a type of employee benefit plan that allows employees to choose between receiving a taxable benefit (such as cash) and tax-free benefits (such as health insurance).

Who is required to file section 125 cafeteria plan?

Employers offering a section 125 cafeteria plan are required to file and administer the plan.

How to fill out section 125 cafeteria plan?

Section 125 cafeteria plans are typically filled out with the assistance of a benefits administrator or HR professional.

What is the purpose of section 125 cafeteria plan?

The purpose of a section 125 cafeteria plan is to provide employees with a choice of benefits while allowing them to save money on taxes.

What information must be reported on section 125 cafeteria plan?

Information such as employee elections, contributions, and plan expenses must be reported on a section 125 cafeteria plan.

Fill out your section 125 cafeteria plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 125 Cafeteria Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.