Get the free Proposed Municipal Income Tax Uniformity - daytonohio

Show details

Este documento analiza las áreas de no uniformidad en las leyes fiscales locales relacionadas con la recaudación del impuesto sobre la renta municipal, la aplicación, las penalidades y el cumplimiento,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proposed municipal income tax

Edit your proposed municipal income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposed municipal income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit proposed municipal income tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit proposed municipal income tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

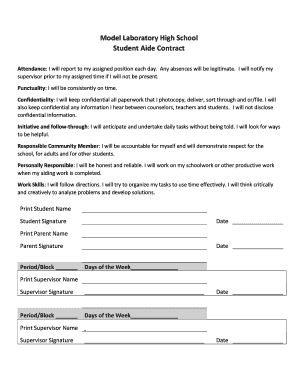

How to fill out proposed municipal income tax

How to fill out Proposed Municipal Income Tax Uniformity

01

Obtain the Proposed Municipal Income Tax Uniformity form from the official website or local municipality office.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details in the designated fields.

04

Enter the relevant financial information as requested, including gross income and deductions.

05

Calculate the proposed income tax based on the formulas provided in the form.

06

Review all the information you've entered for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form to the appropriate municipal authority by the specified deadline.

Who needs Proposed Municipal Income Tax Uniformity?

01

Individuals and businesses operating within municipalities that are implementing or considering a municipal income tax.

02

Tax professionals who assist clients in complying with local tax regulations.

03

Local government officials and agencies responsible for collecting and managing municipal taxes.

Fill

form

: Try Risk Free

People Also Ask about

What are two types of taxes that are specific to local government?

Local taxes come in many forms, from property taxes and payroll taxes to sales taxes and licensing fees. They vary widely from one jurisdiction to the next. Taxes levied by cities and towns are also referred to as municipal taxes.

What are the power of local bodies to levy tax?

The Legislature of a State may, by law: • authorise a Municipality to levy, collect and appropriate such taxes, duties, tolls and fees in accordance with such procedure and subject to such limits; • assign to a Municipality such taxes, duties, tolls and fees levied and collected by the State Government for such

What is the biggest problem in Brazil today?

Brazil has serious problems with crime. With roughly 23.8 homicides per 100,000 residents, muggings, robberies, kidnappings and gang violence are common. Police brutality and corruption are widespread.

What are the tax changes in Brazil 2026?

Brazil's tax system is undergoing major changes set to take effect in 2026. The reforms mark a decisive step toward the modernisation of the country's fiscal structure. Inspired by international best practices, the new system aims to foster a safer, more transparent, and more reliable business environment.

What is the new tax reform in Brazil?

What Does the Tax Reform Entail? With the reform, Brazil will adopt a Dual VAT model, introducing two new taxes: the CBS (Contribution on Goods and Services), at the federal level, and the IBS (Goods and Services Tax), managed by states and municipalities.

Do local governments have the power to tax?

Generally, a local government has the authority to: Impose taxes. Try people accused of breaking local laws or ordinances. Administer local programs within its boundaries.

What is the Brazil tax reform?

The reform consolidates multiple existing taxes into three new ones: the Tax on Goods and Services (IBS), the Contribution on Goods and Services (CBS) and the Selective Tax (IS), altering compliance obligations and tax collection processes.

Why is Brazil tax so complicated?

Taxation in Brazil is complex, with over sixty forms of tax. Historically, tax rates were low and tax evasion and avoidance were widespread. The 1988 Constitution called for an enhanced role of the State in society, requiring increased tax revenue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposed Municipal Income Tax Uniformity?

Proposed Municipal Income Tax Uniformity refers to an initiative aimed at standardizing the various municipal income tax regulations and filing procedures across different jurisdictions to simplify compliance for taxpayers.

Who is required to file Proposed Municipal Income Tax Uniformity?

Typically, individuals and businesses that earn income in a municipality that levies an income tax are required to file Proposed Municipal Income Tax Uniformity.

How to fill out Proposed Municipal Income Tax Uniformity?

To fill out Proposed Municipal Income Tax Uniformity, taxpayers should gather their income information, follow the specific instructions provided in the form, and ensure all necessary sections are completed accurately.

What is the purpose of Proposed Municipal Income Tax Uniformity?

The purpose of Proposed Municipal Income Tax Uniformity is to streamline tax filing processes, reduce confusion among taxpayers, and ensure consistent application of tax laws across different municipalities.

What information must be reported on Proposed Municipal Income Tax Uniformity?

Taxpayers must report their total income, deductions, credits, and any other relevant financial information as specified in the form instructions.

Fill out your proposed municipal income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposed Municipal Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.