Get the free Fair Debt Collection Policy

Show details

This document outlines the Fair Debt Collection Policy of Bedford Borough Council, detailing the principles and practices for the collection and recovery of debts owed to the Council while promoting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fair debt collection policy

Edit your fair debt collection policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair debt collection policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

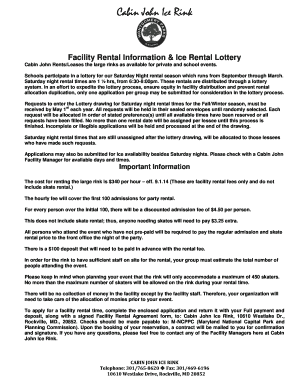

How to edit fair debt collection policy online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fair debt collection policy. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair debt collection policy

How to fill out Fair Debt Collection Policy

01

Identify the purpose of the Fair Debt Collection Policy.

02

Gather necessary legal information regarding debt collection practices.

03

Outline the rights of consumers under the Fair Debt Collection Practices Act (FDCPA).

04

Define the scope of the policy including who it applies to within the organization.

05

Include procedures for staff training on ethical debt collection practices.

06

Detail the complaint resolution process for consumers.

07

Establish guidelines for communication with debtors, ensuring compliance with applicable laws.

08

Review and update the policy regularly to reflect changes in laws and best practices.

Who needs Fair Debt Collection Policy?

01

Businesses that engage in debt collection.

02

Organizations that hire third-party debt collectors.

03

Financial institutions that extend credit.

04

Consumers needing protection against unfair debt collection practices.

05

Regulators and policymakers for compliance oversight.

Fill

form

: Try Risk Free

People Also Ask about

What is the 7 7 7 rule for debt collectors?

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

How long can you be chased for debt in the USA?

Some debts, though, such as federal student loans don't have a statute of limitations. Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt.

What are the 11 words to stop a debt collector?

If you want to stop debt collectors from calling you, the phrase to use is: "Please cease and desist all communication with me about this debt." This simple phrase, when sent in writing to a debt collector, legally requires the debt collector to stop contacting you except to notify you of specific actions, such as

What's the worst a debt collector can do?

DEBT COLLECTORS CANNOT: contact you at unreasonable places or times (such as before 8:00 AM or after 9:00 PM local time); use or threaten to use violence or criminal means to harm you, your reputation or your property; use obscene or profane language;

How to outsmart a debt collector?

You can outsmart debt collectors by following these tips: Keep a record of all communication with debt collectors. Send a Debt Validation Letter and force them to verify your debt. Write a cease and desist letter. Explain the debt is not legitimate. Review your credit reports. Explain that you cannot afford to pay.

What is the most common FDCPA violation?

1. Harassment and Abusive Language. Among the most common FDCPA violations, harassment sits as one of the worst. Debt collectors may employ aggressive tactics in the hopes that you will become afraid and agree to pay the debt, just to end the abuse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fair Debt Collection Policy?

The Fair Debt Collection Policy is a set of guidelines and regulations established to ensure that debt collectors operate fairly and ethically, protecting consumers from abusive practices while collecting debts.

Who is required to file Fair Debt Collection Policy?

Entities involved in debt collection, such as debt collection agencies and creditors who regularly collect debts, are required to comply with the Fair Debt Collection Policy.

How to fill out Fair Debt Collection Policy?

To fill out the Fair Debt Collection Policy, an entity must provide necessary details including the agency's name, address, contact information, and signature, along with a declaration of compliance with regulations governing debt collection practices.

What is the purpose of Fair Debt Collection Policy?

The purpose of the Fair Debt Collection Policy is to promote fair treatment of consumers, establish a framework for lawful collection practices, and minimize the potential for abusive debt collection tactics.

What information must be reported on Fair Debt Collection Policy?

The information that must be reported includes the collector's identity, the amount owed, a description of the debt, a notice of the consumer's rights, and any additional disclosures required by law.

Fill out your fair debt collection policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Debt Collection Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.