Get the free Money For Living

Show details

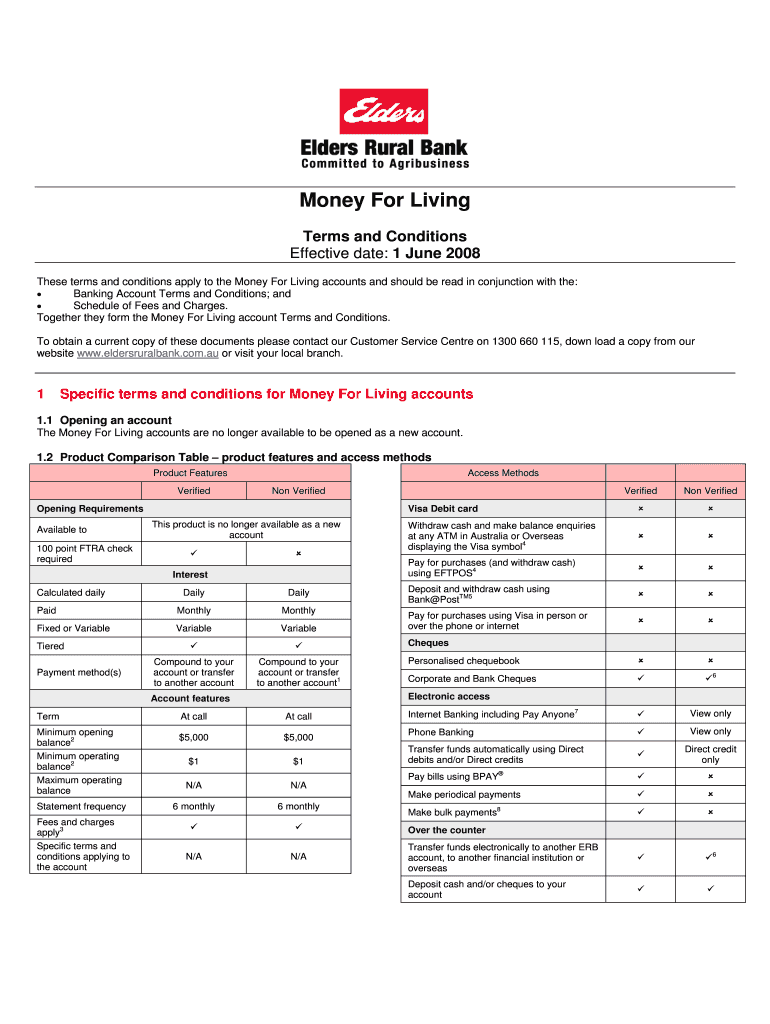

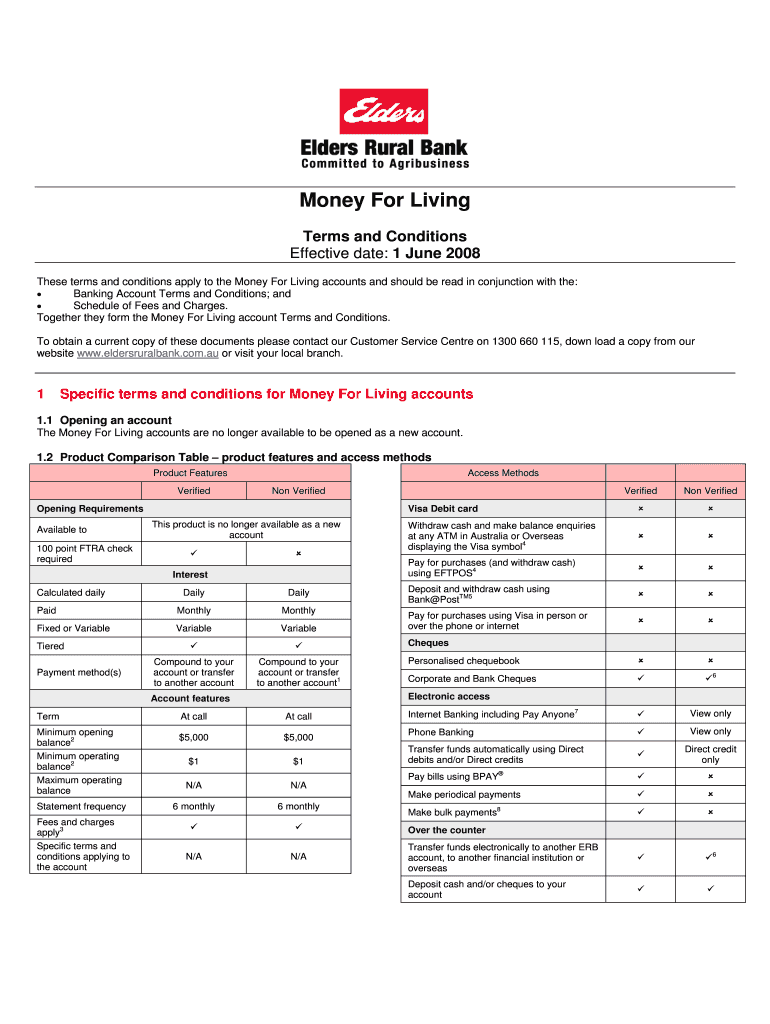

Money For Living Terms and Conditions Effective date: 1 June 2008 These terms and conditions apply to the Money For Living accounts and should be read in conjunction with the: Banking Account Terms

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money for living

Edit your money for living form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money for living form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit money for living online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit money for living. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money for living

How to fill out money for living?

01

Create a budget: Start by evaluating your income and expenses. Determine how much money you need for essential expenses like housing, food, transportation, and bills. Allocate a portion of your income towards savings and investments.

02

Track your expenses: Keep a record of all your expenditures to gain a clear understanding of where your money is going. This can help you identify areas where you can cut back and save more.

03

Reduce unnecessary spending: Look for ways to cut back on non-essential expenses. This could involve reducing eating out, entertainment costs, or finding more affordable alternatives for certain products or services.

04

Increase your income: Explore ways to increase your earnings. This might involve taking up a side job, freelancing, or pursuing career development opportunities to enhance your employability and earn a higher salary.

05

Save and invest: Set aside a portion of your income for savings and investments. Consider establishing an emergency fund for unexpected expenses and prioritize long-term investments that can help your money grow over time.

Who needs money for living?

01

Individuals: Almost everyone needs money to meet their basic needs such as food, shelter, and clothing. Money is essential to cover day-to-day expenses and maintain a decent standard of living.

02

Families: Families need money to support their members and provide for their basic needs. Expenses such as housing, education, healthcare, and childcare require financial resources.

03

Students: Students require money to fund their education, pay for tuition fees, buy books, and cover living expenses while studying. Financial resources are crucial for ensuring a successful academic journey.

04

Retirees: Retirees rely on money to cover their living expenses after they have stopped working. Retirement savings and pensions play a vital role in maintaining a comfortable lifestyle in their later years.

05

Entrepreneurs: Entrepreneurs need money to start and grow their businesses. Financial resources are essential for funding operations, purchasing inventory, marketing, and expanding their ventures.

In summary, managing money for living requires budgeting, expense tracking, reducing unnecessary spending, increasing income, and prioritizing savings and investments. Various individuals and groups, including individuals, families, students, retirees, and entrepreneurs, all need money to support their respective needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send money for living to be eSigned by others?

Once your money for living is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out the money for living form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign money for living and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit money for living on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute money for living from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is money for living?

Money for living refers to the income and expenses that are necessary for an individual or household to meet their basic needs and sustain their standard of living.

Who is required to file money for living?

Individuals or households who earn income and incur expenses are required to file money for living to track their financial status and manage their budget effectively.

How to fill out money for living?

Money for living can be filled out by recording all sources of income and categorizing expenses into essential and non-essential categories. This information can be input into a budgeting tool or spreadsheet.

What is the purpose of money for living?

The purpose of money for living is to track income and expenses, identify areas of overspending or saving, and make informed financial decisions to achieve financial stability and goals.

What information must be reported on money for living?

Information that must be reported on money for living includes income sources, expenses such as rent, utilities, groceries, transportation, healthcare, and other essential costs.

Fill out your money for living online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money For Living is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.