Get the free HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICA...

Show details

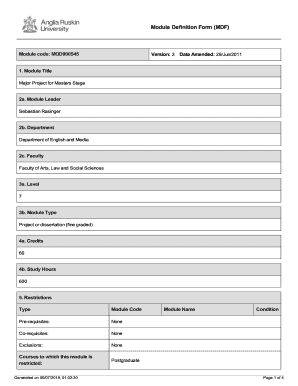

Este documento establece las pautas para la solicitud de fondos de la tasa de ocupación hotelera, definiendo los usos permitidos de los fondos y los procedimientos de aplicación para organizaciones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hotel occupancy tax use

Edit your hotel occupancy tax use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hotel occupancy tax use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hotel occupancy tax use online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hotel occupancy tax use. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hotel occupancy tax use

How to fill out HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICATION FORM 2009-2010

01

Obtain the HOTEL OCCUPANCY TAX USE GUIDELINES form from the appropriate state website or funding agency.

02

Read the instructions carefully to understand the eligibility requirements and application procedures.

03

Fill out the applicant information section, providing accurate details about your organization.

04

Specify the project or purpose for which the funding is requested, ensuring it aligns with the guidelines.

05

Include a detailed budget that outlines how the funds will be utilized, adhering to guidelines set by Texas state law.

06

Attach any required supporting documents, such as proof of eligibility or project plans.

07

Review the completed application for accuracy and completeness.

08

Submit the application by the specified deadline via the designated method (mail, email, online portal).

Who needs HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICATION FORM 2009-2010?

01

Organizations or entities seeking to apply for funding related to hotel occupancy tax purposes in Texas.

02

Non-profit organizations, municipalities, and other eligible applicants that meet the state's criteria for funding.

Fill

form

: Try Risk Free

People Also Ask about

How can I be exempt from hotel tax in Texas?

Contractors and city and county government employees working for the State of Texas or the federal government are not exempt from state or local hotel taxes. Guests who occupy a hotel room for 30 or more consecutive days with no payment interruption are considered permanent residents and are exempt from hotel tax.

How do I apply for tax exemption in Texas?

To apply for exemption, complete AP-204 and reference the statutory citation that establishes the exemption. Non-Texas corporations must also include a copy of the corporation's formation documents and a current Certificate of Existence issued by their state of incorporation.

Are nonprofits exempt from hotel tax in Texas?

When traveling on official business, employees of specific nonprofit entities are exempt from both state and local hotel taxes.

What qualifies as tax exempt purchase in Texas?

Tax-exempt customers Some customers are exempt from paying sales tax under Texas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

What is the hotel occupancy tax number in Texas?

Frequently Called Numbers Help with…Phone Hotel Occupancy Tax 800-252-1385 Historically Underutilized Business Program (HUB) 1-888-863-5881 International Fuel Tax Agreement (IFTA) 800-531-5441 ext. 3-3678 Insurance Tax 800-252-138765 more rows

How much is hotel occupancy tax in Texas?

RATES. According to the Texas State Tax Code, the State of Texas imposes an occupancy tax rate of 6% on hotels, motels, and short-term rentals, and cities can impose their own tax rate.

How to apply for Texas hotel occupancy tax exemption?

You can apply to the hotel for a refund or credit. To receive verification or to apply for exemption, please contact a hotel tax specialist toll free at 1-800-252-1385 or in Austin at 512/463-4600. From a Telecommunications Device for the Deaf (TDD), call 1-800-248-4099 or in Austin 512/463-4621.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICATION FORM 2009-2010?

The HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICATION FORM 2009-2010 outlines the regulations and procedures for utilizing hotel occupancy tax revenues for tourism and related activities in Texas.

Who is required to file HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICATION FORM 2009-2010?

Entities that seek funding for tourism-related projects and are applying for hotel occupancy tax grants are required to file this application form.

How to fill out HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICATION FORM 2009-2010?

To fill out the application, provide detailed information about the proposed project, including budget, expected outcomes, and how the project will promote tourism. Follow the specific instructions outlined in the form.

What is the purpose of HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICATION FORM 2009-2010?

The purpose is to establish criteria for the use of hotel occupancy tax funds and to ensure that the funds are allocated towards projects that enhance tourism in Texas.

What information must be reported on HOTEL OCCUPANCY TAX USE GUIDELINES UNDER TEXAS STATE LAW THIRD PARTY FUNDING APPLICATION FORM 2009-2010?

Applicants must report project details, budget estimates, timeline for implementation, funding sources, and the anticipated impact on tourism in their application.

Fill out your hotel occupancy tax use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hotel Occupancy Tax Use is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.