Get the free Automatic Bank Draft - Perennial Public Power District

Show details

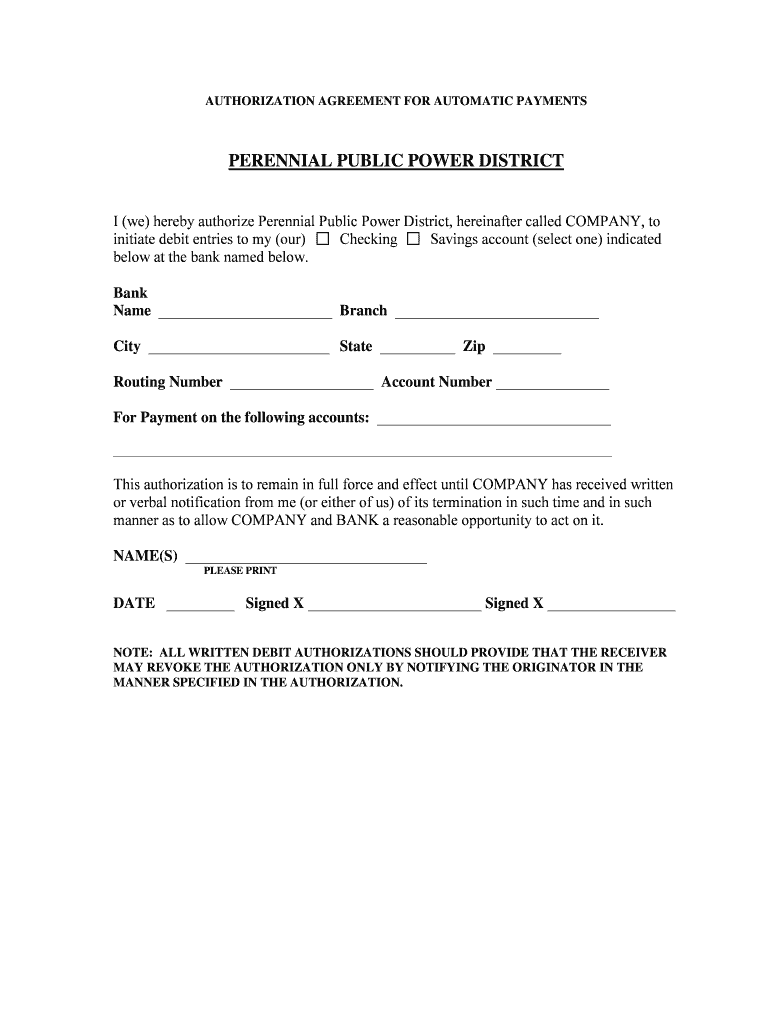

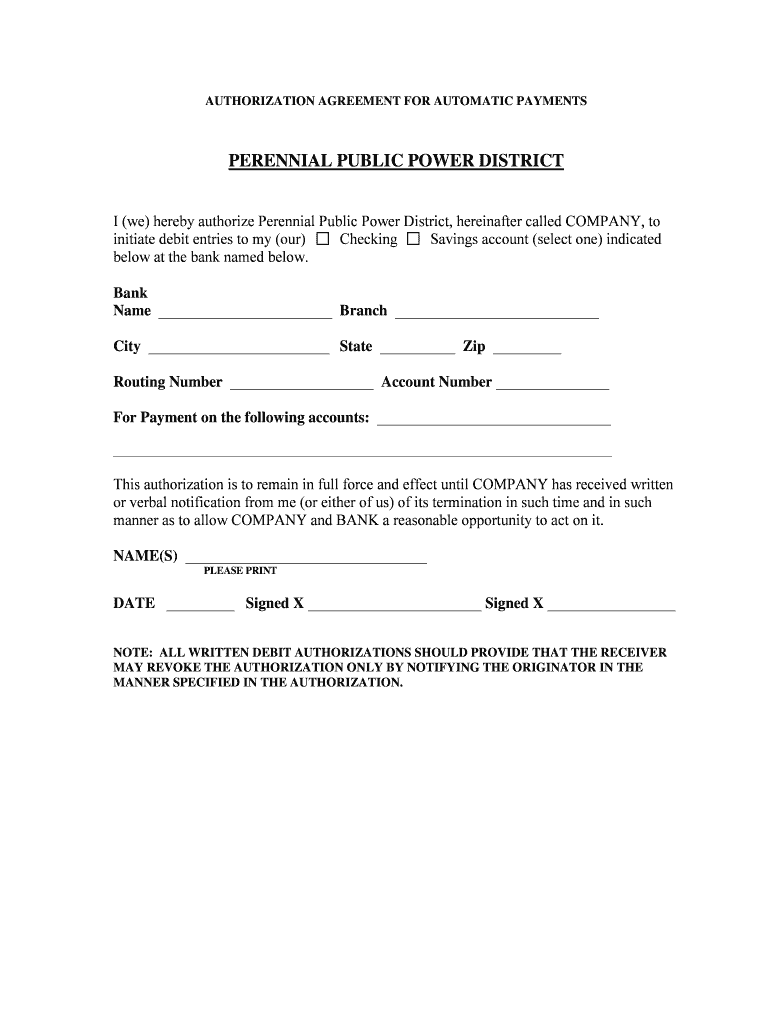

AUTHORIZATION AGREEMENT FOR AUTOMATIC PAYMENTS PERENNIAL PUBLIC POWER DISTRICT I (we) hereby authorize Perennial Public Power District, hereinafter called COMPANY, to initiate debit entries to my

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic bank draft

Edit your automatic bank draft form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic bank draft form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing automatic bank draft online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit automatic bank draft. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic bank draft

How to fill out automatic bank draft:

01

Contact your bank: Reach out to your bank and inquire about the process for setting up an automatic bank draft. They will provide you with the necessary forms or guide you through the online setup.

02

Complete the application or form: Fill out the application or form provided by your bank. This usually requires providing your personal information, including your name, address, contact details, and banking information such as your account number and routing number.

03

Choose payment frequency: Decide on the frequency at which you want the automatic bank draft to occur. This could be monthly, bi-monthly, or any other frequency that suits your needs. Make sure to indicate this on the application or form.

04

Select payment amount: Determine the amount you want to be automatically drafted from your bank account. This could be a fixed amount or variable depending on the billing statement. Indicate this on the application or form as well.

05

Sign and authorize: Review the application or form carefully, ensuring that all the provided information is accurate. Sign the document and provide any necessary authorization for the automatic bank draft to take place.

06

Submit the application: Once you have completed all the necessary steps, submit the application or form to your bank. This can be done either electronically or by physically delivering it to a banking branch.

07

Confirmation and activation: Wait for confirmation from your bank regarding the activation of the automatic bank draft. This may take a few days or weeks, depending on the bank's processing time.

Who needs automatic bank draft?

01

Individuals with recurring bills: Automatic bank draft can be beneficial for individuals who have recurring bills to pay, such as mortgage or rent payments, utility bills, insurance premiums, or subscription fees. It ensures timely payments and eliminates the hassle of manually submitting payments each month.

02

Business owners: Business owners can utilize automatic bank drafts for various purposes, including payroll payments to employees, payment of suppliers or vendors, or recurring business expenses like rent or loan installments. It streamlines the payment process and helps maintain a consistent cash flow.

03

Charitable organizations: Non-profit organizations or charities often rely on regular donations to support their operations. Offering automatic bank draft as a donation method allows donors to provide ongoing financial support without having to remember to make manual payments each time.

04

Individuals with irregular income: For individuals with irregular income streams, such as freelancers or self-employed individuals, automatic bank draft can be helpful in managing their bills and ensuring payments are made even during periods of fluctuating income.

05

Consumers seeking convenience: Automatic bank draft offers convenience for anyone who wants to simplify their bill payment process. It eliminates the need for writing checks, keeping track of due dates, or risking late payments. This can be especially beneficial for busy individuals or those who travel frequently.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my automatic bank draft directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your automatic bank draft and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit automatic bank draft in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your automatic bank draft, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit automatic bank draft on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing automatic bank draft.

What is automatic bank draft?

Automatic bank draft is a system where the bank automatically deducts a specified amount of money from an account to pay bills or make payments.

Who is required to file automatic bank draft?

Individuals or businesses who have authorized automatic payments from their bank account are required to file automatic bank draft.

How to fill out automatic bank draft?

To fill out automatic bank draft, one must authorize the bank to deduct a specified amount of money from their account on a recurring basis for a specific payment.

What is the purpose of automatic bank draft?

The purpose of automatic bank draft is to ensure timely and regular payment of bills or other financial obligations without the need for manual intervention each time a payment is due.

What information must be reported on automatic bank draft?

The information that must be reported on automatic bank draft includes the name of the payee, the amount to be deducted, the frequency of the deduction, and the bank account details.

Fill out your automatic bank draft online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Bank Draft is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.