Get the free pdffiller

Show details

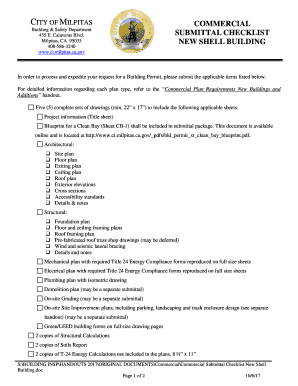

FORM VI (see rule 8 ×I), 9×1) & 9×5)) FORM FOR APPLICATION FOR REGISTRATION OF FACILITIES POSSESSING ENVIRONMENTALLY SOUND MANAGEMENT PRACTICE FOR RECYCLING OF USED LEAD ACID BATTERIES (To be submitted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign i 91 form

Edit your i 91 form online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form i 91 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is i 91 form online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit i91 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

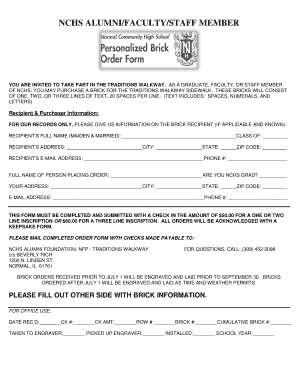

How to fill out form i91

How to fill out the i 91 form:

01

Start by carefully reading the instructions provided with the form. Make sure you understand all the requirements and information needed.

02

Gather all the necessary documents and information before you begin filling out the form. This may include personal identification, financial records, and any supporting documents required.

03

Begin by providing your personal information accurately. This may include your full name, address, date of birth, and social security number.

04

Continue filling out the form by following the instructions for each section. Provide the required information, such as employment history, income details, and any other relevant details requested.

05

Double-check all the information you have entered to ensure its accuracy. Mistakes or incomplete information may delay the processing of your form.

06

If there are any additional forms or documents that need to be included with the i 91 form, make sure to attach them securely before submitting the application.

07

Sign and date the form as required, certifying that all the information provided is true and accurate to the best of your knowledge.

08

Make a copy of the completed i 91 form for your records before submitting it according to the instructions provided.

Who needs the i 91 form:

01

Individuals or businesses who are required to report specific financial or tax-related information to the relevant authorities may need to fill out the i 91 form.

02

The exact requirements for who needs the form may vary depending on the jurisdiction and the specific purpose of the form.

03

Generally, individuals who have certain types of income or financial activities, such as rental income, self-employment income, or income from investments, may be required to fill out the i 91 form.

04

Additionally, businesses may need to fill out the i 91 form to report their financial transactions, expenses, and income for tax or regulatory purposes.

05

It is important to consult with the appropriate regulatory or tax authorities to determine if you are required to fill out the i 91 form and to understand the specific guidelines and deadlines for submission.

Fill

form

: Try Risk Free

People Also Ask about

How can I get my I-94?

How to apply for or see your current Form I-94. Download the CBP One app on your cell phone or tablet or visit the official Form I-94 website to: See your most recent I-94 form and print it, in case you need your record of legal admission to the U.S.

Do green card holders have I-94?

They do not issue an I-94 arrival/departure record to U.S. citizens, permanent residents (green card holders), returning resident aliens (SB-1 visa holders), or most Canadian citizens visiting or in transit.

Who needs an I-94 form?

Everyone entering the U.S. needs an I-94 or I-94W form except: American citizens. Returning resident aliens. Non-U.S. citizens with immigrant visas.

Why is Form I-94 important?

The record is very important because it proves that you entered the country lawfully and shows the date by which you must depart the United States. Travelers may need information from their I-94 admission record to verify immigration status or employment authorization.

What is I-94 form used for?

What is a Form I-94? Form I-94 is the DHS Arrival/Departure Record issued to aliens who are admitted to the U.S., who are adjusting status while in the U.S. or extending their stay, among other things. A CBP officer gen- erally attaches the I-94 to the non-immigrant visi- tor's passport upon U.S. entry.

How do I get U.S. travel history?

Steps to check your U.S. travel history online Step 1: Visit the U.S. Customs and Border Protection homepage. Step 2: Select the "Need a History of Your Arrivals & Departures?" option. Step 3: Provide your consent. Step 4: Input your personal information. Step 5: View your travel history. Step 6: Review the information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdffiller form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your pdffiller form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete pdffiller form online?

Easy online pdffiller form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit pdffiller form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing pdffiller form.

What is i 91 form?

The I-91 form is a document used by certain organizations and individuals for specific reporting and compliance purposes related to immigration.

Who is required to file i 91 form?

Typically, employers and organizations that sponsor foreign nationals or receive certain funds related to immigration are required to file the I-91 form.

How to fill out i 91 form?

To fill out the I-91 form, individuals must gather the necessary information about the applicant, including personal details, employment information, and sponsorship details, and then complete the form according to the provided instructions.

What is the purpose of i 91 form?

The purpose of the I-91 form is to facilitate the tracking and management of immigration-related processes and to ensure compliance with immigration laws.

What information must be reported on i 91 form?

The I-91 form typically requires information such as the applicant's personal details, immigration status, employment details, and the sponsoring organization's information.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.