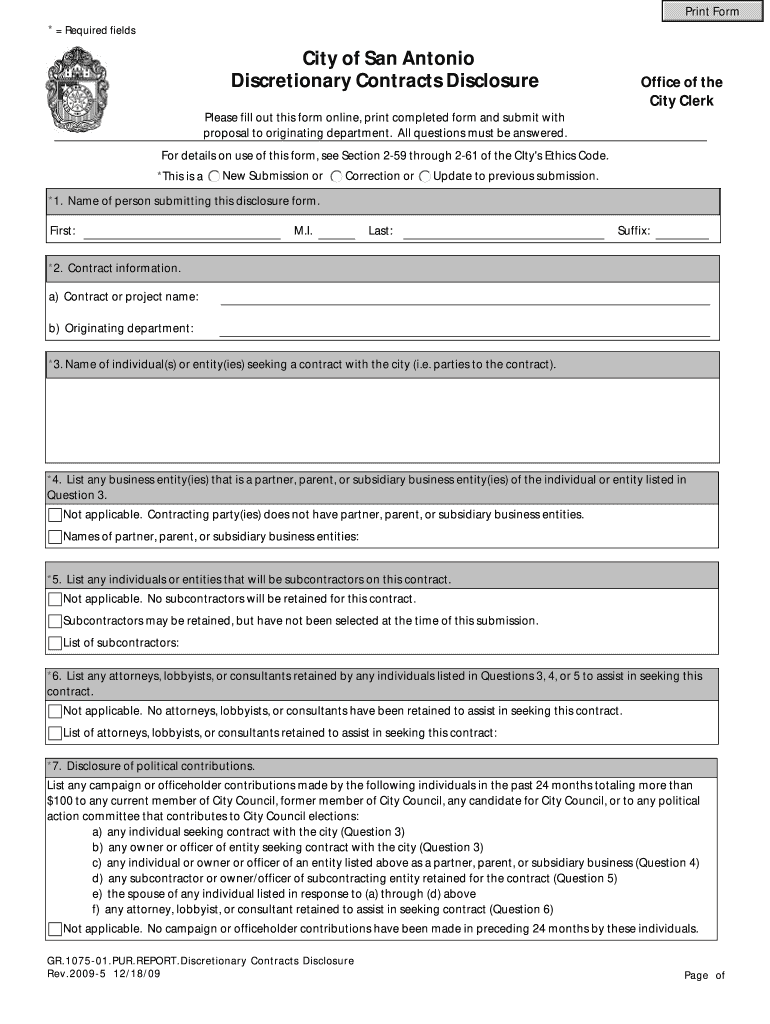

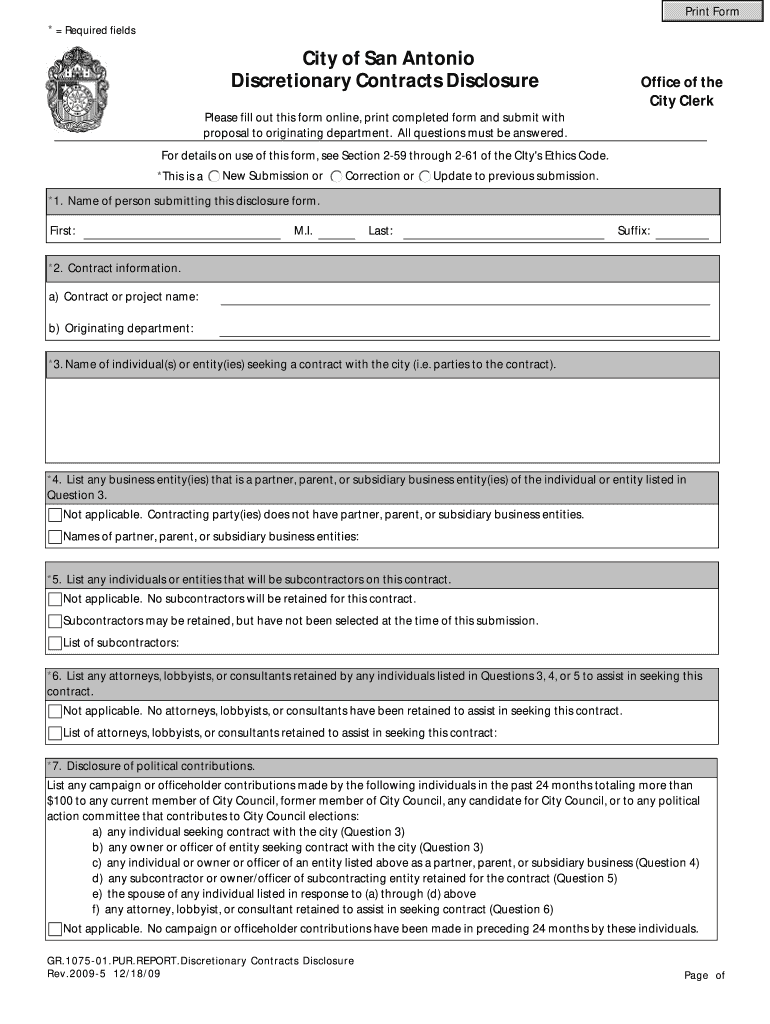

TX GR.1075-01 2009 free printable template

Get, Create, Make and Sign TX GR1075-01

Editing TX GR1075-01 online

Uncompromising security for your PDF editing and eSignature needs

TX GR.1075-01 Form Versions

How to fill out TX GR1075-01

How to fill out TX GR.1075-01

Who needs TX GR.1075-01?

Video instructions and help with filling out and completing san antonio disclosure form

Instructions and Help about TX GR1075-01

Hi John Goodman here we are talking about how to address personal property in a real estate contract specifically the Colorado real estate commission approved contract for 2019 which has been revived on this topic so let's talk about an example we're gonna start with an unrealistic example to make a point but imagine you are brokering a transaction it's a motel the motel is selling for a million dollars and the motel is also selling with beds and furniture desks and chairs etc that the buyer is also buying and the buyer and seller agree that all the personal property is worth 50000 that's 50000 what makes it unrealistic also is that the buyer is buying this property without any financing at all the buyer is reaching into their pocket their buyer is reaching to their bank account and paying 1 million fifty thousand dollars for this project well in this unrealistic example it doesn't it doesn't matter whether you allocate the whole purchase price to the real estate purchase price of a million fifty thousand or whether you allocate it 1 million for the real estate 50000 for the personal property it doesn't make a difference the purchase price for all the stuff together is 1 million fifty thousand dollars but in the real world it's a lot more complicated in the real world because people tend to get financing because people buy these things with borrowed funds there's pressure when there's personal property involved in the transaction to diminish the attributed value two of the personal property and attribute it to the real estate which allows the borrower to borrow more a higher percentage of the purchase price it's much more advantageous for the buyer to buy in this example I just mentioned to get financing based on the value of real estate of 1050000 than it is for the buyer to buy based on evaluation of a million and how to come up out of the buyers own pocket with 50000 to pay for the personal property cash is king people like to leverage their scarce cash as good as possible hence creating the pressure to attribute the value not to the personal property but to attribute the value to the real estate so with that in mind talking about this change in the real estate commission proof contract we're going to talk about three more realistic examples one example what I will call the junk example in a residential real estate transaction yes the buyer is getting some personal property things like let's say the washer dryer and refrigerator that's the junk example it's pretty easy to convince an underwriter that that stuff essentially has zero value if it was removed it has zero value to the seller that's the junk example another one the second one I'm going to call it the ambiguous example this might be the ski condo where the seller is kept selling ski condo the sellers own the ski condo for 12 years the ski condo is furnished the furniture has been beat up over 12 years by ski boots and sleds and snow melting and cigarette smoke and whatever else it...

People Also Ask about

Does Texas require disclosure?

What is a Texas disclosure form?

What happens if seller does not disclose Texas?

What is form T-64 Texas disclosure?

Is Texas a disclosure state?

Which sellers disclosure is required in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit TX GR1075-01 online?

How do I fill out TX GR1075-01 using my mobile device?

Can I edit TX GR1075-01 on an iOS device?

What is TX GR.1075-01?

Who is required to file TX GR.1075-01?

How to fill out TX GR.1075-01?

What is the purpose of TX GR.1075-01?

What information must be reported on TX GR.1075-01?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.