Get the free Registered Plan Application - ci sammamish wa

Show details

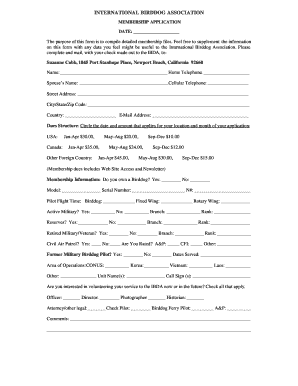

This document serves as an application form for registering building plans, including details on the contact information for various parties involved in the construction, building data, engineering

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registered plan application

Edit your registered plan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registered plan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing registered plan application online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit registered plan application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registered plan application

How to fill out Registered Plan Application

01

Gather necessary personal information including your full name, address, date of birth, and social insurance number.

02

Determine the type of Registered Plan you are applying for (e.g., RRSP, TFSA).

03

Complete the application form with accurate and truthful details.

04

Select your investment options and any required contribution amounts.

05

Review the completed application for accuracy and completeness.

06

Sign and date the application form.

07

Submit the application to the financial institution or organization managing the plan.

Who needs Registered Plan Application?

01

Individuals looking to save for retirement through tax-advantaged accounts.

02

People wanting to invest in a Registered Plan for long-term financial goals such as education or home purchases.

03

Anyone seeking to secure tax benefits associated with contributions to Registered Plans.

Fill

form

: Try Risk Free

People Also Ask about

Is an RSP the same as an RRSP?

The key difference between an RSP and an RRSP is that the term RSP is used prior to it being registered with the Canada Revenue Agency (CRA). Once the RSP is registered with the CRA, it is called a Registered Retirement Savings Plan (RRSP).

What is a registered plan in Canada?

Registered plans are savings and investment accounts registered with the federal government that offer tax advantages. Investing in a registered plan can help you save for a number of goals, including saving for a down payment, education savings, or retirement.

What type of account is an RSP?

An RSP is a Canadian retirement or savings plan, while an IRA (Individual Retirement Account) is a U.S. “equivalent.” Both have tax advantages, but the countries' rules for contributions, withdrawals, and tax treatment differ.

What is the difference between RSP and RRSP?

The key difference between an RSP and an RRSP is that the term RSP is used prior to it being registered with the Canada Revenue Agency (CRA). Once the RSP is registered with the CRA, it is called a Registered Retirement Savings Plan (RRSP).

What is a registered retirement savings plan?

An RRSP is a retirement savings plan that you establish, that the CRA registers, and to which you or your spouse or common-law partner contribute. Deductible RRSP contributions can be used to reduce your tax.

Can I withdraw from an RSP?

If your RRSPs are not locked in, you can withdraw funds at any time.

Can I move my RSP to an RRSP?

Did you know that you can transfer any remaining income to your Registered Retirement Savings Plan (RRSP)? There's a good chance you can. You'd typically transfer the income when closing the RESP. Ideally, the beneficiary has pursued post-secondary education and withdrawn all the income and government grant money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Registered Plan Application?

A Registered Plan Application is a formal request submitted to the relevant regulatory body to register a specific financial plan that meets legal requirements, such as retirement savings plans or other tax-advantaged accounts.

Who is required to file Registered Plan Application?

Organizations such as financial institutions and plan sponsors that offer registered plans to individuals, such as RRSPs (Registered Retirement Savings Plans) or RRIFs (Registered Retirement Income Funds), are required to file the Registered Plan Application.

How to fill out Registered Plan Application?

To fill out a Registered Plan Application, one must provide detailed information about the plan, including the type of plan, eligibility criteria, terms and conditions, and the identities of the plan administrators, followed by any required signatures and supporting documentation.

What is the purpose of Registered Plan Application?

The purpose of the Registered Plan Application is to ensure that financial plans comply with statutory regulations, allowing participants to benefit from tax advantages and ensuring the integrity of the financial system.

What information must be reported on Registered Plan Application?

The Registered Plan Application must report information such as the name and address of the plan sponsor, the type of registered plan, details of the plan’s investment options, administrative procedures, and compliance measures.

Fill out your registered plan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registered Plan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.