Get the free SUB MISC

Show details

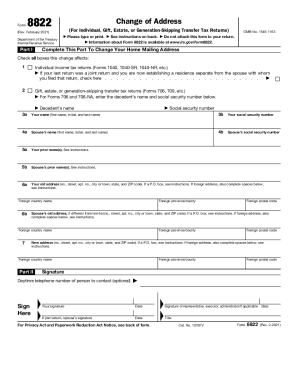

SUB / MISC. TIME CARD Cut Bank School District #15 101 3rd Avenue SE Cut Bank, MT 59427 Phone: 4068732229 Fax: 4068734691 www.cutbankschools.net Employee Name: From (date): To (date): **SEE RATES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sub misc

Edit your sub misc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sub misc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sub misc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sub misc. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sub misc

How to fill out sub misc:

01

Start by gathering all the necessary information and documents required to complete the sub misc form. This may include personal details, employment information, and any other relevant information.

02

Carefully read and understand the instructions provided on the sub misc form. Make sure to follow them precisely to avoid any errors or delays in processing.

03

Begin filling out the form section by section, ensuring that you provide accurate and up-to-date information. Double-check all the entries to avoid any mistakes or omissions.

04

Pay close attention to any specific guidelines or requirements mentioned on the form. For example, if there are specific formats or codes to be used for certain fields, make sure to comply with them.

05

If you encounter any doubts or difficulties while completing the form, refer to the official instructions or seek assistance from a knowledgeable individual, such as a tax professional or an employer's human resources representative.

06

Once you have thoroughly reviewed and filled out all the necessary sections of the sub misc form, make sure to sign and date it as required. Failure to do so may invalidate the form.

Who needs sub misc:

01

Independent contractors: If you work as a freelancer, consultant, or any other type of self-employed individual, you may need to fill out sub misc to report your earnings and tax information.

02

Employers: If you hire independent contractors or freelancers, you may need to provide them with a sub misc form to report the payments made to them for their services.

03

Recipients of miscellaneous income: Even if you are not classified as an employee or independent contractor, you may still receive miscellaneous income, such as rent or royalties. In such cases, you might be required to fill out sub misc to report these earnings to the tax authorities.

04

Financial institutions: Banks and other financial institutions may also need to fill out sub misc forms for their customers, especially when reporting interest income or other financial transactions that fall under the miscellaneous income category.

It is important to note that the specific circumstances and requirements for using the sub misc form may vary depending on the country and tax regulations in place. Therefore, it is always advisable to consult with a tax professional or refer to official resources for accurate and updated information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sub misc online?

The editing procedure is simple with pdfFiller. Open your sub misc in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the sub misc in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your sub misc right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit sub misc on an iOS device?

Use the pdfFiller mobile app to create, edit, and share sub misc from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is sub misc?

Sub misc is a form used to report miscellaneous income, such as freelance income or income from rental properties.

Who is required to file sub misc?

Individuals or businesses who pay $600 or more in miscellaneous income to a contractor or vendor are required to file sub misc.

How to fill out sub misc?

Sub misc can be filled out online or through traditional paper forms. The payer must provide their information, the recipient's information, and the amount of miscellaneous income paid.

What is the purpose of sub misc?

The purpose of sub misc is to report miscellaneous income to the IRS for tax reporting purposes.

What information must be reported on sub misc?

Sub misc requires information such as the payer's name, address, and taxpayer identification number, as well as the recipient's name, address, and taxpayer identification number.

Fill out your sub misc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sub Misc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.