Get the This Form is FREE and NOT FOR SALE FOR OFFICIAL USE ONLY - nagis

Show details

This Form is FREE and NOT FOR SALE (this Form can be copied) SRO FOR OFFICIAL USE ONLY Payment Detail Stamp Processing Fee Amount Bank Teller Number Receipt Number Signature Accountant Statutory Right

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign this form is and

Edit your this form is and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your this form is and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit this form is and online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit this form is and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out this form is and

How to fill out this form is and?

01

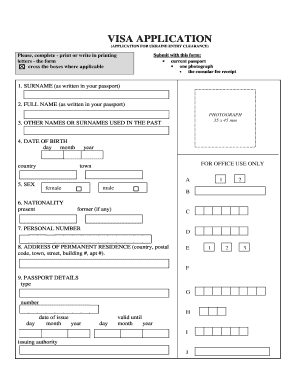

Start by carefully reading the instructions provided on the form. Make sure you understand the purpose of the form and the information it requires.

02

Begin filling out the form by entering your personal details such as your name, address, and contact information. Ensure that you provide accurate and up-to-date information.

03

Provide the requested information in the appropriate sections of the form. This may include details about your employment, educational background, or any other relevant information.

04

If there are any optional sections on the form, decide whether you want to fill them out or not. Optional sections are usually not mandatory but can provide additional information if you choose to include it.

05

Pay attention to any specific formatting instructions given on the form. This may include using specific date formats or providing information in a certain order.

06

Check your form for any errors or missing information before submitting it. Review all the fields to ensure nothing has been skipped or overlooked.

07

If required, sign and date the form in the designated area. This is necessary to validate the information provided and confirm your agreement with the form's contents.

08

Once you have completed the form, submit it according to the instructions provided. This could involve mailing it, hand-delivering it, or submitting it online, depending on the form's requirements.

Who needs this form is and?

01

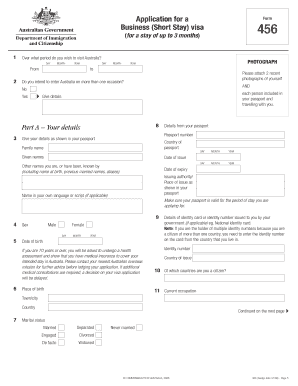

Individuals applying for a job may need this form to provide their employment history, qualifications, and other relevant details to a potential employer.

02

Students applying for admission to a college or university may need this form to provide their educational background, achievements, and personal information.

03

Individuals seeking financial aid or scholarships may need this form to provide information about their financial situation, academic performance, and extracurricular activities.

04

Business owners or entrepreneurs may need this form to register their business, provide necessary legal information, or apply for permits and licenses.

05

Individuals applying for government benefits or programs may need this form to provide their personal and financial information, as well as their eligibility for the specific program.

06

Researchers or survey administrators may need this form to collect data from participants for their studies or surveys.

07

Public or private organizations may require this form from individuals for various purposes, such as membership applications, event registrations, or consent forms.

08

Government agencies may require this form for tax purposes, census data collection, or record-keeping.

Note: The specific needs for this form may vary depending on the context and purpose for which it is being used.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit this form is and in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing this form is and and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the this form is and electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete this form is and on an Android device?

Complete this form is and and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is this form is and?

This form is Form W-9, which is used to provide a taxpayer identification number to the person who is required to file information returns with the IRS.

Who is required to file this form is and?

Any person or business that makes payments to individuals or entities that are required to be reported on an information return must file Form W-9.

How to fill out this form is and?

The person or business requesting the taxpayer identification number must provide their name, address, requestor's name, type of entity, and taxpayer identification number.

What is the purpose of this form is and?

The purpose of Form W-9 is to obtain the correct taxpayer identification number to report income paid to the recipient.

What information must be reported on this form is and?

The recipient's name, address, and taxpayer identification number must be reported on Form W-9.

Fill out your this form is and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

This Form Is And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.