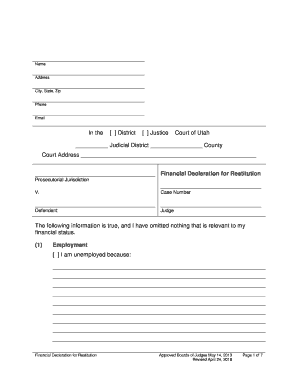

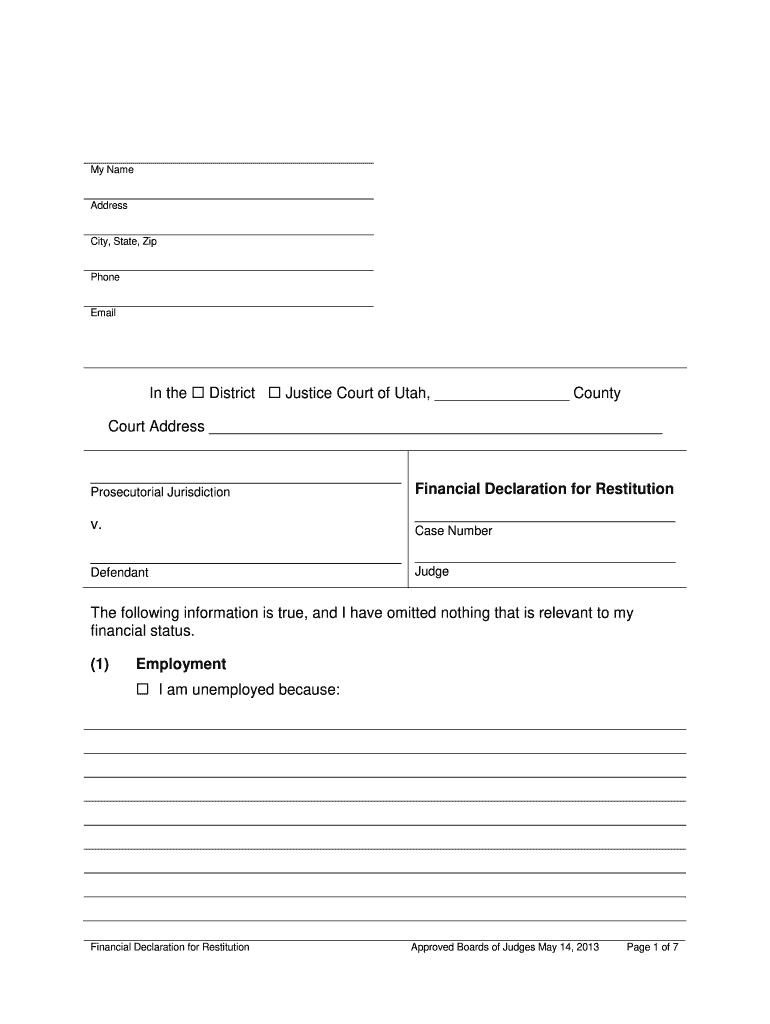

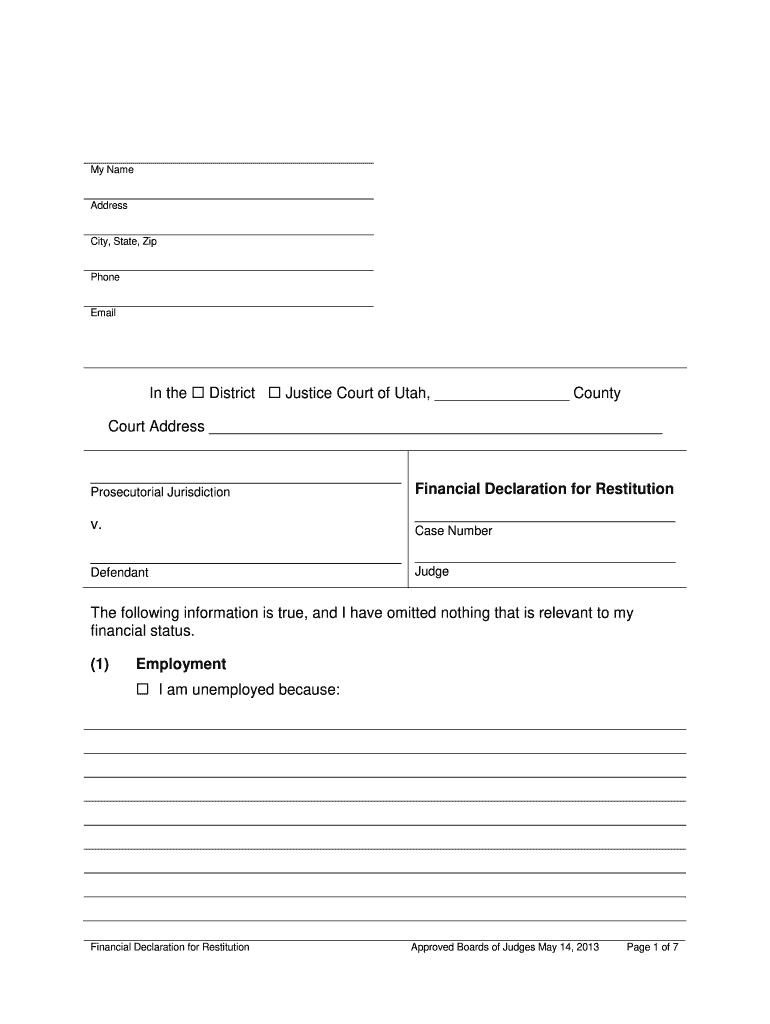

UT Financial Declaration for Restiution 2013 free printable template

Show details

My Name Address City, State, Zip Phone Email In the ? District ? Justice Court of Utah, County Court Address Prosecutorial Jurisdiction Financial Declaration for Restitution v. Case Number Defendant

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT Financial Declaration for Restiution

Edit your UT Financial Declaration for Restiution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT Financial Declaration for Restiution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT Financial Declaration for Restiution online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UT Financial Declaration for Restiution. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT Financial Declaration for Restiution Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT Financial Declaration for Restiution

How to fill out UT Financial Declaration for Restiution

01

Obtain the UT Financial Declaration for Restitution form, usually available on the relevant university website or financial aid office.

02

Fill out your personal information at the top of the form, including your full name, student ID, and contact details.

03

Provide details about your financial situation, including income from all sources, expenses, and any financial support you may receive.

04

List your assets, such as savings accounts, investments, and any property you own.

05

Indicate any debts or financial obligations you have, including loans and credit card debt.

06

Review the information for accuracy and completeness.

07

Sign and date the declaration to certify that the information provided is true and accurate.

08

Submit the completed form to the appropriate university office, following any specific submission guidelines outlined on the form.

Who needs UT Financial Declaration for Restiution?

01

Students who have incurred financial hardship or who are seeking financial aid for educational expenses may need to complete the UT Financial Declaration for Restitution.

02

Individuals who are involved in a restitution process as mandated by the university may also be required to submit this declaration.

Fill

form

: Try Risk Free

People Also Ask about

What is the restitution code in Utah?

Under Utah Code section 77-38a-302, complete restitution is the total amount determined by the court that is necessary to compensate a victim for damage or loss caused by the defendant. Court-ordered restitution is the amount ordered by the court to actually be paid by the defendant as part of a sentencing order.

What is Utah Code 77 18 114?

The Office of State Debt Collection shall notify the court when a civil judgment of restitution or a civil accounts receivable is satisfied. may be collected by any means authorized by law for the collection of a civil judgment.

What is a form of restitution?

There are three different types of restitution: restitution fines, parole revocation fines, and direct orders. The court can order all three types of restitution in the same case. If the offender is found guilty in multiple cases, the court can order all three types of restitution in each case.

What is the Utah Code for complete restitution?

Under Utah Code section 77-38a-302, complete restitution is the total amount determined by the court that is necessary to compensate a victim for damage or loss caused by the defendant. Court-ordered restitution is the amount ordered by the court to actually be paid by the defendant as part of a sentencing order.

What is state of Utah restitution?

Utah criminal restitution means a court order in a criminal case ordering the convicted defendant to pay back the money amount for any damage his criminal activities caused. These restitution payments can be made monthly or in a lump sum, depending on the judge's orders.

What is a cr110 form?

States a court's decision that an offender must repay a crime victim for any losses suffered as the result of an offense. Once this order is entered in the court records, the crime victim may use it to collect the money owed. Get form CR-110.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UT Financial Declaration for Restiution to be eSigned by others?

To distribute your UT Financial Declaration for Restiution, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit UT Financial Declaration for Restiution straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing UT Financial Declaration for Restiution, you need to install and log in to the app.

How do I fill out UT Financial Declaration for Restiution on an Android device?

Complete UT Financial Declaration for Restiution and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is UT Financial Declaration for Restitution?

The UT Financial Declaration for Restitution is a legal document required by the University of Texas that outlines an individual's financial situation, typically in the context of restitution or financial agreements.

Who is required to file UT Financial Declaration for Restitution?

Individuals who have been ordered to make restitution as part of a legal judgment or requirement, such as students or employees in specific disciplinary actions, are typically required to file the UT Financial Declaration for Restitution.

How to fill out UT Financial Declaration for Restitution?

To fill out the UT Financial Declaration for Restitution, gather your financial documents, complete each section accurately detailing your income, expenses, assets, and liabilities, and submit the completed form to the appropriate office at the University of Texas.

What is the purpose of UT Financial Declaration for Restitution?

The purpose of the UT Financial Declaration for Restitution is to assess an individual's financial capacity to fulfill restitution obligations and to ensure that the court or relevant authority has a clear understanding of the filer’s financial circumstances.

What information must be reported on UT Financial Declaration for Restitution?

The UT Financial Declaration for Restitution must include information about income, expenses, assets, liabilities, dependents, and any other financial obligations that may affect the individual's ability to pay restitution.

Fill out your UT Financial Declaration for Restiution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT Financial Declaration For Restiution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.