Get the free Authorization to Sell Bonds

Show details

This document presents a resolution authorizing Wayne State University to issue general revenue bonds totaling up to $92,000,000 to fund various capital projects.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign authorization to sell bonds

Edit your authorization to sell bonds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization to sell bonds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing authorization to sell bonds online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit authorization to sell bonds. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

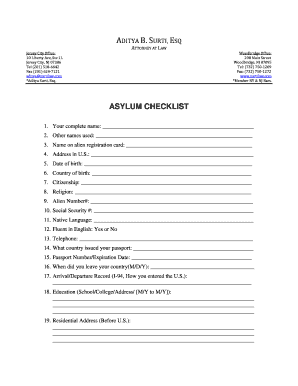

How to fill out authorization to sell bonds

How to fill out Authorization to Sell Bonds

01

Start by obtaining the Authorization to Sell Bonds form from the appropriate authority.

02

Fill out the identification section with the seller's name, address, and contact information.

03

Provide details about the bonds, including the type, quantity, and any identification numbers.

04

Record the selling price and any terms associated with the sale.

05

Include information about the buyer, including their name and contact details.

06

Sign and date the form to certify that all information is accurate.

07

Submit the completed form to the appropriate regulatory or governing body for approval.

Who needs Authorization to Sell Bonds?

01

Individuals or entities looking to sell municipal or government bonds.

02

Financial institutions or brokers facilitating the bond sale.

03

Corporations planning to divest from bond holdings.

Fill

form

: Try Risk Free

People Also Ask about

How do you sell your bonds?

You can hold a Treasury marketable security until it matures or sell it before it matures. To sell a Treasury marketable security, you must work through a bank, broker, or dealer.

What happens when bonds are sold?

In general, when interest rates go down, bond prices go up. If this happens, you can make money by selling your bond before it matures. You'll get more than you paid for it, and you'll keep the interest you've made up until the time you sell it.

What does it mean when a company sells bonds?

These bonds, debt securities issued by corporations, offer an investment opportunity wherein the company receives needed capital while investors earn a pre-established interest on their investment.

How does it benefit an organization to sell bonds?

One of the main advantages of issuing bonds is that companies can raise capital without giving up equity. Unlike selling shares to investors, bonds are a form of debt financing — meaning the company retains full ownership and decision-making power.

Who is authorized to issue bonds?

Corporate bonds are issued by corporations to raise money for funding business needs. Government bonds are issued by governments to fund the government's needs, such as to pay for infrastructure projects, government employee salaries, and other programs.

What does it mean for a company to sell bonds?

Corporate bonds are bonds issued by companies. Companies issue corporate bonds to raise money for a variety of purposes, such as building a new plant, purchasing equipment, or growing the business.

What is the point of selling bonds?

However, by selling bonds after they have risen in price – and before maturity – investors can realize price appreciation, also known as capital appreciation, on bonds. Capturing the capital appreciation on bonds increases their total return, which is the combination of income and capital appreciation.

What do you call a person who sells bonds?

Issuers sell bonds or other debt instruments to raise money; most bond issuers are governments, banks, or corporate entities. Underwriters are investment banks and other firms that help issuers sell bonds. Bond purchasers are the corporations, governments, and individuals buying the debt that is being issued.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Authorization to Sell Bonds?

Authorization to Sell Bonds is a legal document or approval that allows an entity, such as a government or corporation, to issue and sell bonds to raise capital.

Who is required to file Authorization to Sell Bonds?

Typically, governmental bodies, municipalities, and certain private organizations that wish to issue bonds are required to file an Authorization to Sell Bonds.

How to fill out Authorization to Sell Bonds?

To fill out an Authorization to Sell Bonds, one must complete a form that includes details like the purpose of the bond issuance, the amount to be raised, and the maturity date, along with signatures from appropriate authorities.

What is the purpose of Authorization to Sell Bonds?

The purpose of Authorization to Sell Bonds is to provide legislative or regulatory approval for organizations to finance projects or operations through bond sales.

What information must be reported on Authorization to Sell Bonds?

Information that must be reported on Authorization to Sell Bonds typically includes the issuer's details, the type and amount of bonds being issued, the intended use of the proceeds, and information about the bonds' maturities and interest rates.

Fill out your authorization to sell bonds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization To Sell Bonds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.