Get the free SFN 21937

Show details

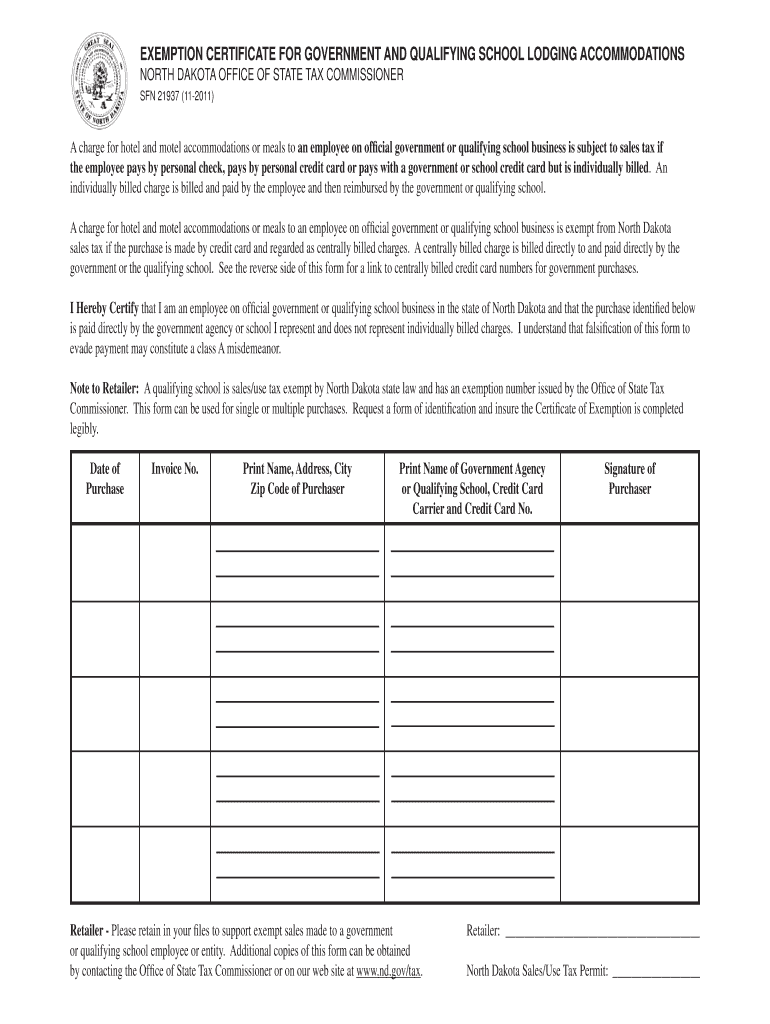

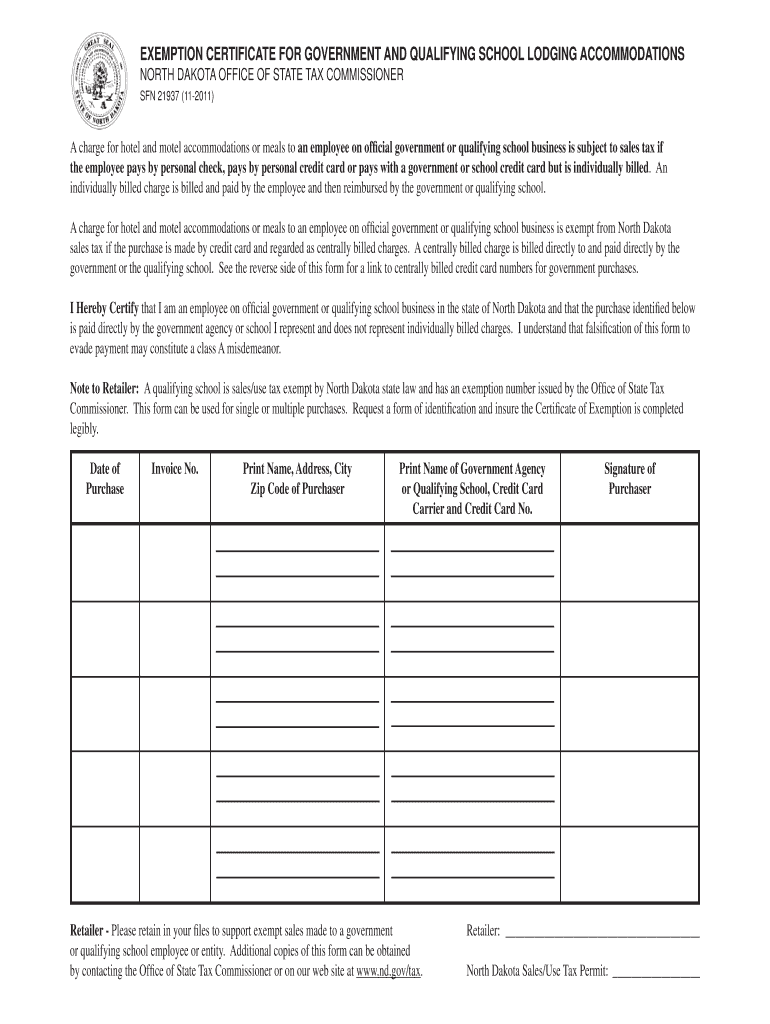

This document serves as an exemption certificate for government employees or qualifying school employees in North Dakota to certify that their lodging or meal purchases made under certain conditions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sfn 21937

Edit your sfn 21937 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sfn 21937 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sfn 21937 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sfn 21937. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sfn 21937

How to fill out SFN 21937

01

Obtain a blank SFN 21937 form from the appropriate source.

02

Fill in the applicant's information in the designated sections, including full name and contact information.

03

Provide the necessary details regarding the purpose of the form.

04

Complete any sections related to previous employment or education, if applicable.

05

Review all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed SFN 21937 to the relevant authority.

Who needs SFN 21937?

01

Individuals applying for assistance or services that require the SFN 21937 form.

02

Organizations submitting information on behalf of an applicant.

03

Professionals in fields that require official documentation related to the applicant's circumstances.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a California tax clearance certificate?

To apply for the use tax clearance certificate (CDTFA-111), use CDTFA's online services and select Request Use Tax Clearance for Registration with DMV/HCD under the Limited Access Functions.

Does North Dakota accept out of state resale certificates?

Yes, North Dakota accepts out-of-state resale certificates, provided they are properly completed and comply with North Dakota's requirements.

What is a California exemption certificate?

A California sales tax exemption certificate is essential for businesses to legally avoid paying sales tax on qualifying purchases. Proper management of these certificates helps ensure businesses don't overpay taxes and remain compliant with state regulations.

What is a California tax exemption certificate?

0:09 1:22 But for those directly related to the exempted business activities. It is important to note that notMoreBut for those directly related to the exempted business activities. It is important to note that not all purchases are eligible for exemption. And misuse of the certificate.

Who qualifies for tax exemption in California?

State Income Tax A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax Board stating it is exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701).

Do North Dakota sales tax exemption certificates expire?

Many states' tax exemption certificates have no expiration: Arizona (the seller chooses the period of exemption); Arkansas; Colorado (this can depend on the purpose of the exemption); Georgia; Hawaii; Idaho; Indiana; Maine; Minnesota; Mississippi; Nebraska; New Mexico; New Jersey, New York, North Carolina; North Dakota

Is a California seller's permit the same as a tax exempt certificate?

A seller's permit is a state license that allows you to sell items at the wholesale or retail level and to issue resale certificates to suppliers. Issuing a resale certificate allows you to buy items you will sell in your business operations without paying amounts for tax to your suppliers.

What are exemption numbers?

If you qualify for an exemption, the notice will include your unique identifier, called the exemption certificate number (ECN). Each member of your household who qualifies for the exemption will get their own ECN. You'll need your ECN when you file your federal taxes for the year you don't have coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SFN 21937?

SFN 21937 is a Tax Exempt Organization Annual Reporting Form used in the state of North Dakota.

Who is required to file SFN 21937?

Organizations that qualify as tax-exempt under state law are required to file SFN 21937 annually.

How to fill out SFN 21937?

To fill out SFN 21937, organizations must provide their identification information, details about their activities, financial data, and any additional required documentation.

What is the purpose of SFN 21937?

The purpose of SFN 21937 is to ensure compliance with state tax regulations for tax-exempt organizations and to maintain transparency in their financial activities.

What information must be reported on SFN 21937?

The information that must be reported on SFN 21937 includes the organization’s name, address, tax identification number, a summary of activities, financial statements, and any changes in the organizational structure.

Fill out your sfn 21937 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sfn 21937 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.