Get the free International Mortgage Service

Show details

This document is an application form for an international mortgage, requiring personal information, employment history, financial background, property details, and consent for marketing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international mortgage service

Edit your international mortgage service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international mortgage service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit international mortgage service online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit international mortgage service. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

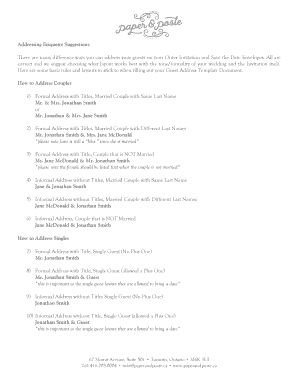

How to fill out international mortgage service

How to fill out International Mortgage Service

01

Gather necessary personal documents such as identification, income verification, and credit history.

02

Research and select the appropriate lender that offers International Mortgage Services.

03

Fill out the mortgage application form provided by the chosen lender.

04

Provide the required documentation and details about the property you wish to purchase.

05

Submit the completed application and wait for the lender's assessment.

06

Respond to any additional requests for information or documents from the lender.

07

Review the loan offer, including terms and conditions, before proceeding.

Who needs International Mortgage Service?

01

Expatriates looking to purchase property abroad.

02

Foreign investors interested in real estate in a different country.

03

Individuals relocating for work or study wanting to buy a home in a new country.

04

Those seeking to diversify their investment portfolio by holding property internationally.

Fill

form

: Try Risk Free

People Also Ask about

Which banks do expat mortgages?

The main UK banks that offer expat mortgages are: HSBC. Skipton International. Market Harborough. Suffolk Building Society. Santander. Gatehouse Bank. NatWest.

Can a foreigner get a mortgage in Brazil?

The good news? You don't need to be a resident or have Brazilian income to secure a mortgage. What you do need is strategy, the right partners, and a lot of local knowledge. This guide will walk you through everything you need to know to make your Brazilian property goals a reality.

Can I get a UK mortgage for a house abroad?

It works pretty much the same as a mortgage on a UK property. But you'll either apply for a specialist product such as an 'overseas mortgage' from a UK provider, or you'll apply from a foreign bank or lender in the country you're buying property in.

Can I get a mortgage in the US if I live abroad?

An international mortgage allows buyers to finance property in one country while living or earning income in another. US expats typically face several major obstacles when applying for traditional US mortgages. Most domestic lenders ask for US-based income and a local credit history.

What is an international mortgage?

An overseas mortgage is any mortgage you take out on a property that's not in your country of residence. It can be from a local bank, or from an overseas lender in the country you want to buy in. Your approach will depend on your personal and financial situation, so it's important to do your research.

Do US banks do international mortgages?

You can also take out an international mortgage if you're a US expat living abroad who wants to purchase property back in the states. Not all US banks and lenders offer international mortgage loans, so you'll need to find the right provider for you.

Can I get a mortgage if I live abroad?

Yes, it's possible. An expat mortgage is a term used to describe a home loan for former UK residents who want to buy a property in the country, but either don't live here anymore, or have recently moved back.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is International Mortgage Service?

International Mortgage Service refers to a financial service that assists individuals and entities in obtaining mortgage loans for properties located outside their home countries, often catering to expatriates or foreign nationals.

Who is required to file International Mortgage Service?

Individuals or entities engaged in cross-border mortgage transactions or those who have received international mortgage loans are typically required to file International Mortgage Service documentation.

How to fill out International Mortgage Service?

To fill out International Mortgage Service forms, one must provide specific details such as personal identification, property information, mortgage details, and any relevant financial data as required by the mortgage service policies.

What is the purpose of International Mortgage Service?

The purpose of International Mortgage Service is to facilitate the financing of real estate purchases across international borders, providing financial solutions for individuals looking to acquire properties abroad.

What information must be reported on International Mortgage Service?

Reported information on International Mortgage Service typically includes borrower identification details, mortgage amount, property location and valuation, loan terms, and other pertinent financial details related to the international transaction.

Fill out your international mortgage service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Mortgage Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.