Get the free and Lending

Show details

Grade FourBorrowing

and Lending

Overview

Students share the book Ben and Me, by Robert Lawson, to learn about borrowing,

lending, and interest. Students complete a worksheet about borrowing money,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign and lending

Edit your and lending form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your and lending form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit and lending online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit and lending. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out and lending

How to fill out and lending:

01

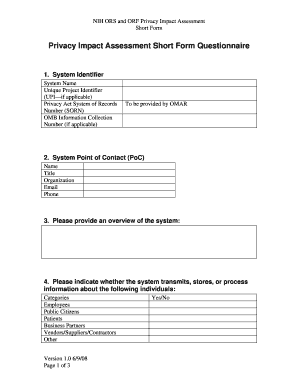

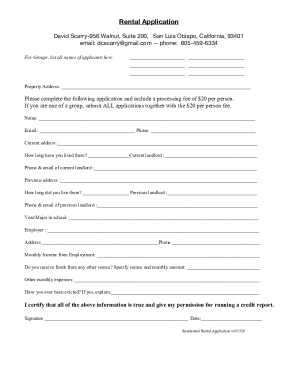

Start by gathering all the necessary documents required for the lending process. This may include identification proof, income proof, address proof, and any other relevant paperwork.

02

Next, carefully study and understand the terms and conditions of the lending agreement. Make sure you are aware of the interest rates, repayment schedule, and any additional fees or charges.

03

Complete the lending application form accurately and legibly. Double-check all the information you provide to ensure its correctness.

04

If applying for a loan from a bank or financial institution, you may need to present your documents in person or through online submission. Follow the prescribed method of submission as per the lender's instructions.

05

Wait for the lending institution to process your application. This may take some time, so be patient. If necessary, follow up on the status of your application.

06

Once your lending application is approved, carefully review the terms and conditions once again before signing the contract. Make sure you understand all the clauses and obligations.

07

If required, provide any additional documentation or collateral as per the lender's requirements.

08

Receive the agreed-upon lending amount and ensure it is used for the intended purpose. Keep track of repayment schedules and make timely payments to avoid any penalties or default.

Who needs and lending:

01

Individuals seeking financial assistance for various purposes, such as education, home purchase, business start-up, debt consolidation, or emergencies, may need lending.

02

Small businesses or entrepreneurs looking for working capital or investment funds may also require lending to support their operations or expansion plans.

03

Individuals or organizations with low credit scores or limited access to traditional financing options may turn to alternative lending sources.

04

People facing unexpected financial burdens or emergencies, such as medical expenses or home repairs, may seek lending to cover these costs.

05

Sometimes, even individuals or organizations with sound financial standing may opt for lending if it offers better terms or flexibility compared to their existing financial arrangements.

06

Depending on the specific criteria and requirements set by lenders, the need for lending can vary from person to person and situation to situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get and lending?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific and lending and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete and lending online?

pdfFiller has made it easy to fill out and sign and lending. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the and lending form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign and lending. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is and lending?

And lending is a financial transaction where one party provides funds to another party and expects repayment with interest.

Who is required to file and lending?

Any individual or organization that engages in lending activities is required to file and lending.

How to fill out and lending?

To fill out and lending, one must provide details of the loan agreement, including the amount borrowed, interest rate, repayment terms, and any collateral involved.

What is the purpose of and lending?

The purpose of and lending is to provide financial assistance to individuals or organizations in need of funds.

What information must be reported on and lending?

Information such as the amount borrowed, interest rate, repayment schedule, and any collateral must be reported on and lending.

Fill out your and lending online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

And Lending is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.