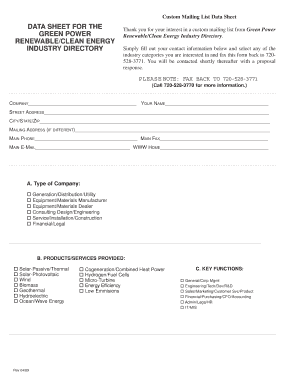

Get the free Rule 144(k) Seller’s Certification

Show details

This form is used for sellers to certify their compliance with SEC Rule 144(k) when selling securities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rule 144k sellers certification

Edit your rule 144k sellers certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rule 144k sellers certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

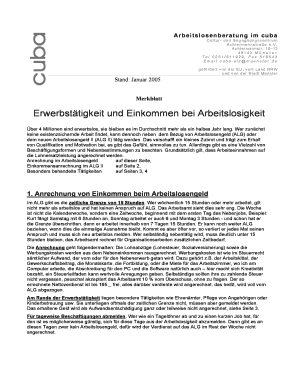

Editing rule 144k sellers certification online

Follow the steps down below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rule 144k sellers certification. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rule 144k sellers certification

How to fill out Rule 144(k) Seller’s Certification

01

Obtain the Rule 144(k) Seller’s Certification form from the appropriate regulatory authority or website.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide information about the securities you are selling, including the type of securities and the amount you have held.

04

Confirm that you have held the securities for at least the required holding period, which is generally six months.

05

Sign and date the certification to validate the information you’ve provided.

06

Submit the completed form to the relevant parties involved in the transaction, such as the brokerage or transfer agent.

Who needs Rule 144(k) Seller’s Certification?

01

Individuals or entities looking to sell their restricted securities without having to register the sale with the SEC.

02

Companies that have issued restricted stock and need to comply with SEC regulations for their shareholders.

03

Investors who meet the holding period requirements and want to ensure their sale qualifies for exemption under Rule 144.

Fill

form

: Try Risk Free

People Also Ask about

What is the Rule 144 for selling to cover?

144: Remarks and Signature This is a sell-to-cover transaction for taxes owed related to recent vestings of stock unit awards granted by the issuer.

Who needs to file form 144?

Anyone who sells restricted, unregistered, and control securities in the United States must follow Rule 144 of the Securities Act of 1933,1 which was passed as a way to protect investors after the stock market crashed in 1929.

How to comply with Rule 144?

Form 144 provides the SEC with notice of sales by insiders, promoting transparency. Affiliates must file Form 144 with the SEC if the sale involves: More than 5,000 shares, or. An aggregate dollar amount greater than $50,000 in any three-month period.

What is the 144A selling restriction?

Rule 144A securities are restricted securities that can only be sold to qualified institutional buyers (QIBs) or under certain conditions, such as after a holding period or in compliance with Rule 144.

What are the requirements for filing Form 144?

1 An entity filing a Form 144 must have a bona fide intention to sell the securities referred to in the form within a reasonable time after the filing of the Form. While the SEC does not require the form to be sent electronically to the SEC's EDGAR database, some filers choose to do so.

How does Rule 144 work?

Rule 144 regulates transactions dealing with restricted, unregistered, and control securities. (Control securities are held by insiders or others with significant influence on the issuer.) These types of securities are typically acquired over the counter (OTC) or through private sales.

Who is considered an affiliate under Rule 144?

Directors, officers and holders of ten percent or more of an issuing company's voting securities (including securities which are issuable within the next sixty days) are deemed to be affiliates of the issuing company.

What is the Rule 144 for sellers?

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rule 144(k) Seller’s Certification?

Rule 144(k) Seller’s Certification is a document that allows certain holders of restricted securities, specifically under Rule 144, to certify their eligibility to sell their securities without the typical restrictions that apply to other sellers.

Who is required to file Rule 144(k) Seller’s Certification?

Individuals or entities who wish to sell restricted securities and qualify for the exemption provided by Rule 144(k), which generally applies to those who have held the securities for at least six months and meet other criteria.

How to fill out Rule 144(k) Seller’s Certification?

To fill out the Rule 144(k) Seller’s Certification, one must provide the required personal information, details about the securities, the holding period, and certify that they meet the conditions of Rule 144(k).

What is the purpose of Rule 144(k) Seller’s Certification?

The purpose of Rule 144(k) Seller’s Certification is to enable eligible sellers to sell their restricted securities with fewer burdensome restrictions and to establish that they have met the required holding period before selling.

What information must be reported on Rule 144(k) Seller’s Certification?

The information that must be reported includes the seller's name, the number of shares being sold, the date of acquisition, the holding period, and any additional information needed to affirm compliance with Rule 144(k).

Fill out your rule 144k sellers certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rule 144k Sellers Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.