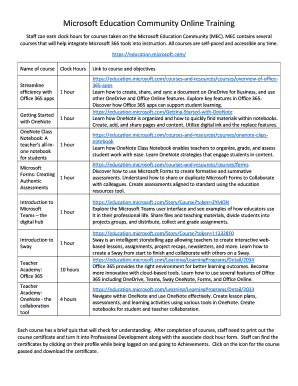

Get the free Actuaries Supplemental Application

Show details

This document is used to collect information from applicants who are actuaries or related professionals, specifically for the purpose of assessing errors and omissions insurance coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign actuaries supplemental application

Edit your actuaries supplemental application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your actuaries supplemental application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit actuaries supplemental application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit actuaries supplemental application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

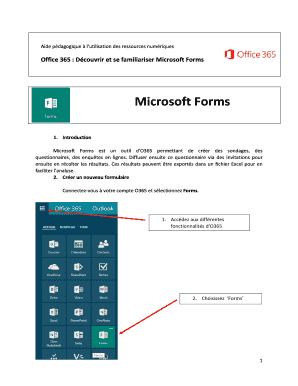

How to fill out actuaries supplemental application

How to fill out Actuaries Supplemental Application

01

Obtain the Actuaries Supplemental Application form from the relevant authority or website.

02

Read all instructions carefully before starting to fill out the application.

03

Provide your personal information, including your name, contact details, and professional designation.

04

Include your educational background, listing all degrees and certifications relevant to your actuarial profession.

05

Detail your professional experience, including past employers, job titles, and relevant responsibilities.

06

Answer all questions related to specific actuarial practices or areas you have worked in.

07

Include any continuing education courses or professional development activities completed.

08

Provide information on any memberships in professional actuarial organizations.

09

Review the completed application to ensure all information is accurate and complete.

10

Submit the application as per the instructions, whether online or via postal mail.

Who needs Actuaries Supplemental Application?

01

The Actuaries Supplemental Application is required for actuaries seeking to obtain a license, certification, or membership in professional organizations.

02

It is also needed by employers who are hiring actuaries to verify qualifications and professional experience.

Fill

form

: Try Risk Free

People Also Ask about

Is CFA more difficult than CPA?

CFA vs CPA difficulty Or are the CPA exams harder than the CFA exams? As we've established when looking at the differences between the CFA and CPA exams, the breadth, depth and length of the CFA exams combined make the CFA exams a lot more challenging to undertake and pass than the CPA exams.

Which country is best to pursue Actuarial Science?

UK, Sweden, Switzerland and Germany have a high reputation among the european actuarial community. Canadian and Australian universities have an excellent reputation too and they will also grant exemptions from their local actuarial association. The US actuarial associations don't grant exam exemptions.

Is Actuary harder than CFA?

Which is harder: Actuary exams or CFA exams? Actuary exams are more math-intensive and longer; CFA exams are broader in scope.

What McMaster programs require supplementary applications?

Level I Programs with a Supplementary Application: Arts & Science (due February 1, 2025 at 11:59 p.m. ET) Honours Health Sciences (due mid February 2025) Bachelor of Technology (due January 30, 2025 by noon ET) Business *optional submission* (due February 3, 2025) Computer Science (due January 30, 2025 by noon ET)

Which is more difficult, CA or Actuary?

Which is harder, Actuary or CA? Actuarial examinations can be slightly more challenging than the CA examinations as the candidate needs to master statistical, analytical and mathematical skills extensively.

Is CFA losing value?

As the number of candidates passing increases, the value diminishes. For instance, the pass rate for Level 1 has jumped from 34% to 46%. Clearing all three levels of the CFA is still worth it, but relying solely on passing Level 1 is becoming less impactful. With more candidates clearing it, competition has increased.

Is the CFA the hardest?

CFA Exams Pass Rates The CFA exams are perhaps the most challenging exams out there. They are often referred to as “bar none” the toughest exams — even harder than medical school or law school exams — with pass rates that hover around 50% and were much lower during the recent pandemic.

Will actuaries be replaced by AI?

Adapt to Technology: AI and machine learning aren't replacing actuaries — they're tools that make actuaries more effective. Automation handles the repetitive stuff, freeing actuaries to focus on strategy and innovation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Actuaries Supplemental Application?

The Actuaries Supplemental Application is a document that provides additional information and details required for actuarial evaluations and assessments related to insurance or pension plans.

Who is required to file Actuaries Supplemental Application?

Typically, insurance companies and pension plans that are subject to regulatory oversight and need to report detailed actuarial data are required to file the Actuaries Supplemental Application.

How to fill out Actuaries Supplemental Application?

To fill out the Actuaries Supplemental Application, one should gather relevant data regarding the insurance or pension plan, complete each section of the application accurately, and ensure all required signatures and supporting documentation are included.

What is the purpose of Actuaries Supplemental Application?

The purpose of the Actuaries Supplemental Application is to gather necessary information that enables regulators to assess the financial health, risk exposure, and compliance of insurance companies and pension plans.

What information must be reported on Actuaries Supplemental Application?

The Actuaries Supplemental Application typically requires reporting on demographic data, claim history, reserve calculations, assumptions used in actuarial work, and any adjustments made to estimates.

Fill out your actuaries supplemental application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Actuaries Supplemental Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.