Get the free OFFICIAL BUSINESS TAX APPLICATION

Show details

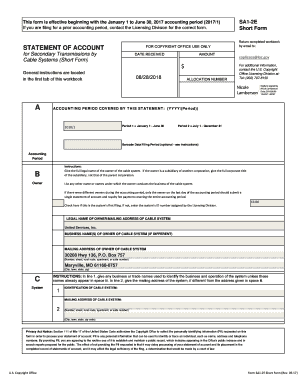

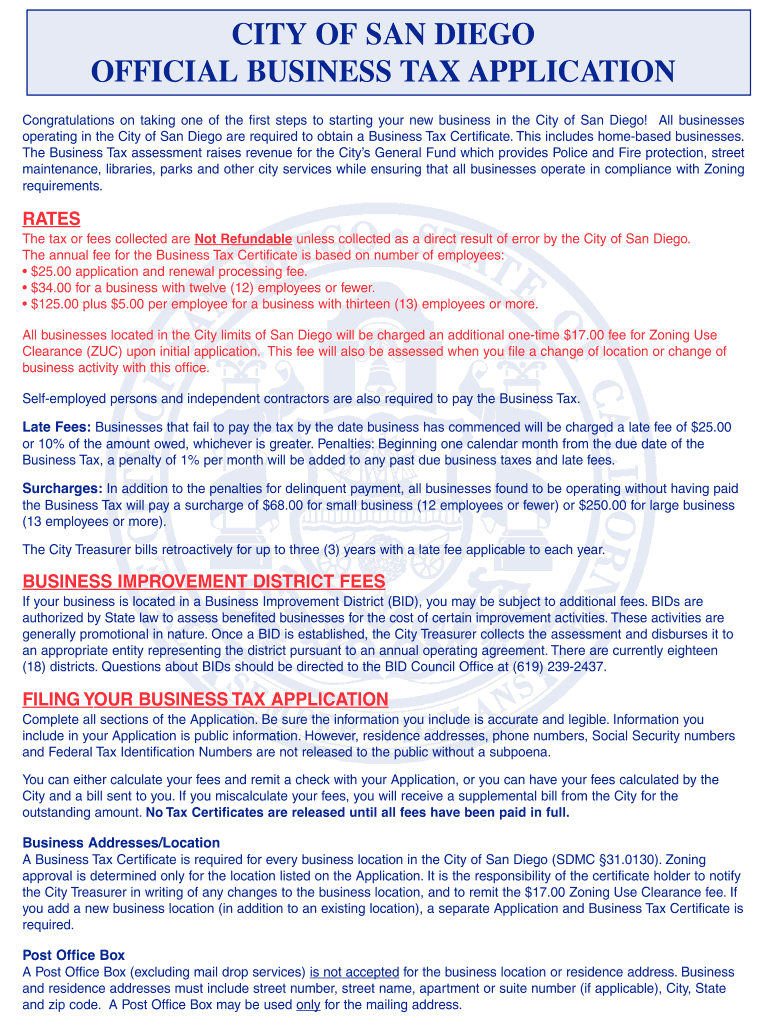

This document serves as an application for businesses to obtain a Business Tax Certificate in the City of San Diego, outlining fees, requirements, and other important information related to starting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign official business tax application

Edit your official business tax application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your official business tax application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing official business tax application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit official business tax application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out official business tax application

How to fill out OFFICIAL BUSINESS TAX APPLICATION

01

Obtain the OFFICIAL BUSINESS TAX APPLICATION form from your local tax authority website or office.

02

Fill out the business information section, including business name, address, and contact details.

03

Provide your business structure information (e.g., sole proprietorship, partnership, corporation).

04

Specify the nature of your business activities or services offered.

05

Fill in the ownership information, including names of owners and their identification details.

06

Complete the financial information section, including estimated income and expenses.

07

Review the application for accuracy, ensuring all required fields are filled out completely.

08

Sign and date the application to certify that the information provided is correct.

09

Submit the application to the appropriate local tax authority office, either in person or online if available.

10

Keep a copy of the submitted application for your records.

Who needs OFFICIAL BUSINESS TAX APPLICATION?

01

Any individual or entity intending to operate a business that requires taxation registration.

02

Small business owners seeking to formalize their business operations.

03

Freelancers and contractors who need to report their earnings for tax purposes.

04

Corporations and partnerships to comply with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

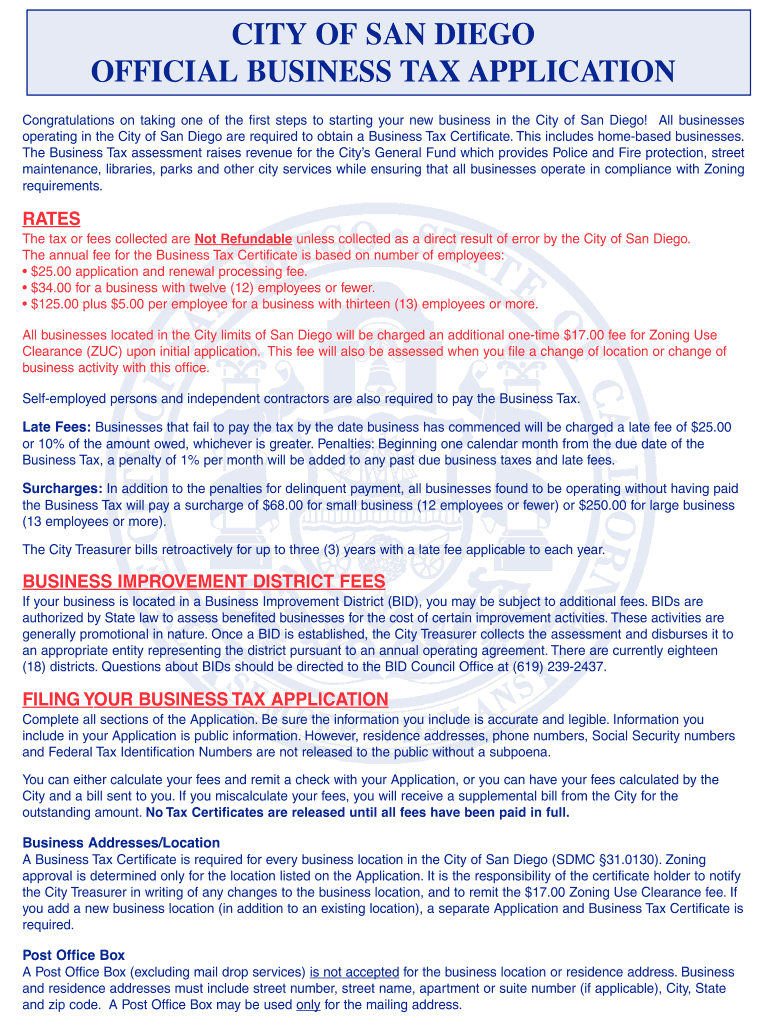

What is a tax clearance certificate in the USA?

Tax Clearance Certificate (eTCC) is an Electronic Tax Clearance Certificate which stands as an evidence that adequate tax has been paid on verifiable income of the Tax payer as at the time the clearance was requested. It is always issued to cover three years previous to the year of application.

What is a business registration certificate in the USA?

Generally speaking, a business registration certificate is what allows the state to identify and recognize your business as a separate legal entity. Upon the successful completion of the filing process, the state will confer the legal benefits of registration on your business.

Who needs a business tax certificate in California?

A California business tax certificate is a necessity to operate any form of business in the state. This even applies to both home-based and small businesses.

What is US tax form 1120?

A 1120 tax form is an Internal Revenue Service (IRS) form that corporations use to find out their tax liability, or how much business tax they owe. It is also called the U.S. Corporation Income Tax Return. American corporations use this form to report to the IRS their income, gains, losses deductions and credits.

How to file an income tax return online in English?

Income Tax e-Filing Step 1: Calculate Income and Tax. Step 2: TDS Certificates and Form 26AS. Step 3: Select the Suitable Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill Out the Downloaded File. Step 6: Validate the Information Entered. Step 7: Convert the File to XML Format.

What is a US business tax certificate?

The tax registration certificate is often a part of or issued alongside a business license . The certificate serves the purpose of confirming the business has been registered for tax purposes and can file its own tax return .

What is a US tax certificate?

Form 6166, also known as Certification of U.S. Tax Residency, is a letter printed on stationary bearing the U.S. Department of Treasury letterhead that certifies that a person or entity is a United States resident for purposes of the income tax laws of the United States for the fiscal year indicated on the Form.

What is a business tax ID in the USA?

An EIN is a federal tax ID number for businesses, tax-exempt organizations and other entities. You can get an EIN for free directly from the IRS in minutes. Apply online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OFFICIAL BUSINESS TAX APPLICATION?

The Official Business Tax Application is a formal document required by government authorities to report and pay business taxes.

Who is required to file OFFICIAL BUSINESS TAX APPLICATION?

Any individual or entity operating a business and generating taxable income is required to file the Official Business Tax Application.

How to fill out OFFICIAL BUSINESS TAX APPLICATION?

To fill out the Official Business Tax Application, individuals or entities need to provide their business information, income details, and any applicable deductions before submitting it to the relevant tax authority.

What is the purpose of OFFICIAL BUSINESS TAX APPLICATION?

The purpose of the Official Business Tax Application is to calculate and collect the appropriate taxes owed by businesses, ensuring compliance with tax laws.

What information must be reported on OFFICIAL BUSINESS TAX APPLICATION?

The information that must be reported includes business name, address, tax identification number, revenue, expenses, and any applicable deductions or credits.

Fill out your official business tax application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Official Business Tax Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.