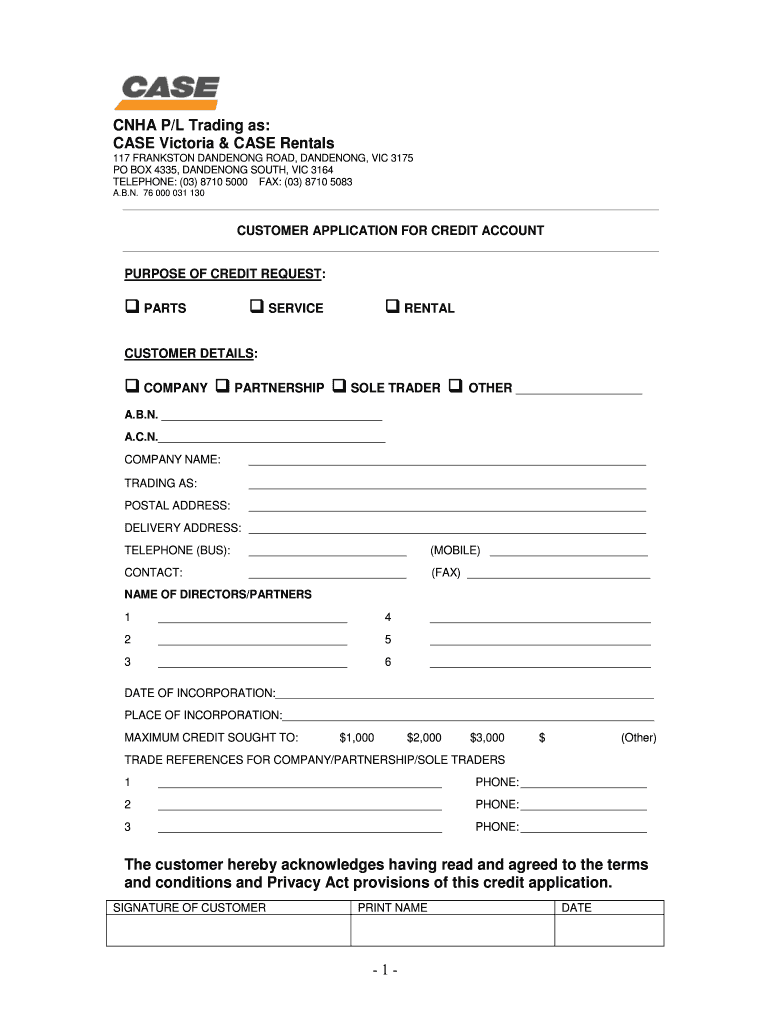

Get the free CUSTOMER APPLICATION FOR CREDIT ACCOUNT PURPOSE OF CREDIT

Show details

CNH P×L Trading as: CASE Victoria & CASE Rentals 117 CRANSTON GARDENING ROAD, GARDENING, VIC 3175 PO BOX 4335, GARDENING SOUTH, VIC 3164 TELEPHONE: (03× 8710 5000 Faxes: (03× 8710 5083 A.B.N. 76

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer application for credit

Edit your customer application for credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer application for credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing customer application for credit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit customer application for credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer application for credit

How to fill out a customer application for credit:

01

Start by gathering all necessary documentation such as identification, proof of income, and address verification.

02

Read through the application form carefully, ensuring you understand each section and the information required.

03

Begin by providing your personal information, including your full name, date of birth, and contact details.

04

Provide details about your current employment, including your job title, employer's name and contact information, and your monthly income.

05

If you have any additional sources of income, such as investments or rental properties, make sure to include those details as well.

06

Fill out the sections related to your current financial situation, including details about your assets (such as savings accounts, investments, or properties) and liabilities (such as loans, credit card debt, or mortgages).

07

Answer questions regarding your credit history, including any past bankruptcies or foreclosures.

08

If you are applying jointly with someone, provide their information in the appropriate sections.

09

Carefully review the application form once completed, ensuring all information provided is accurate and up to date.

10

Sign and date the application form, and submit it along with any supporting documentation as required.

Who needs a customer application for credit?

01

Individuals who are looking to apply for a credit card.

02

Individuals who want to obtain a loan, such as a personal loan or a mortgage.

03

Individuals who are interested in financing a big ticket purchase, like a car or furniture.

04

Small business owners who need credit for their business operations.

05

Individuals looking to establish or improve their credit history.

06

Those who want to take advantage of credit options offered by retailers or financial institutions.

07

People who want to consolidate their debts with a personal loan or a line of credit.

08

Individuals applying for a student loan or other education-related credit.

09

Homeowners seeking to refinance their mortgage or apply for a home equity line of credit.

10

Those looking to lease a vehicle or obtain financing for equipment or machinery.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit customer application for credit from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including customer application for credit. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send customer application for credit to be eSigned by others?

Once your customer application for credit is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out the customer application for credit form on my smartphone?

Use the pdfFiller mobile app to fill out and sign customer application for credit. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is customer application for credit?

Customer application for credit is a form or document that individuals or businesses fill out when applying for credit, such as a loan or credit card.

Who is required to file customer application for credit?

Anyone seeking credit from a financial institution or lender is required to file a customer application for credit.

How to fill out customer application for credit?

To fill out a customer application for credit, individuals or businesses typically need to provide personal information, financial details, and consent for a credit check.

What is the purpose of customer application for credit?

The purpose of customer application for credit is to assess the creditworthiness of the applicant and determine their eligibility for credit.

What information must be reported on customer application for credit?

Information such as name, address, income, employment history, and existing debts must be reported on a customer application for credit.

Fill out your customer application for credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Application For Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.