Get the free rfzvweuhrqg site youtube com

Get, Create, Make and Sign rfzvweuhrqg site youtube com

How to edit rfzvweuhrqg site youtube com online

Uncompromising security for your PDF editing and eSignature needs

Instructions and Help about rfzvweuhrqg site youtube com

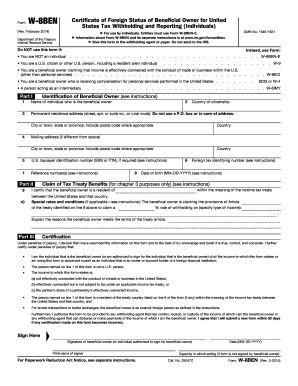

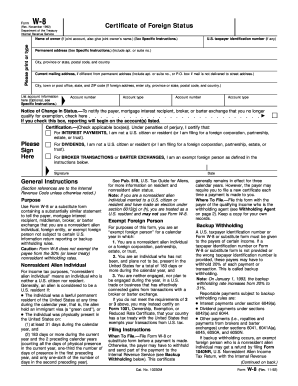

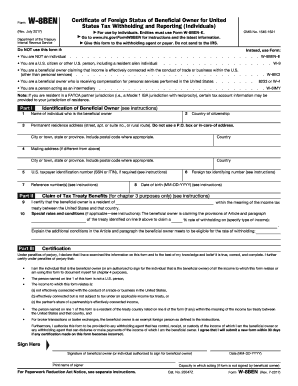

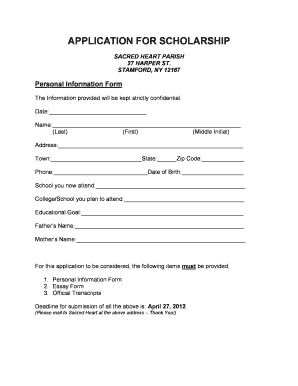

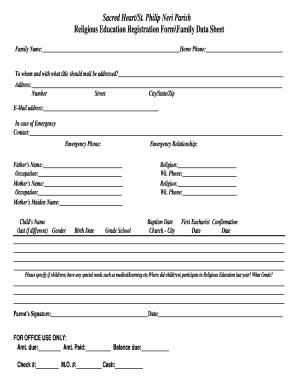

Hey guys Anthony here with a tutorial nohow to complete the w8 Bend form first let me briefly explain what the w8 Ben form is it's called certificate of foreign status of beneficial owner forfeited States tax withholding in simple terms it#39’s a legal document required byte IRS or the Internal Revenue Service in the United States in order to declare your tax status the form is divided into three main parts, so part 1 is the identification of beneficial owner a din this section you enter your name country of citizenship your permanent address and leave section 4 blank if your mailing address is the same infection 6 if you are Canadian you can enter a social insurance number and finally your date of birth in section 8part 2 is the claim of tax we D benefit sin section 9 you enter the name of the country and in section 10 enter article7in zero rate of withholding and under the type of income specify the income for example Commission#39’s and under the explanation you can write something like beneficial owner has a permanent establishment only in Canada and all work is performed in Canada as per article five you would obviously have to replace Canada with your own country and finally part three is certification in this section you are certifying that the information provided is accurate, so you need to sign at the bottom enter the date and then print your name and that×39;pretty much it before I wrap up here few additional notes if you are an individual you see form w8 pen the one that I just showed you if you area business entity use form w8 Ben E and if you are a US citizen or resident youwouldn'’t use any of these form instead you would use form w-9 you're done#39’t need to send the w8 Ben form to the IRS you only need to provide it to the individual or company in the US from whom you are receiving income and of course you need to file a tax return in a country in my case Canada for income earned from us sources well hope you found this it×39;all helpful if you've got any questions please leave them in a comment section, and thanks for watching Music

People Also Ask about

Why do I need to fill out a W-8BEN form?

What is the permanent residence address of w8ben?

How do I fill out a W-8BEN form?

What is the foreign tax identifying number on w8ben?

Who needs to fill out a w8ben form?

How to fill out a w8ben tax form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit rfzvweuhrqg site youtube com online?

How do I edit rfzvweuhrqg site youtube com straight from my smartphone?

How do I fill out rfzvweuhrqg site youtube com using my mobile device?

What is rfzvweuhrqg site youtube com?

Who is required to file rfzvweuhrqg site youtube com?

How to fill out rfzvweuhrqg site youtube com?

What is the purpose of rfzvweuhrqg site youtube com?

What information must be reported on rfzvweuhrqg site youtube com?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.