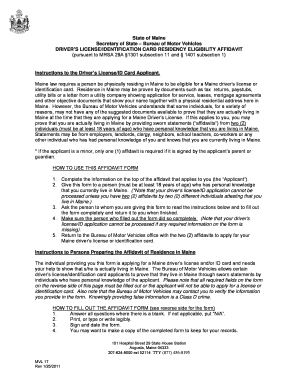

Get the free 14-060 Insurable interest, property

Show details

304.14060 Insurable interest, property. (1)(2)(3×No contract of insurance of property or of any interest in property or arising from property shall be enforceable as to the insurance except for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 14-060 insurable interest property

Edit your 14-060 insurable interest property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 14-060 insurable interest property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 14-060 insurable interest property online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 14-060 insurable interest property. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 14-060 insurable interest property

How to fill out 14-060 insurable interest property:

01

Start by entering your personal information, including your name, address, and contact details. Ensure that all the information provided is accurate and up to date.

02

Next, provide the details of the property for which you are seeking insurable interest. This includes the address, type of property (e.g., residential, commercial), and any additional relevant information about the property.

03

Specify the type of coverage you are seeking for the property. This could include insurance against fire, theft, natural disasters, or other specific risks. Be clear and specific in describing the coverage you need.

04

If applicable, indicate any existing insurance coverage you may already have for the property. This could include policies from other insurance providers.

05

Provide information about any outstanding mortgages or liens on the property. This is important as it may affect the amount of coverage you are eligible for or the terms of the insurance policy.

06

Include any additional information or special requests that may be relevant to your application. For example, if you have a specific timeframe within which you need the insurance coverage to be in effect, or if there are any unique circumstances related to the property that the insurance provider should be aware of.

07

Review all the information you have entered to ensure its accuracy and completeness. Make any necessary corrections or additions before submitting the form.

Who needs 14-060 insurable interest property:

01

Property owners: Individuals who own residential or commercial properties can apply for 14-060 insurable interest property to protect their investment against potential risks and damages.

02

Real estate investors: Investors who own multiple properties can benefit from insurable interest property coverage to safeguard their portfolio and mitigate potential financial losses.

03

Mortgage lenders: Lenders that have a financial interest in the property, such as mortgage lenders, may require 14-060 insurable interest property coverage as a condition for approving the loan.

04

Landlords: Landlords who lease residential or commercial properties may opt for insurable interest coverage to protect their rental income and property assets.

05

Homeowners associations: Organizations responsible for managing and maintaining properties within a community or development may secure insurable interest property coverage to safeguard community assets and ensure necessary repairs are covered.

06

Property developers: Developers who are in the process of constructing or renovating properties may obtain insurable interest property coverage to mitigate risks and potential losses during the construction period.

Note: It is always recommended to consult with an insurance professional or the specific insurance provider to ensure you understand the requirements and procedures for filling out the 14-060 insurable interest property form properly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 14-060 insurable interest property?

14-060 insurable interest property refers to property that is deemed to have a financial interest that can be protected by insurance coverage.

Who is required to file 14-060 insurable interest property?

Property owners or individuals with a financial interest in a property are required to file 14-060 insurable interest property.

How to fill out 14-060 insurable interest property?

To fill out 14-060 insurable interest property, you need to provide information about the property, the owner or individual with the financial interest, and details about the insurance coverage.

What is the purpose of 14-060 insurable interest property?

The purpose of 14-060 insurable interest property is to ensure that property owners or individuals with a financial interest have adequate insurance coverage to protect their assets.

What information must be reported on 14-060 insurable interest property?

Information such as the property address, owner's name, insurance coverage details, and any other relevant information must be reported on 14-060 insurable interest property.

How can I modify 14-060 insurable interest property without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 14-060 insurable interest property, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete 14-060 insurable interest property online?

Filling out and eSigning 14-060 insurable interest property is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the 14-060 insurable interest property in Gmail?

Create your eSignature using pdfFiller and then eSign your 14-060 insurable interest property immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your 14-060 insurable interest property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

14-060 Insurable Interest Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.